Updated on: May 31st, 2021 5:13 PM

Updated on: May 31st, 2021 5:13 PM

Tamil Nadu Vehicle Tax

Tamil Nadu vehicle tax is levied as excise duty on every motor vehicle used or kept for use in Tamil Nadu at the rates specified by the State Government for each type of vehicle. The Government of Tamil Nadu has conferred the power of levying vehicle tax under the Tamil Nadu Motor Vehicle Taxation Act, 1974. According to this Act, the registered owner or any person having possession control of a motor vehicle has to pay Tamil Nadu Vehicle Tax. On payment of Tamil Nadu Vehicle Tax, State Transport Authority of Tamil Nadu issues a license to the registered owner. In this article, we will look at Tamil Nadu Vehicle Tax in detail.Tamil Nadu Motor Vehicle Taxation Act

Tamil Nadu Motor Vehicle Taxation Act consolidates the laws relating to the levy of tax on motor vehicles and passengers and goods carried by such vehicles in Tamil Nadu. According to this TNMVT act, no vehicle tax will be levied on a motor vehicle kept by a dealer or a manufacturer of the car for trade and used under the authorisation of a trade certificate granted by the registering authority. Know more about Input Tax Credit on Motor VehicleTamil Nadu Vehicle Tax - Eligibility

According to this act, the person who has transferred the ownership or has ceased to be in possession or control of below-mentioned vehicle has to pay Tamil Nadu Vehicle Tax- Goods Carriages – Lorries, Light Goods Vehicle, National Permit Vehicle

- Contract Carriages – Omni Bus, Ordinary and Tourist Motor Cab, Maxi Cab Vehicle, Auto rickshaw

- Stage Carriages(per seat per quarter) - Town Service, Express Service, Mofussil Service, Mini Bus

- Private Service Vehicles - Educational Institution Bus

- Non-Transport Vehicles

Tamil Nadu Vehicle Tax – Exemption

The following vehicle owners are exempted from the payment of Tamil Nadu Vehicle Tax:- Vehicles owned by disabled persons used solely for the conveyance of those persons can claim exempt from the amount of vehicle tax.

- The vehicles used only for agricultural purposes will be exempted from payment of Tamil Nadu vehicle tax.

Tamil Nadu Vehicle Tax Schedule (Rate)

The Tamil Nadu Government will specify the rate of Vehicle Tax rate for each type of vehicle. The State Government has powers to increase the rate of vehicle tax from time to time. You can get up to date Vehicle Tax rate details from the official website of Tamil Nadu State Transport Vehicle Department. You can refer the Kerala vehicle tax current rate from the document enclosed here.Green Tax

The purpose of the implementation of various measures to control air pollution, the Government will be levied and collected an additional tax called a green tax. The Rate of green tax is tabulated here:|

S.No |

Class of Motor Vehicles | Tax |

Period |

| 1 | Motor vehicles other than a transport vehicles which has completed 15 years from the date of registration | ||

| 1. Motor Cycle | Rs. 500 | Five Years | |

| 2. Other Motor vehicles | Rs. 1000 | Five Years | |

| 2 | Transport vehicle which has completed seven years from the date of its registration. | ||

| 1. Other than auto rickshaw | Rs.500 | Per annum | |

| 2. Auto rickshaw | Rs. 200 | Per annum |

Road Safety tax

The Government of Tamil Nadu will be levied and collected an additional tax called road safety tax at the time of registration of motor vehicles, at the rates specified below for the implementation of various road safety measures.| S.No | Class of Motor Vehicles | Tax |

| 1 | Motor Cycles | Rs.250 |

| 2 | LMV | Rs.1500 |

| 3 | Others | Rs.2000 |

| New Motor Cycle | ||

| 1 | At the time of Registration | 8% of the total cost of vehicle |

| Old Vehicles | ||

| 1 | Not more than One Year | 7.75% of the cost of Vehicle |

| 2 | More than one year but not more than two Years | 7.50% of the cost of Vehicle |

| 3 | More than three years but not more than four years | 7.00% of the cost of Vehicle |

| 4 | More than four years but not more than five years | 6.75% of the cost of Vehicle |

| 5 | More than five years but not more than six years | 6.50% of the cost of Vehicle |

| 6 | More than six years but not more than seven years | 6.25% of the cost of Vehicle |

| 7 | More than seven years but not more than eight years | 6.00% of the cost of Vehicle |

| 8 | More than eight years but not more than nine years | 5.75% of the cost of Vehicle |

| 9 | More than nine years but not more than ten years | 5.50% of the cost of Vehicle |

| 10 | More than ten years but not more than eleven years | 5.25% of the cost of Vehicle |

| 11 | More than eleven years | 5.00% of the cost of Vehicle |

Prescribed Period for Tax Payment

The tax levied under TNMVT act will have to be paid in the manner prescribed by the registered owner or by any other person having possession or control of the motor vehicle, at his choice, either quarterly, half-yearly or annually, on a license to be taken out by him for that quarter, half-year or year. The tax due under this Act will have to be paid within the prescribed period, not being less than is seven days or more than forty-five days from the commencement of the quarter, half-year. Note: Different periods may be prescribed for different classes of motor vehicles.Tamil Nadu Vehicle Tax Online Payment Procedure

The procedure to pay Tamil Nadu Vehicle Tax online is explained in step by step procedure here: Note: The User or Applicant (Transport Vehicle Owner) should have an active E-Mail ID for pay vehicle tax. If you are not having, create an individual E-Mail ID.Access Transport Web page

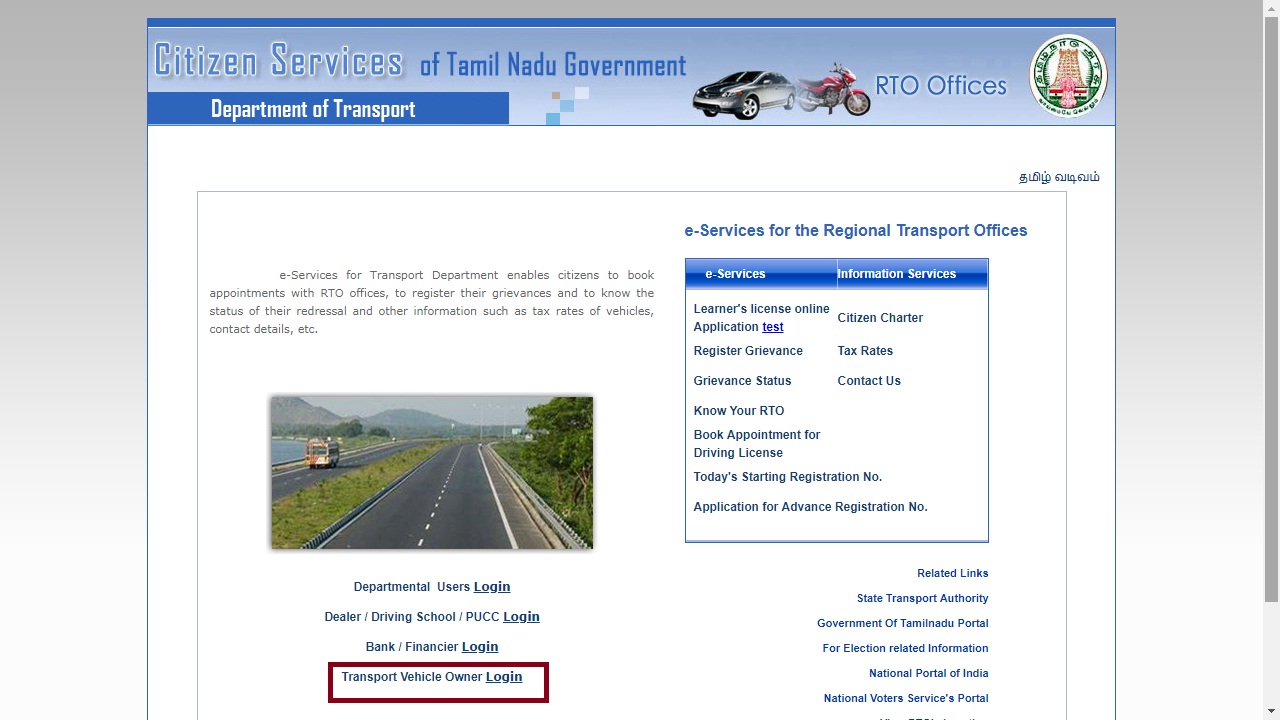

Step 1: The applicant needs to visit the home page of the Department of Transport, Government of Tamil Nadu. Step 2: From the Home Page of the e-Services Web Portal of the Transport Department of Government of Tami Nadu, Click on Transport Vehicle Owner Login option. Image 1 Tamil Nadu Vehicle Tax

Image 1 Tamil Nadu Vehicle Tax

User Registration

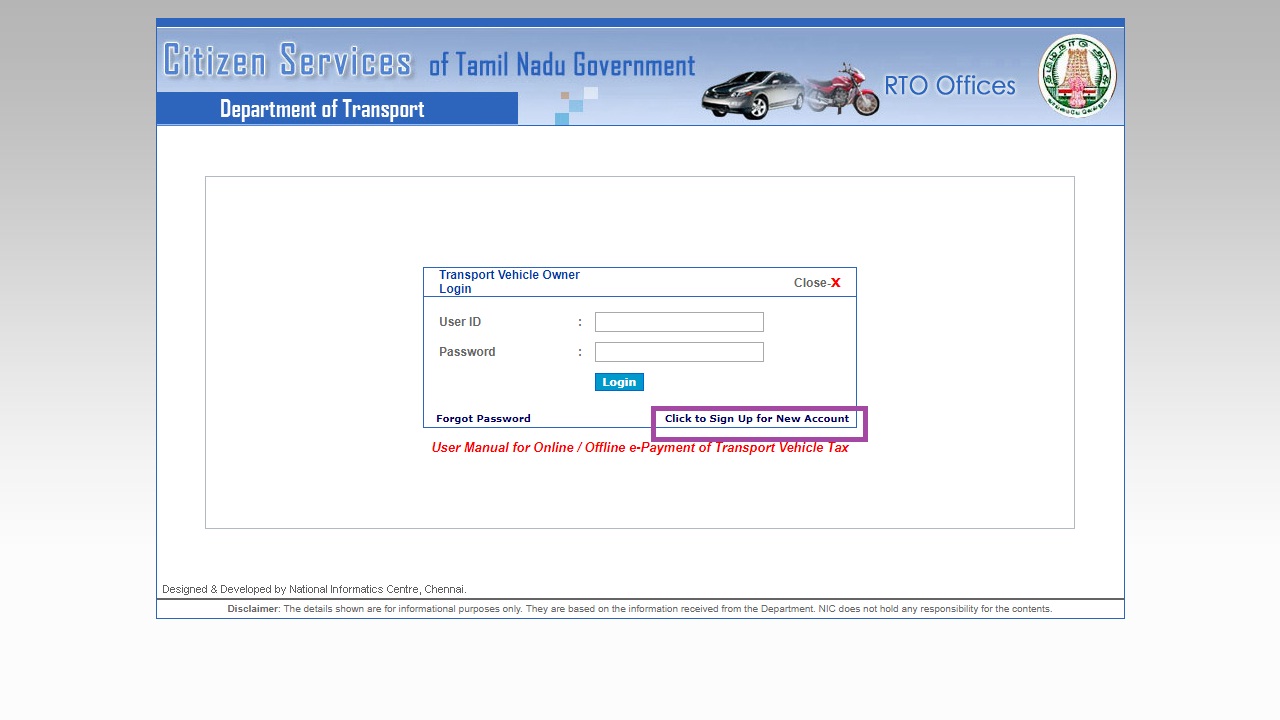

Step 3: The link will be redirected to the new page. If you are a new user to this page, you have to create a profile for this site. Click on Sign up the option for user registration. Image 2 Tamil Nadu Vehicle Tax

Step 4: Enter the required details for user registration and Click “Submit” button to process further. You have to provide the following details for registration:

Image 2 Tamil Nadu Vehicle Tax

Step 4: Enter the required details for user registration and Click “Submit” button to process further. You have to provide the following details for registration:

- Vehicle Owner Name

- Relationship

- Father/Husband Name

- User ID and Password

- Address, Mail Id and Mobile number

- Enter authentication value

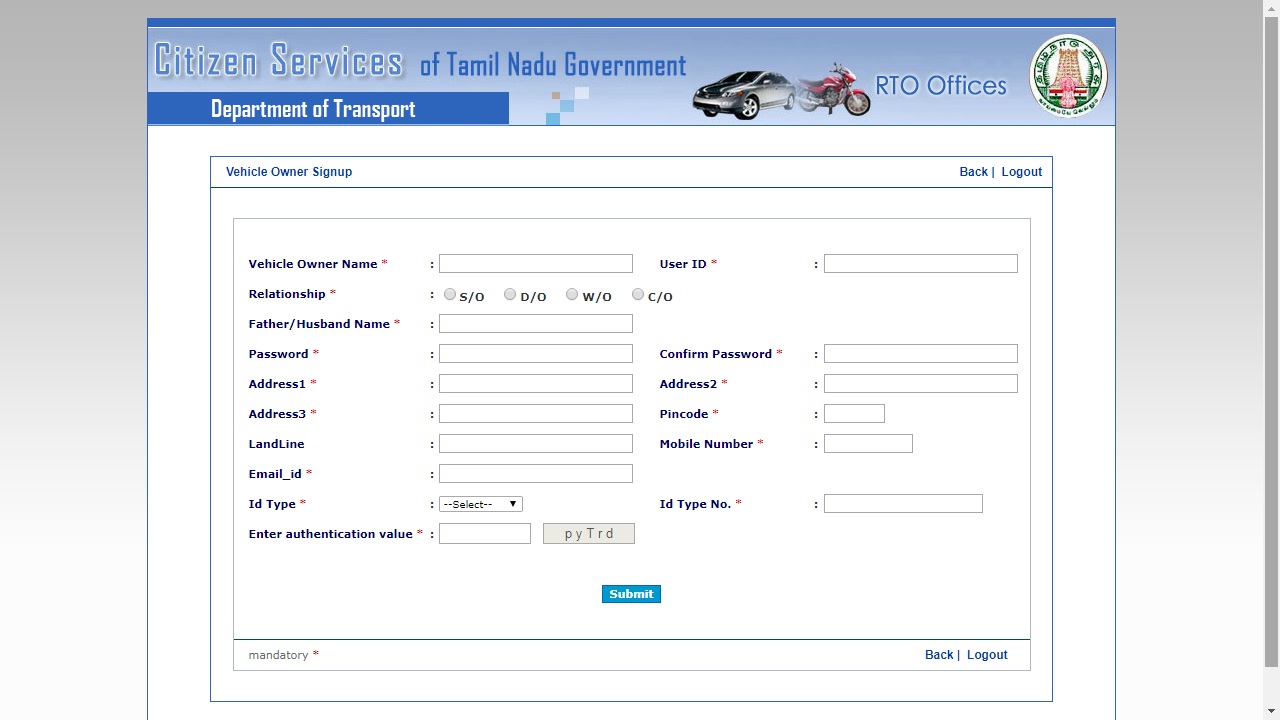

Image 3 Tamil Nadu Vehicle Tax

Step 5: Once you submitted the user creation application, an activation link will be sent to the registered E-Mail ID.

Image 3 Tamil Nadu Vehicle Tax

Step 5: Once you submitted the user creation application, an activation link will be sent to the registered E-Mail ID.

Activate Account

Step 6: Sign in to your mail, open the E-Mail received from noreply.tn@nic.in with the subject as “Vehicle Owner Signup Approval” and click on the link “Click here to Activate”. By clicking on that, your account will get activated. Step 7: Click Here for Vehicle Owner Login Page option will be displayed. Click on that the login page for new vehicle owner will be displayed.Login to Portal

Step 8: In the login page enter the User Name or User ID and Password. After that, click on the Login button. Step 9: After login to the portal, a welcome message with welcome User – User Name / User ID will be shown.Update/Add Vehicle Details

Step 10: In this page click on the Transactions option from the menu and select ‘Add Vehicle for Tax Payment’ from the drop-down menu. Step 11: Add Vehicle will be Page displayed. Provide the Registration Number and Chassis Number of your vehicle. By clicking on the Add button, you can add many vehicles.Make Payment

Step 12: After adding the vehicle details you can pay Tamil Nadu Vehicle Tax. For that click on the back button, the login will display. From the Transactions menu select the option “Payment for Motor Vehicle Tax”. Step 13: In the new page, the Registered Vehicle list will be displayed. Select the vehicle registration number for which the Tamil Nadu Vehicle Tax to be paid. Step 14: The System will check for Tax demand details, Insurance Certificate Validity and PUCC Validity for the selected Vehicle from the Tax Demand File raised by the respective RTOs / MVIs of Unit Office.Update Insurance Details

If insurance Certificate is not updated for the selected Vehicle, then the System will prompt you to update the same. Step 15: To update the Validity of the Insurance Certificate, you need to select “Add Insurance Details for Tax Payment” from the Transaction menu. (Go back to login page) Step 16: Insurance Details will be displayed. In the Insurance Details page enter the registration number of the vehicle and update the insurance details. By clicking on the Save Details button, the insurance certificate details will be updated in the portal.Update PUCC Details

If PUCC Validity is not updated for the selected vehicle, then the System will prompt you to update the same. Step 17: To update the Validity of the Insurance Certificate, you need to select “Add PUCC Details for Tax Payment” from the Transaction menu. (Go back to login page) Step 18: PUCC Details will be displayed. In the Insurance Details page enter the “Registration Number and update the Insurance Details. By clicking on the Save Details button, the PUCC details will be updated in the portal.Select Tax Opted Mode

Step 19: If all the details of the vehicle are correctly updated, the System will allow you to select the Tax opted mode and the Payment Type- Tax opted mode - Quarterly/Half Yearly/Annually

- Payment Type - Online / Offline

Make Payment Online

To can make Online Mode of Payment through Net Banking facility offered by the Accredited Banks such as State Bank of India, Indian Overseas Bank, Canara Bank, Bank of Baroda, Indian Bank and State Bank of Mysore. Step 22: If you have selected online payment mode, then the System will show the list of Accredited Banks, and you can select the appropriate Bank and click on the go to e-Payment. Step 23: This link will redirect to the respective Bank Web site and log in to the portal using the User-ID and Password. Step 24: After login to the concerned bank portal, the system will show the Head-wise payment due to be paid by the User for the respective Vehicle. Step 25: After successful payment, you have to click on the e-Challan-1 and e-Receipt menu option to print the e-Challan-1 and e-Receipt. Step 26: After taking print out of e-Challan and e-Receipt, you need to click on the link “Return Bank to Department web site”. The link will redirect to Transport Department’s e-Services Web Portal. The payment is successful message will be displayed.Print e-Payment Acknowledgement

Step 27: Click on the “Print e-Payment Acknowledgement link to get the e-Payment Acknowledgement along with e-Tax Token details. Note: In case the transaction is not listed, go to the Menu and click on the Option ”e-Payment Verification” and select the particular Pending Transaction which will update the status. After that, you can take the printout of e-Payment Acknowledgement along with e-Tax Token.Proof for Tax Payment

The e-Receipt, e-Challan-1 and e-Payment Acknowledgement are the proof for the payment made which can be shown to RTO / Enforcement Officials as and when demanded. Note: User can also print the e-Payment Acknowledgement on later dates through the menu option “Print e-Payment Acknowledgement”. A link will be shown on the screen “Print e-Payment Acknowledgement”. Click the link will print the e-Payment Acknowledgement along with Tax Token details.Make Payment Offline

To make Offline Mode of Payment based on e-Pay-in-Slip to be tendered at Accredited Banks’ such as Indian Overseas Bank, Canara Bank, Bank of Baroda and Indian Bank Counters. Step 28: If the Payment Type selected is Offline, then the system will show the vehicle payment details. Select e-Demand payment. The “e-Pay-in Slip” will display. Step 29: You need to take print out of two copies of the “e-Pay-in-Slip” for submission at the Accredited Banks’ Counters. Step 30: Both the e-Pay-in-Slip along with payment Instrument has to submit at the Accredited Bank’s counter. Step 31: The concerned bank officials will collect the Payment Instrument and sign with Bank Seal in both the e-Pay-in-Slip. Step 32: One “e-Pay-in-Slip” will be retained by the Bank and another signed “e-Pay-in-Slip” will be handed over to you (vehicle owner) Note: The Payment Status would be updated before the end of the day by the Officials of the Accredited Banks. Step 33: You need to login to the e-Services Web Portal of the Transport Department and check Payment Status through the “e-Payment verification” option from the menu. Click on the particular Pending Transaction which will update the status and allow you to print “e-Payment Acknowledgement”. Step 34: If the payment is a success, the system will show the payment success details and enable the print option Print e-Payment Acknowledgement. By clicking on this, you can take print out of the same. Note: In case, the Bank returns Status as “Pending for Realization”, then, the transaction will appear again in the Pending Payment Verification menu which can be verified by the User after some time.Proof for Tax Payment

The e-Payment Acknowledgement and Signed “e-Pay-in-Slip” are the proof for Tax payment made through Counter Payment using “e-Pay-in-Slip” which can be shown to RTO / Enforcement Officials as and when demanded by them.Get License

When you pay the amount of tax due in respect of a motor vehicle or provide proof to licensing officer that the tax is paid, the licensing officer will grant a license in a prescribed format for the period concerned. The officer will record that the tax has been paid for a specified period in respect of the vehicle. Every license granted under motor vehicle taxation act will be valid throughout the State of Tamil Nadu.Issue of Temporary License

A temporary license for a period not exceeding seven days or thirty days or ninety days will be issued in respect of any class of motor vehicles on payment of tax.- Temporary license exceeding thirty days will be issued on payment of an amount at the rate of quarterly tax

- Temporary license exceeding seven days but not exceeding thirty days will be given on payment of an amount at the rate of one-third of the quarterly tax

- Temporary license not exceeding seven days will be granted at the rate of one-tenth of the quarterly tax.

Refund of Vehicle Tax

The tax for any motor vehicle has been paid for any quarter, half-year, year or lifetime and the vehicle has not been used in any public road during the whole of that quarter, half year, year or the lifetime or a continuous ( not being less than one month) the tax will be refunded to the owner. The Government will notify the rate of a refund amount from time to time.For More Information

In case of any doubt/clarification/technical issues, you can send your queries/feedback to the techsupport.tn@nic.in.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...