Last updated: December 23rd, 2022 8:08 PM

Last updated: December 23rd, 2022 8:08 PM

Telangana Encumbrance Certificate

Encumbrance certificate is one of the most important documents required at the time of property purchase. Encumbrance certificate certifies that there are no dues on the property, and the ownership of the property is clear and marketable. Encumbrance certificate contains details of all transactions done on the specific property. In Telangana, the Department of Registration issues encumbrance certificate. In this article, we look at the procedure for obtaining a Telangana encumbrance certificate in detail. To know about property registration in Telangana, click here.Need for Encumbrance Certificate

Some of the situations when an encumbrance certificate requires are below:- The encumbrance certificate is important for applying for a home loan from the banks.

- The encumbrance certificate is necessary to obtain a loan from the respective bank against a property.

- The encumbrance certificate is mandatory when one wants to buy or sell a property.

- The encumbrance certificate acts as evidence that the property is free from legal liabilities.

- The encumbrance certificate ensures to know about the past transactions of property at the time of purchase of the property.

Details Present in the Certificate

The following details relating to the property will be provided in the encumbrance certificate:- All transactions are representing the property that has been recorded by the Registrar.

- All necessary details in the sales deeds will be included in the encumbrance certificate. The certificate usually concerns a specific period and transactions applicable to that period alone mentioned.

- For gifted deeds, details on gift settlement will be notified.

- Certain documents, such as testamentary documents and short-term lease deeds, need not be registered as per the law.

Applicable Fee for Encumbrance Certificate

The following applicable charges for the applicant are below:- The service charges to be given by the applicant are Rs. 25 and the applicant must also pay legal fees. There are different payments as per age are:

- If the applicant age is below 30 years, then he/she has to remit charges are Rs. 200.

- If the applicant age is 30 or above 30 years, then he/she has to remit Rs. 500 to be paid.

Application Procedure for Encumbrance Certificate

To apply for encumbrance certificate in Telangana, follow the steps given below: Step 1: The applicant has to visit the official website of the Meeseva portal. [caption id="attachment_57957" align="aligncenter" width="719"] Telangana-Encumbrance-Certificate-Home-Page

Step 2: Click on "Government forms" which is on the homepage of the portal.

Step 3: In the next page, click on "Meeseva services" from the list of service.

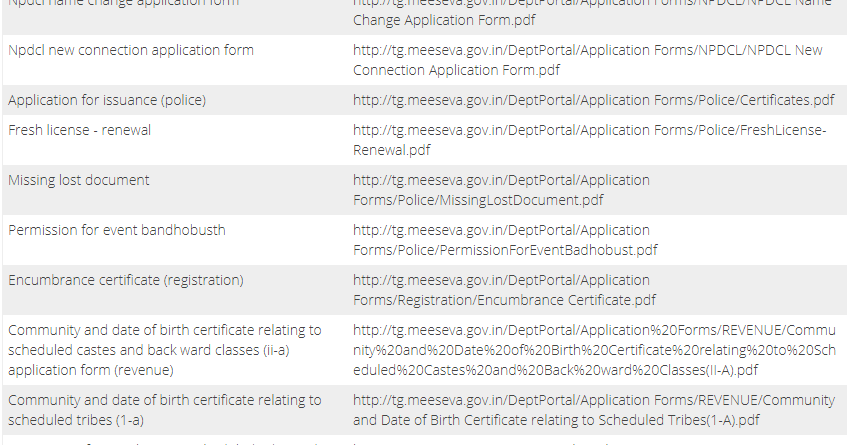

Step 4: Now scroll down the number of departments listed out from that the user can choose the Encumbrance certificate (registration).

[caption id="attachment_57958" align="aligncenter" width="739"]

Telangana-Encumbrance-Certificate-Home-Page

Step 2: Click on "Government forms" which is on the homepage of the portal.

Step 3: In the next page, click on "Meeseva services" from the list of service.

Step 4: Now scroll down the number of departments listed out from that the user can choose the Encumbrance certificate (registration).

[caption id="attachment_57958" align="aligncenter" width="739"] Telangana-Encumbrance-Certificate-Service-List

needStep 5: Download the application form for the encumbrance certificate from the portal.

Step 6: Fill the application form with the necessary details like

Telangana-Encumbrance-Certificate-Service-List

needStep 5: Download the application form for the encumbrance certificate from the portal.

Step 6: Fill the application form with the necessary details like

- Name of the property owner

- Sale / Purchase deed of the property, etc.

- Fill the details correctly and attach the necessary documents.

Track Application status

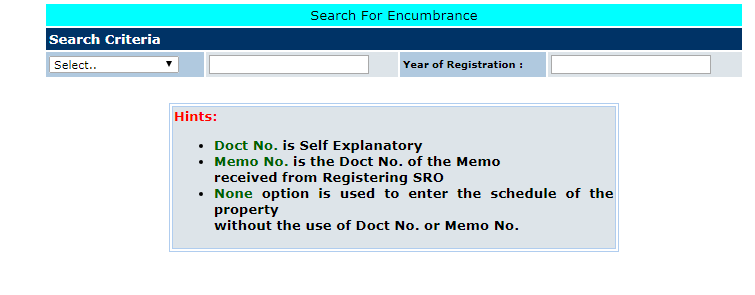

The applicant can check the status of the application online by following the steps below: Step 1: The applicant needs to revisit the Meeseva portal. Step 2: Click on "Encumbrance search" option. Step 3: Select the criteria and enter the year of registration. [caption id="attachment_57960" align="aligncenter" width="755"] Telangana-Encumbrance-Certificate-Track-Applicant

Step 4: Now, the applicant can able to see the current status of the application.

Telangana-Encumbrance-Certificate-Track-Applicant

Step 4: Now, the applicant can able to see the current status of the application.

Processing Time

The applicant will receive the encumbrance certificate within 6 working days from the date of application.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...