Last updated: February 25th, 2020 11:55 AM

Last updated: February 25th, 2020 11:55 AM

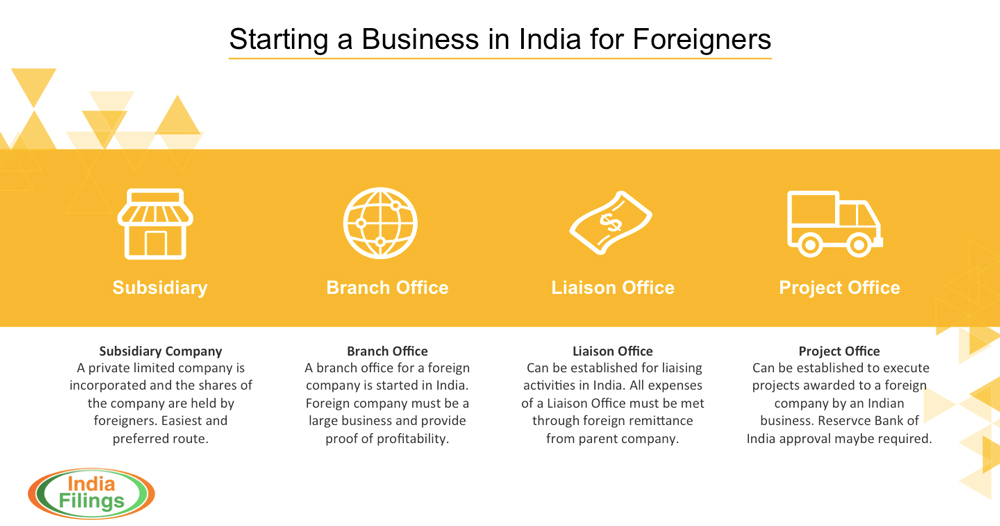

Starting a Foreign Company's Subsidiary in India

Foreign-Company-Starting-a-Business-in-India

Foreign-Company-Starting-a-Business-in-India

Investing in a Business in India by way of Equity

Foreign Direct Investments that are allowed in India

Reporting to Government under Automatic Route

Procedure for starting a Foreign Company’s Subsidiary in India

Unique documents required for incorporation of foreign company’s subsidiary in India

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...