Last updated: April 19th, 2019 12:33 PM

Last updated: April 19th, 2019 12:33 PM

Table 6A of GSTR 1 - Returns Offline Tool

To facilitate refund of inputs contained in the export of Goods and Services, “Table 6A of GSTR 1” has been introduced. Exporters can file details of all exports under Table 6A of GSTR 1 using returns offline tool. Once, the details of the export invoice are filed on the GST Portal under Table 6A; the details will be matched with the bill of export filed with the Customs Department and amount mentioned in GSTR 3B return. If all the details matches, then GST refund on exports will be quickly processed by the Government. In this article, we will look at the procedure to add Invoices summary data for Table 6A of GSTR 1 on the GST Portal using the Returns Offline tool.Due Dates Modified

The Government has recently deferred the due date for filing GSTR 1 from the 11th of April to the 13th. Apart from this, the following are the due dates for filing GSTR 1 for the months of April, May and June 2019:- April 2019 – 11th May 2019

- May 2019 – 11th June 2019

- June 2019 – 11th July 2019

Import of E-way Bill Data

It is essential for taxpayers to validate the data of their transactions before proceeding with the process of filing returns, as it saves time and unnecessary data entry. To cater to this purpose, the GST portal has now been integrated with the E-way Bill Portal (EWB). The integration enables the users to import the B2B and B2C invoice sections and the HSN-wise-summary of outward supplies section. Using these details, the taxpayers may verify the data and complete the filing. The feature has been introduced considering the major data gaps between self-declared liability in Form GSTR 1 and Form GSTR 3B. A similar rule also applies to Input Tax Credit (ITC) claimed in GSTR 3B, as it could be compared with the credit available in Form GSTR 2A. Data validation and comparison can be pursued through the following tabs of the portal:- Liability other than export/reverse charge

- Liability due to reverse charge

- Liability due to export and SEZ supplies.

- ITC credit claimed and due

Due Dates Modified

The Government has recently deferred the due date for filing GSTR 1 from the 11th of April to the 13th. Apart from this, the following are the due dates for filing GSTR 1 for the months of April, May and June 2019:- April 2019 – 11th May 2019

- May 2019 – 11th June 2019

- June 2019 – 11th July 2019

Import of E-way Bill Data

It is essential for taxpayers to validate the data of their transactions before proceeding with the process of filing returns, as it saves time and unnecessary data entry. To cater to this purpose, the GST portal has now been integrated with the E-way Bill Portal (EWB). The integration enables the users to import the B2B and B2C invoice sections and the HSN-wise-summary of outward supplies section. Using these details, the taxpayers may verify the data and complete the filing. The feature has been introduced considering the major data gaps between self-declared liability in Form GSTR 1 and Form GSTR 3B. A similar rule also applies to Input Tax Credit (ITC) claimed in GSTR 3B, as it could be compared with the credit available in Form GSTR 2A. Data validation and comparison can be pursued through the following tabs of the portal:- Liability other than export/reverse charge

- Liability due to reverse charge

- Liability due to export and SEZ supplies.

- ITC credit claimed and due

Who should file Table 6A of GSTR 1?

Table 6A of GSTR 1 must be filed by any person who was involved in exporting goods from India to claim GST refund. If any person did not export any goods since the introduction of GST in July 2017, he/she would not be required to file Table 6A of GSTR1. Note: There is no requirement for filing a NIL return. Know more about Who can File GST Returns & Reply NoticeInvoices Summary for Table 6A of GSTR 1

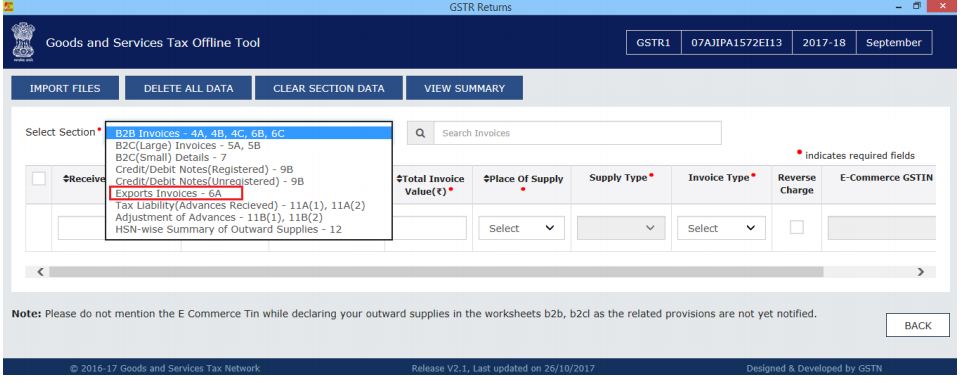

To add Invoices summary data for Table 6A of GSTR 1 on the GST Portal using the GST Returns Offline tool, follow the procedure explained below: Step 1: To upload invoice details for filing return, click the NEW button from GST Returns Offline Tool. The File Returns page will be displayed. Know more about the procedure to instal GST returns offline tool Step 2: Select the GSTR 1 option from the GST statement or Returns drop-down menu. Step 3: On selection, a new page will be issued, In the GSTIN of Supplier field; you need to enter the GSTIN. Step 4: Select the appropriate fiscal year for which the return has to be prepared and filed from the Financial Year drop-down list. Step 5: The tax period drop-down list will be displayed, select the tax period for which return for which the return has to be prepared. Step 6: In the Aggregate Turnover in the preceding Financial Year field, enter the aggregate turnover in the previous financial year. Step 7: In the Aggregate Turnover - April to June 2017 field, provide the aggregate turnover for the quarter ended 30th Jun-17. Note: If there was no such turnover, enter zero. Step 8: After providing all mandatory fields click on the Proceed button. Image 1 Filing Table 6A of GSTR 1

Step 9: The new window will be displayed, Select the Exports Invoices – 6A from the drop-down list under the select section option.

Image 1 Filing Table 6A of GSTR 1

Step 9: The new window will be displayed, Select the Exports Invoices – 6A from the drop-down list under the select section option.

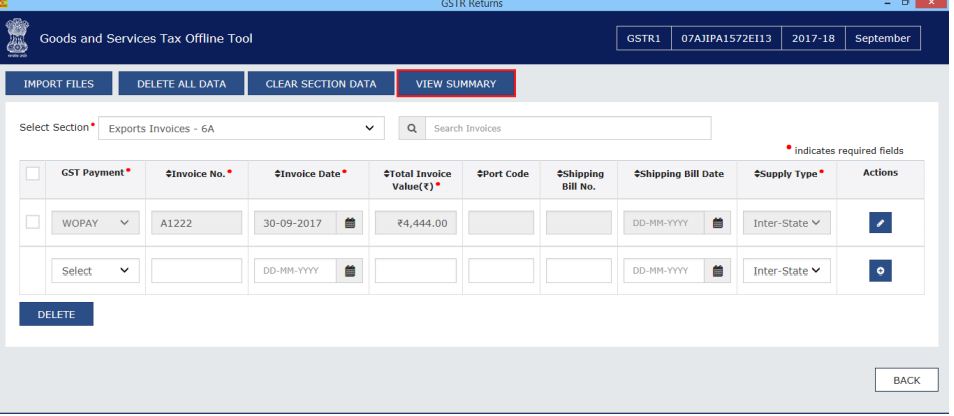

Image 2 Filing Table 6A of GSTR 1

Step 10: Enter the following details in the respective columns:

Image 2 Filing Table 6A of GSTR 1

Step 10: Enter the following details in the respective columns:

- GST Payment

- Invoice number

- Invoice date

- Total invoice value

- Port code

- Shipping bill number & date

- Supply type

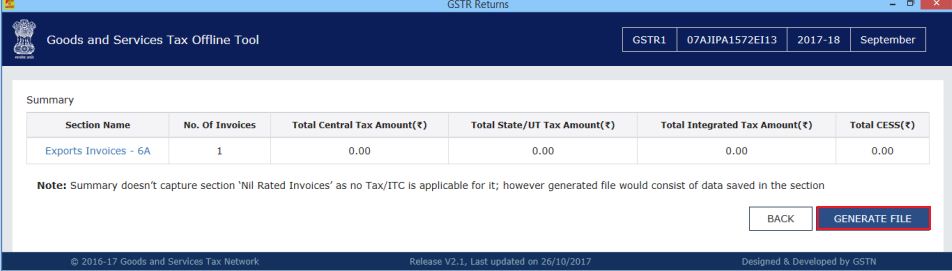

Image 3 Filing Table 6A of GSTR 1

Step 12: After checking the summary details, click on the Generate File option.

Image 3 Filing Table 6A of GSTR 1

Step 12: After checking the summary details, click on the Generate File option.

Image 4 Filing Table 6A of GSTR 1

Step 13: The GST Compliant file generated by the Returns Offline tool (JSON format) will have to be saved to the computer for uploading the same on GST portal. Click on save option.

Image 4 Filing Table 6A of GSTR 1

Step 13: The GST Compliant file generated by the Returns Offline tool (JSON format) will have to be saved to the computer for uploading the same on GST portal. Click on save option.

Image 5 Filing Table 6A of GSTR 1

Image 5 Filing Table 6A of GSTR 1

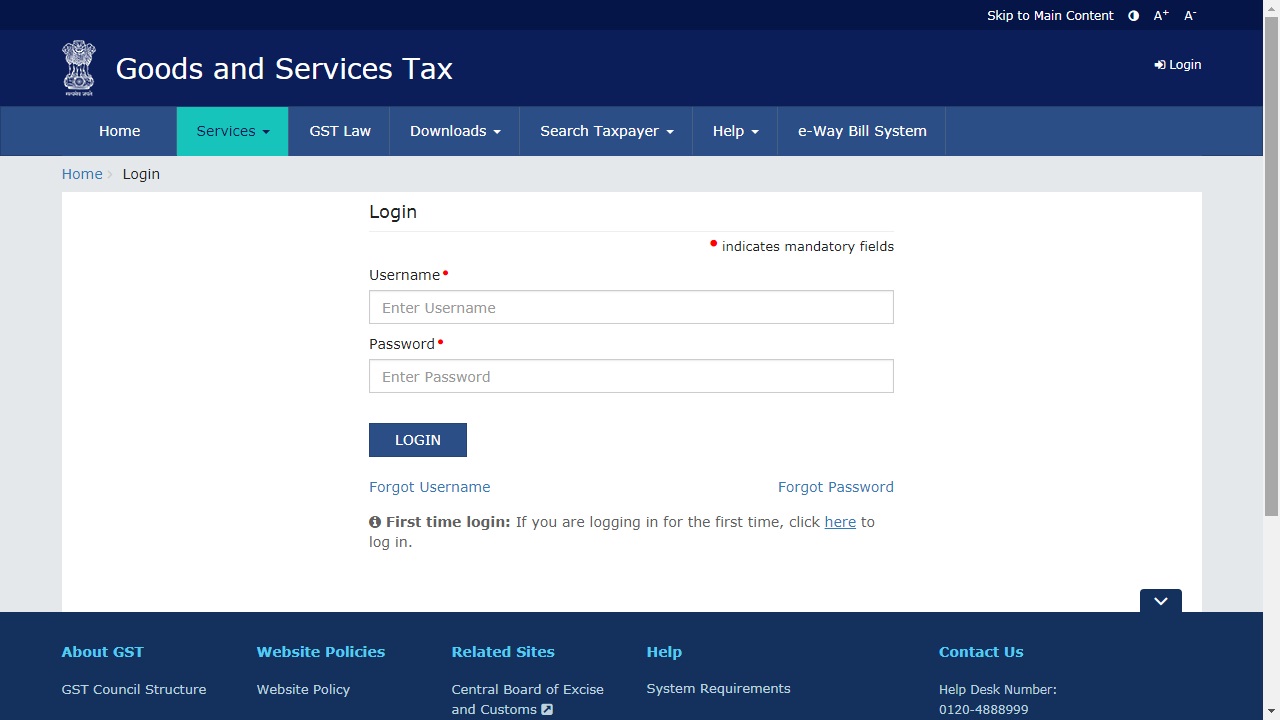

Upload to GST Portal

Step 14: Access the home page of GST portal. To file Table 6A of GSTR 1, you need to noggin to log in to the GST Portal with valid credentials. Image 6 Filing Table 6A of GSTR 1

Step 15: After login into the portal select the Services option, and then select Returns. The list will be shown from that select returns dashboard command.

Step 16: Once you select the returns dashboard command option, the concerned file returns page will be displayed.

Step 17: In the Financial Year drop-down list, select the financial year for which the return has to be uploaded.

Step 18: From the Return Filing Period drop-down list, select the return filing period for which the return has to be uploaded.

Step 19: After selecting a financial year and return filing period, Click on the Search button.

Step 20: Applicable returns of the selected tax period will be displayed. In Table 6A of FORM GSTR 1 tile, click the Prepare offline button.

Image 6 Filing Table 6A of GSTR 1

Step 15: After login into the portal select the Services option, and then select Returns. The list will be shown from that select returns dashboard command.

Step 16: Once you select the returns dashboard command option, the concerned file returns page will be displayed.

Step 17: In the Financial Year drop-down list, select the financial year for which the return has to be uploaded.

Step 18: From the Return Filing Period drop-down list, select the return filing period for which the return has to be uploaded.

Step 19: After selecting a financial year and return filing period, Click on the Search button.

Step 20: Applicable returns of the selected tax period will be displayed. In Table 6A of FORM GSTR 1 tile, click the Prepare offline button.

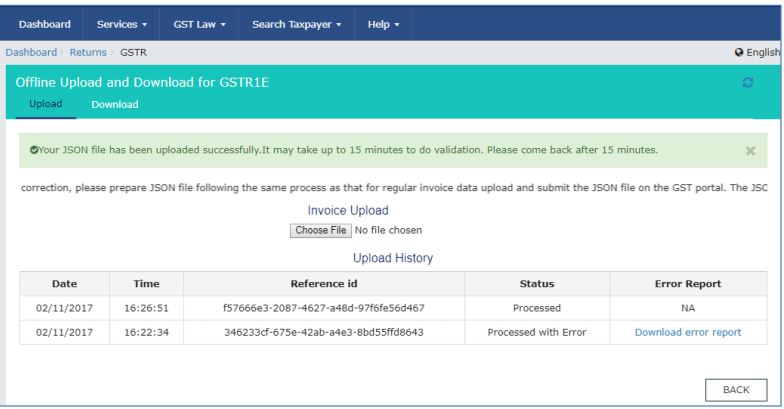

Image 7 Filing Table 6A of GSTR 1

Step 21: The Upload page will be displayed. Click on the Choose File option.

Image 7 Filing Table 6A of GSTR 1

Step 21: The Upload page will be displayed. Click on the Choose File option.

Image 8 Filing Table 6A of GSTR 1

Step 22: Browse and navigate the file JSON to be uploaded from the computer. Click on the Open button.

Step 23: Reference ID Number will be generated, and a message will display that the uploaded invoices are being processed.

Step 24: Go to the Prepare Online, Export Invoices Summary option. Check the uploaded invoice details.

Image 8 Filing Table 6A of GSTR 1

Step 22: Browse and navigate the file JSON to be uploaded from the computer. Click on the Open button.

Step 23: Reference ID Number will be generated, and a message will display that the uploaded invoices are being processed.

Step 24: Go to the Prepare Online, Export Invoices Summary option. Check the uploaded invoice details.

Image 9 Filing Table 6A of GSTR 1

Note: The exporters need not file this section in GSTR 1 again if Table 6A of GSTR 1 has already filed

If all the information matches with the shipping bill filed with the Customs Department, then GST refund on exports will be processed by the Government.

Image 9 Filing Table 6A of GSTR 1

Note: The exporters need not file this section in GSTR 1 again if Table 6A of GSTR 1 has already filed

If all the information matches with the shipping bill filed with the Customs Department, then GST refund on exports will be processed by the Government.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...