Last updated: August 30th, 2024 2:32 PM

Last updated: August 30th, 2024 2:32 PM

Statement of Financial Transactions (SFT) for Dividend income

The Central Board of Direct Taxes (CBDT) prescribed the Format, Procedure, and Guidelines for submission of Statement of Financial Transactions (SFT) for Dividend income vide a Notification No. 1 of 2021 dated 20th April 2021. With this Notification, CBDT announced that the statement of financial transactions shall be furnished on or before the 31st May, immediately following the financial year in which the transaction is registered.Synopsis of Notification

Synopsis of Notification about the Statement of Financial Transactions (SFT) for Dividend income is as follows:- With this notification, CBDT prescribes the guidelines for the preparation and submission of Statement of Financial Transactions (SFT) information for Dividend income.

- The information is required to be uploaded in a data file. The data structure and validation rules are also enclosed with this notification.

Overview of Statement of Financial Translations (SFT)

Statement of Financial Translations or SFT refers to information related to certain high-value transactions which specified persons are required to report to the income tax department. The SFT was earlier known as ‘Annual Information Return (AIR)’. The objective of SFT was to curb black money and widening the tax base.Section 285BA of the Income Tax Act

The specified reporting entity/person must furnish a statement of financial transaction or reportable account as per Section 285BA of the Income Tax Act, 1961.Rule 114E of the Income Tax Rules

To furnish a statement of financial transactions, specified forms are required to be submitted as per Rule 114E of Income Tax Rules, 1962 referred to as “Statement of Financial Transaction (SFT). Rule 114E of the Income Tax Rules, 1962 specifies that the statement of financial transaction to be furnished in Form No. 61AFurnishing of Statement of Financial Transaction

As mentioned above, the statement of the financial transaction needs to be furnished in respect of a financial year in Form No. 61A under sub-section (1) of section 285BA of the Income Tax ActStatement of Financial Translations (SFT) for Dividend income

To enable pre-filling of return of income, CBDT has issued an Income-tax (4th Amendment) Rules, 2021 to include reporting of information relating to dividend income. According to the Income-tax (4th Amendment) Rules, the sub-rule 5A is inserted by the Income-tax department for pre-filling the return of income. The new sub-rule 5A of rule 114E specifies that the information shall be furnished in a prescribed form, at such frequency, and in such manner, as may be specified by the Director-General of Income Tax (Systems), with the approval of the CBDT.Prescribed Date for Submission of SFT

The statement of financial transactions needs to be furnished on or before the 31st of May, immediately following the financial year in which the transaction is registered or recorded.The Eligible Person for Submission of STP

- The statement of the financial transaction shall be signed, verified, and furnished by the specified Designated Director.

- If the reporting person is a non-resident, the statement may be signed, verified, and furnished by a person who holds a valid power of attorney from such Designated Director

Note to Reporting Person/Entity

The reporting person is required to document and implement appropriate information security policies and procedures with clearly defined roles and responsibilities to ensure the security of submitted information and related documents. The reporting person is also required to document and implement appropriate archival and retrieval policies and procedures with clearly defined roles and responsibilities to ensure that submitted information and related information are available promptly to the competent authorities.Guidelines for Preparation of Statement of Financial Transactions (SFT) for Dividend Income

The guidelines for Preparation of Statement of Financial Transactions (SFT) are as follows:| Transaction Code | SFT 015 |

| Transaction Description | Dividend income |

| Nature and value of the transaction | Dividend distributed during the financial year. |

| Class of person required to furnish | A company paying dividends. |

| Remarks |

|

Preparation of Data File for Submission of SFT

The SFT information is required to be uploaded in a data file. Reporting entities are required to prepare the data file in a prescribed format from their internal system.- An excel-based report preparation utility has also been provided to assist small reporting entities in preparing data files.

- The data files prepared by the internal system/report preparation utility should be validated using Text File Validator/Submission Utility.

- After validation, the text file is required to be compressed, encrypted, and signed using the Text File Submission Utility before uploading on the reporting portal

- Reporting entities, having a large number of data files, can also submit the data files using SFTP Server (specific request may be made for SFTP upload).

Procedure for Submission of SFT on Reporting Portal

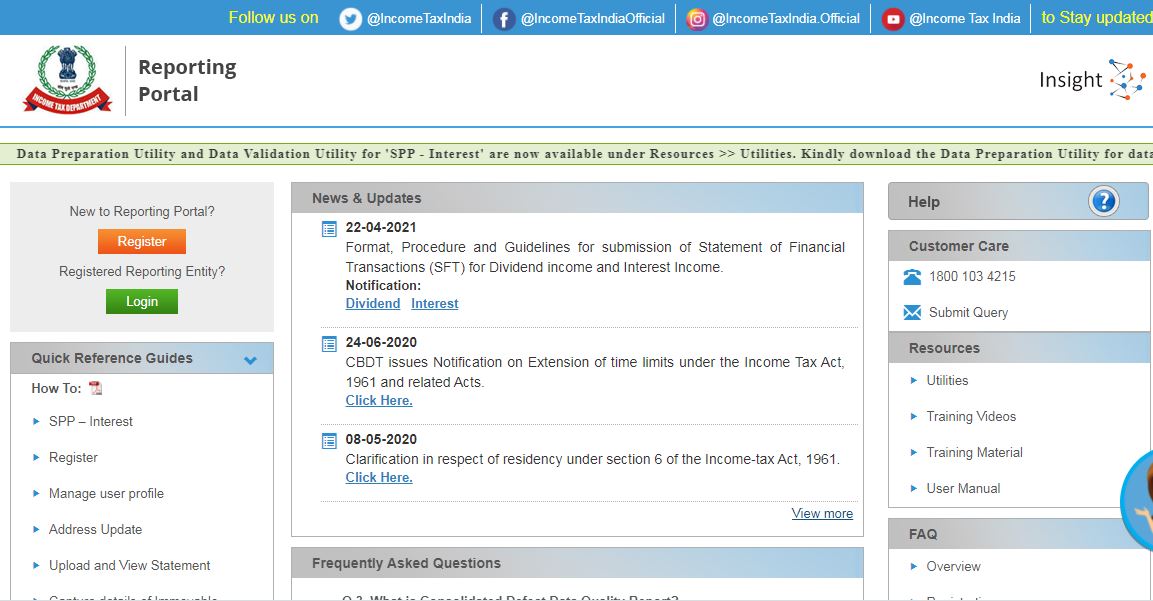

The statement of financial transactions shall be furnished online through the Income Tax Department Reporting Portal. Statement of Financial Transactions (SFT) for Dividend income - Reporting

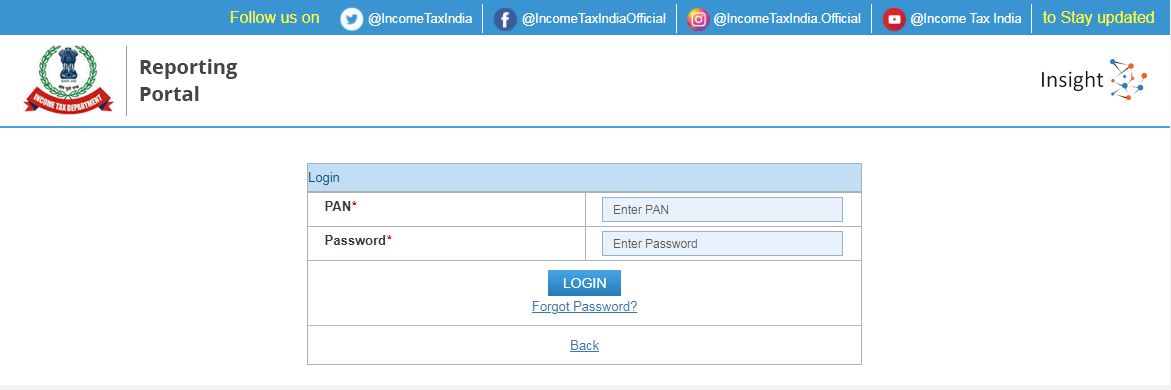

The data files are required to be uploaded at the reporting portal through the login credentials (PAN and password) of the designated director.

Statement of Financial Transactions (SFT) for Dividend income - Reporting

The data files are required to be uploaded at the reporting portal through the login credentials (PAN and password) of the designated director.

Already registered reporting entities on Income Tax e-filing portal:

The registration details of already registered reporting persons have been migrated from the e-filing portal to reporting portal. The registered users of such reporting persons shall be communicated with their new login credentials through registered email to be used at Reporting Portal. There is no need of registering again for such persons/entities. Statement of Financial Transactions (SFT) for Dividend income -Login Page

Statement of Financial Transactions (SFT) for Dividend income -Login Page

New Registration on Reporting Portal

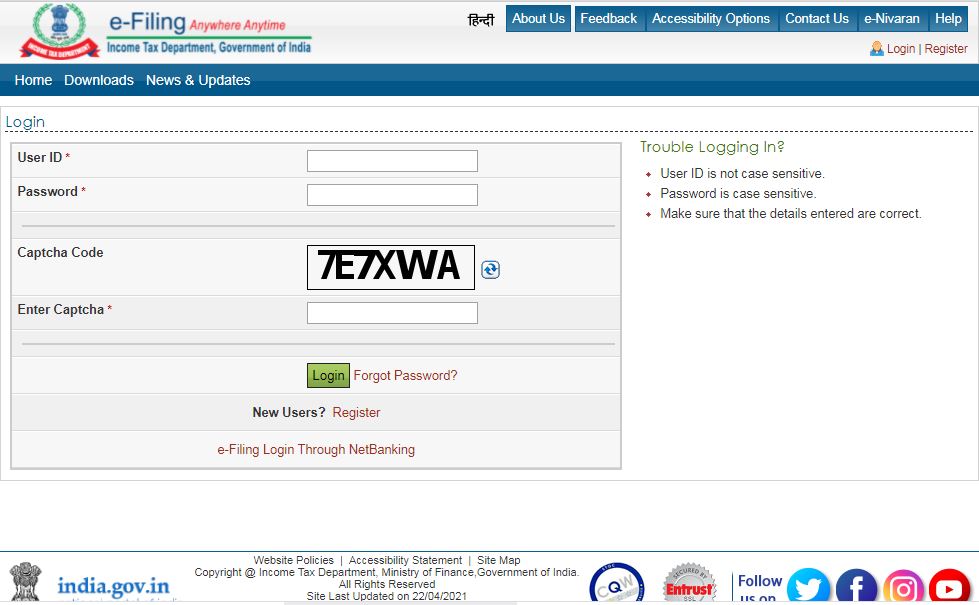

- The reporting person is required to get registered with the Income Tax Department by logging in to the e-filing website with the login ID used to file the Income Tax Return of the reporting person.

- The reporting person needs to click on the “Reporting Portal” link under the “My Account” tab at the e-filing portal to access the ‘Reporting Portal’ for first-time registration.

- The reporting person will be required to enter the details of form type, category, and address of reporting person along with details of Principal Officer mandatorily.

- On successful submission, the ITDREIN is generated and the principal officer will receive a confirmation e-mail on his/her registered e-mail address and SMS at his/her registered mobile number.

-

Statement of Financial Transactions (SFT) for Dividend income -Reporting Portal Login Page

Statement of Financial Transactions (SFT) for Dividend income -Reporting Portal Login Page

Addition of Designated Director

The reporting person is required to submit the details of the designated director either at the time of new registration or at a later stage, but before the STF submission on reporting portal.- The designated director will receive a confirmation e-mail with login credentials for login into reporting portal at his/her registered email address.

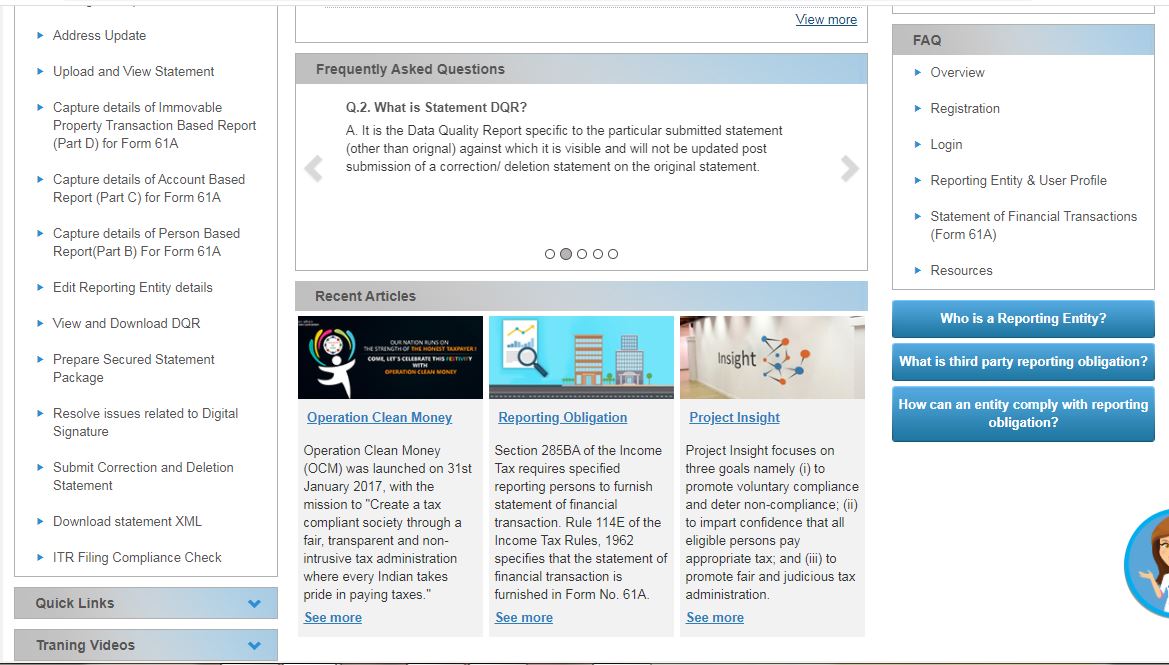

- The designated director of the reporting person can digitally sign and upload the Statement of Financial Transaction (SFT) and the corresponding correction statements if any through his/her own login credentials at the reporting portal or through Generic Submission Utility.

Submission of Form No. 61A

Every reporting person is required to submit the Statement of Financial Transaction (SFT) in Form No. 61A. The prescribed schema, Report Generation and Validation Utility for Form No. 61A and Generic Submission Utility can be downloaded from the reporting portal under the “Resources” tab. Statement of Financial Transactions (SFT) for Dividend income -Reporting Portal

The prepared SFTs to be filed is required to be digitally signed by and uploaded at the reporting portal or through Generic Submission Utility through the login credentials (PAN and password) of the designated director

Statement of Financial Transactions (SFT) for Dividend income -Reporting Portal

The prepared SFTs to be filed is required to be digitally signed by and uploaded at the reporting portal or through Generic Submission Utility through the login credentials (PAN and password) of the designated director

- The reporting entities are advised to furnish information of dividend income, reported to Income Tax Department, to the taxpayers which will enable them to reconcile the information displayed in the Annual Information Statement (AIS) (Form 26AS).

Error in Uploaded File

In case of any error, the complete file will be rejected and the rejection reason can be viewed by clicking the Rejected link under the Status column. The reporting entity needs to correct the relevant errors and upload the file again.Modification of uploaded data

In case Reporting Entity needs to modify uploaded data, a Correction Statement is required to be filed. In the Correction Statement, only those reports should be uploaded in which correction is required. Statement ID of the original Statement which is being corrected should be selected while uploading. The Report Serial Number (RSN) and Original Statement ID will uniquely identify the report being corrected. If the correction statement is successfully accepted, the reports in the earlier statement will be marked as inactive and the newly uploaded report will be active.Procedure to delete uploaded data

If the Reporting Entity needs to delete uploaded data, Deletion Statement is required to be filed. In the Deletion Statement, only those reports should be uploaded which are to be deleted. Statement ID of the original Statement which is being deleted should be selected while uploading. The Report Serial Number (RSN) and Original Statement ID will uniquely identify the report that is being deleted. If the Deletion Statement is successfully accepted, the reports in the earlier statement will be marked as inactive. Click here to learn more about Tax on Dividend Income: Taxation of Dividend IncomeValidation of SFT Date Files

Upload level validation would be done to ascertain that the correct file is being uploaded. The file would be rejected at the upload stage if it does not clear the upload level validations. Any file which does not meet the following requirements will be rejected.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...