Last updated: May 24th, 2024 12:56 PM

Last updated: May 24th, 2024 12:56 PM

TIIC Warehouse and Cold Storage Scheme

Tamil Nadu Industrial Investment Corporation Limited (TIIC) has introduced the Warehouse and Cold Storage Scheme to provide financial assistance for Small Scale Industry (SSI) units. The Warehouse and Cold Storage Scheme provide funding for the construction of the Warehouse or Cold Storage facility predominantly for storing goods manufactured by SSI units. In this article, we look at the procedure for availing finance under the TIIC Warehouse and Cold Storage Scheme in detail.Objectives of the Scheme

The primary objective of the Warehouse and Cold Storage Scheme is to promote SSI units for constructing Warehouses and storage Godowns and purchasing material handling equipment such as overhead cranes, forklifts, weighing machines, and cold storage facilities.Eligibility Criteria

The following persons can get the loan under the TIIC Warehouse and Cold Storage Scheme:- Corporate Bodies

- Partnership firms

- Proprietary concerns

Loan Limit

The maximum amount of loan can be obtained as per the requirements of the project cost.Promoter's Contribution

The Promoter Contribution under the Warehouse and Cold Storage scheme will be at the rate of 35% of the value of the total project cost.Rate of Interest

The proposed rate of interest charged for the loan amount is given here.Conditions

- Interest can be paid either on a monthly or quarterly basis.

- Subsidy Loan and Term Loan against Credit Linked Capital subsidy will carry an interest rate that applies to Term Loan.

- In the case of default penal interest of 2.50% per annum will be imposed for the defaulted period.

Registration Fees

The applicant has to pay the registration fee at the time of registration of the application.- The Registration Fee of Rs. 5,000 has to be remitted if the loan is processed by the Branch Sanction Committee (BSC).

- The Registration Fee of Rs. 25,000 has to be paid if the Head Office processes the credit.

Investigation Fees

The investigation fees are inclusive of the registration fees, and the applicant is requested to make an investigation fee before the prescribed sanction committee sanctions the loan proposal.| Loan Amount | Investigation Fee |

| Loans up to Rs.10.00 lakhs | Rs.5000 |

| Loans above Rs.10.00 lakhs and up to Rs.50.00 lakhs | Rs.10000 |

| Loans above Rs.50 lakhs and up to Rs.100 lakhs | Rs.30,000 |

| Loans above Rs.100 lakhs and up to Rs.200 lakhs | Rs.40,000 |

| Loans above Rs.200 lakhs and up to Rs.300 lakhs | Rs.50,000 |

| Loans above Rs.300 lakhs and up to Rs.2000 lakhs | 0.20% up to a maximum of Rs.2.00 lakhs |

| Loans above Rs.2000 lakhs | Rs.5,00,000 |

Pre-closure Terms

In the case of document rate of interest on a loan is equal to or less than the current rate of interest, no preclosure premium will be collected. For other cases, Pre-closure premium of 1% per annum will be collected for pre-closure of loans by borrowers.Repayment Period

The maximum repayment period for the Warehouse and Cold Storage loan is 9 years, including a moratorium of up to 2 years for principal repayment, and the repayment can be made in equated monthly instalments.Collateral Security

The collateral security of not less than 50% of the loan amount is required from the borrower. Higher collateral security may be obtained if necessary.Documents Required

The below-following documents are to be furnished along with the application form:For leasehold premises:

-

- Lease Deed

- Rent receipt

- Corporation/Local authority tax receipt

- No objection certificate from the lessor

For collateral security/primary security:

-

- Original of the registered sale deed

- Parent documents

- Encumbrance certificate for 30 years.

- Kist receipt for tax

- Patta, Chitta and Adangal extract

- VAO certificate for possession, enjoyment and the latest boundaries for the land offered as security.

- FMB sketch (Field Measurement Book)

For SlDCO/SIPCOT/DIC/Government Industries Estate Sheds/Plots:

-

- Original allotment order

- Copy of memorandum of understanding

- Original sale deed, if executed by the higher authorities.

- NOC from the above agency to mortgage the land/shed in favour of TIIC for loan assistance.

- Handing over/taken over letter/boundary certificate.

- EC from the date of allotment

For Partnership Firm:

-

- Copy of Partnership Deed and any supplementary deed

- Copy of Firm Registration Certificate

- Form A/Rule V certificate if there is any change in partnership.

For Private or Public Limited Company:

-

- Copy of Memorandum and Articles of Association

- Certificate of Incorporation/Commencement of business

- Resolution under 293 (1) (a) and 293 (1)

- In respect of mortgage of assets and borrowing limits in the case of Public Limited Companies.

Refund for Rejection of Loan

In case of refusal of the loan application, the prescribed fee will be refunded as given below:- The investigation fee paid as the second instalment will be considered for refund at the rate of 50% on fees paid if the applicant withdraws the proposal before sanction. However, the initial registration fees will not be refunded.

- If the corporation or the applicant rejects the loan application after the sanction of loan, no reimbursement will be entertained.

- No refund of investigation fee will be allowed if the contractor availed for 50% concession already.

Application Procedure

To apply for the Warehouse and Cold Storage scheme, follow the procedure specified here:Visit Official Website

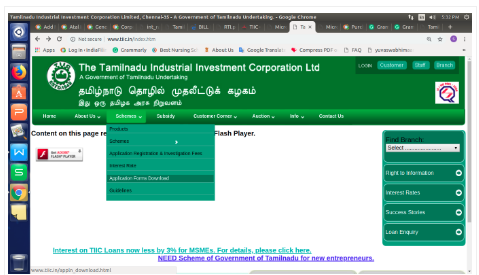

Step 1: Please, visit the official portal of TIIC, Tamilnadu Government.

Application form Download

Step 2: Click on “Application form download” under the scheme option, which is displayed on the home screen of the portal.

[caption id="attachment_84075" align="aligncenter" width="479"] TIIC Warehouse and Cold Storage Scheme - Image 1

TIIC Warehouse and Cold Storage Scheme - Image 1

Choose Application Form

Step 3: Select the particular application form from the list of options shown below.

[caption id="attachment_84078" align="aligncenter" width="505"] TIIC Warehouse and Cold Storage Scheme - Image 2

TIIC Warehouse and Cold Storage Scheme - Image 2

Download the Form

Step 4: Now, the form for the Warehouse and Cold Storage scheme will be downloaded on your screen.

The application form for the Warehouse and Cold Storage is reproduced below in the pdf format for your reference.

Complete the Details

Step 5: Fill the application form with the necessary details such as

-

-

- Name of the applicant

- Address of the organisation

- Industry Type

- Details of the Director/ Proprietor/ Partners

-

Attach Upload Documents

Step 6: After filling all the mandatory information and then attach the documents required along with the application form.

Submit the Application

Step 7: Now apply the duly filled application form to the nearby TIIC office.

The concerned authority will verify the submitted application with the particulars and proceed further if satisfied with the submissions.

To get Online SSI Registration, visit IndiaFilings.com SSI / MSME Registration page.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...