Last updated: December 30th, 2022 12:15 PM

Last updated: December 30th, 2022 12:15 PM

Startup India Scheme

The Startup India Scheme is an initiative of the Government of India in 2016. The primary objective of Startup India is the promotion of startups, generation of employment, and wealth creation. The Startup India has initiated several programs for building a robust startup ecosystem and transforming India into a country of job creators instead of job seekers. These programs are managed by the Department for Industrial Policy and Promotion (DPIIT).Definition of "Startup"

Any company which fall into below list of category will be called as "Startup" and eligible to be recognised by the DPIIT to avail the benefits from the Government of India.- Age of the Company - The Date of Incorporation should not exceed 10 years

- Type of Company - Should have been Incorporated as a Private Limited Company or a Registered Partnership Firm or a Limited Liability Partnership

- Annual Turnover - Should not exceed Rs.100 crore for any of the financial years since its Incorporation

- Original Entity - The company or Entity should have been formed originally by the promoters and should not have been formed by splitting up or reconstructing an existing business

- Innovative & Scalable - Should have plan for development or improvement of a product, process or service and/or have a scalable business model with high potential for the creation of wealth & employment

Benefits from DPIIT

Under the Startup India Initiative, the companies which are registered under DPIIT are eligible to receive the following benefits: Simplification and Handholding - Easier compliance, easier exit process for failed startups, legal support, fast-tracking of patent applications and a website to reduce information asymmetry. Funding & Incentives - Exemptions on Income Tax and Capital Gains Tax for eligible startups; a fund of funds to infuse more capital into the startup ecosystem and a credit guarantee scheme. Incubation & Industry-Academia Partnerships - Creation of numerous incubators and innovation labs, events, competitions and grants.Self Certification

The procedure to self-certification is to reduce the regulatory burden on Startups. Also, the Startups could focus on the core business. Benefits- Startups are allowed to self-certify compliance for 6 Labour Laws and 3 Environmental Laws through a simple online procedure. (Refer below for the details of laws)

- For labour laws, there will be any inspections for a period of 5 years. Startups will be inspected only on receipt of a credible and verifiable complaint of violation in the form of writing to the inspecting officer.

- For environment laws, startups which fall under the ‘white category’ [as defined by the Central Pollution Control Board (CPCB)] would be able to self-certify compliance and only random checks would be carried out in such cases

- The startup has to register their company in the portal belong to the Ministry of Labour and Employment "Shram Suvidha Portal"

- Register at Shram Suvidha Portal and then login.

- After successful login, click link "Is Any of your Establishment a Startup?"

- Then the registration can be done by following the instructions.

Tax Exemption under 80IAC

Eligible startups are exempted from paying income tax for 3 consecutive financial years out of their first ten years since incorporation. Eligibility to avail tax exemption under 80IAC The entity should be recognised by the DPIIT Only Private Limited Companies or Limited Liability Partnerships are eligible for tax exemption under Section 80IAC The Startup must have been incorporated on or after 1st April, 2016 Registration Process & Documents Access Startup India portal and register After registration, apply for DPIIT recognition Access the Section 80 IAC exemption application Fill in all details with the below-mentioned documents uploaded and submit the application form Documents Needed- Memorandum of Association for Pvt. Ltd./LLP Deed

- Board Resolution (If Any)

- Annual Accounts of the startup for the last three financial years

- IT returns for the last three financial years Electronic Process after Applying

- Refer to your Dashboard on the Startup India Portal for the status of your application. This can be found on the top right of the page after you log in.

- For any clarifications, please email: dipp-startups@nic.in

Section 56 Exemption

Exemption under Section 56(2)(VIIB) of Income Tax Act- Investments into eligible startups by listed companies with a net worth of more than INR 100 Crore or turnover more than INR 250 Crore shall be exempt under Section 56(2) VIIB of Income Tax Act

- Investments into eligible Startups by Accredited Investors, Non-Residents, AIFs (Category I), & listed companies with a net worth more than 100 crores or turnover more than INR 250 Crore, shall be exempt under Section 56(2)(VIIB) of Income Tax Act

- Consideration of shares received by eligible startups shall be exempt upto an aggregate limit of INR 25 Crore

- Should be a private limited company

- Should have been recognised as a DPIIT. To get DPIIT recognition, click on "Get Recognised" below.

- Not Investing in specified asset classes

- Startup should not be investing in immovable property, transport vehicles above INR 10 Lakh, Loans and advances, capital contribution to other entities, except in the ordinary course of business

- Registration to be done at the Startup India Portal

- Get DPIIT Recognition

- File the up Section 56 Exemption application form from this link

- Startup company will receive an email once the registration is activated

Easy Winding up of Company

This is to ease the shut down or wind up operations of the startups. This will allow the entrepreneurs to reallocate capital and resources to more productive avenues faster. To encourage entrepreneurs to experiment with new and innovative ideas without facing complex exit processes where their capital stuck in case of business failure. As per the Insolvency and Bankruptcy Code, 2016, startups with simple debt structures, it can be wound up in 90 days of filing the application for insolvency. An insolvency professional can be appointed for the Startup who can be in charge of the company including liquidation of its assets and paying its creditors within six months of such appointment. It is responsibility of the insolvency professional to the closure of the business, sale of assets and repayment of creditors in accordance with the distribution waterfall set out in the IBC.Patent Application and IPR Application

The objective is to reduce the cost and time taken for a startup to acquire a patent, making it financially viable for them to protect their innovations and encouraging them to innovate further.- Fast-tracking of Startup Patent Applications - The applications will be fast-tracked so that the value can be realised sooner.

- Panel of facilitators to assist in the filing of IP applications - The facilitators will be assisting in the filing of applications.

- Government to bear facilitation cost - Under this scheme, the Central Government shall bear the entire fees of the facilitators for any number of patents, trademarks or designs that a Startup may file, and the Startups shall bear the cost of only the statutory fees payable.

- Rebate on the filing of application - Startups shall be provided with an 80% rebate in filing of patents vis-a-vis other companies. This will help them pare costs in the crucial formative years

Features of the Scheme

The following features make the scheme a stand-out factor:- New-entrants are granted a tax-holiday for three years.

- The government has provided a fund of Rs.2500 crore for startups, as well as a credit guarantee fund of Rs.500 crore rupees.

Eligibility For Startup Registration

- The company to be formed must be a private limited company or a limited liability partnership.

- It should be a new firm or not older than five years, and the total turnover of the company should be not exceeding 25 crores.

- The firms should have obtained the approval from the Department of Industrial Policy and Promotion (DIPP).

- To get approval from DIPP, the firm should be funded by an Incubation fund, Angel Fund or Private Equity Fund.

- The firm should have obtained a patron guarantee from the Indian patent and Trademark Office.

- It must have a recommendation letter by an incubation.

- Capital gain is exempted from income tax under the startup India campaign.

- The firm must provide innovative schemes or products.

- Angel fund, Incubation fund, Accelerators, Private Equity Fund, Angel network must be registered with SEBI ( Securities and Exchange Board of India).

Register Your Company

As have been observed, registration on startup portal can be done only through for the following firms:- Partnership Firm

- Limited Liability Partnership Firm

- Private Limited Company

Partnership Firm

Partnership firm is registered under the Partnership Firm Act. To start a partnership firm, the concerned parties have to draft a partnership deed where the terms and conditions of the partnership firm will be mentioned. This partnership deed must be registered with the registrar of firms. We can help you with the formation of a partnership firm. For more details, click here.Limited Liability Partnership Firm

A Limited liability partnership firm is registered under the LLP Act. Both partnership firm and LLP are very similar, but LLP has more in common with a private limited company like limited liability protection, transferability, etc. For more details on LLP registration, click here.Private Limited Company

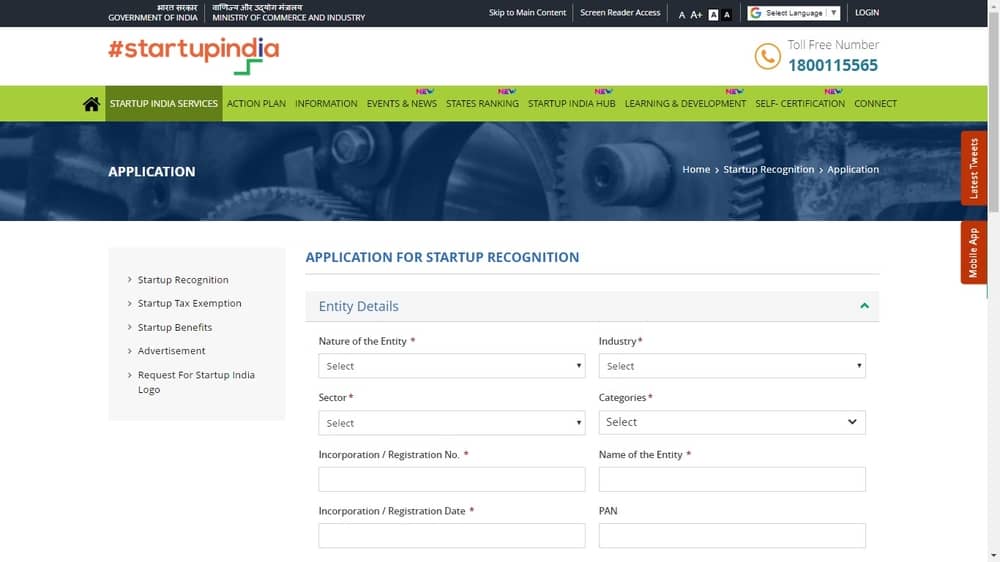

The private limited company is the most popular type of legal entity in India. Know more about company registration here.Application Procedure

Step 1: Log on Startup India Portal https://startupindia.gov.in/registration.php. Step 1 - Log on Startup India Portal

Step 2: Enter your Legal Entity.

Step 3 : Enter your Incorporation/Registration No.

Step 4 : Enter your Incorporation/Registration Date.

Step 5: Enter the PAN Number (optional).

Step 6: Enter your address, Pin Code & State.

Step 7: Enter details of the Authorised Representative.

Step 8: Enter the Details of Directors and Partners.

Step 9: Upload the essential documents and Self-certification in the prescribed manner.

Step 10: File the Incorporation/Registration certificate of the company.

Step 1 - Log on Startup India Portal

Step 2: Enter your Legal Entity.

Step 3 : Enter your Incorporation/Registration No.

Step 4 : Enter your Incorporation/Registration Date.

Step 5: Enter the PAN Number (optional).

Step 6: Enter your address, Pin Code & State.

Step 7: Enter details of the Authorised Representative.

Step 8: Enter the Details of Directors and Partners.

Step 9: Upload the essential documents and Self-certification in the prescribed manner.

Step 10: File the Incorporation/Registration certificate of the company.

Contact Details

Office Address INVEST INDIA 110, Vigyan Bhavan Annexe, 001, Maulana Azad Road, New Delhi 110 001 Phone - +91 011 2304 8155 Working Hours: 10:00AM - 5:30PM (Mon to Fri) Toll Free Number: 1800 115 565 Working Hrs: 10:00AM - 5:30PM Email: dipp-startups@nic.inPopular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...