Last updated: April 13th, 2018 12:40 AM

Last updated: April 13th, 2018 12:40 AM

Types of Share Capital

The share capital of a company must be classified into different types while being presented in the financial statements. In this article, we look at the different types of share capital and the mode for presentation of share capital on the financial statements.Authorised Share Capital

Authorized capital, also called nominal capital, as stated in the Memorandum of Association (MOA) is the amount of share capital that a company can raise at any time by issuing new shares. A company cannot issue shares of the value more than the authorized capital. If capital is to be raised beyond the authorized capital, the memorandum has to be amended via a resolution passed at a general meeting of the shareholders. Once this is done and the limit of authorized capital is increased, the company may raise more finance by way of sale of share. To know more about increase of authorised capital, click here.Issued Share Capital

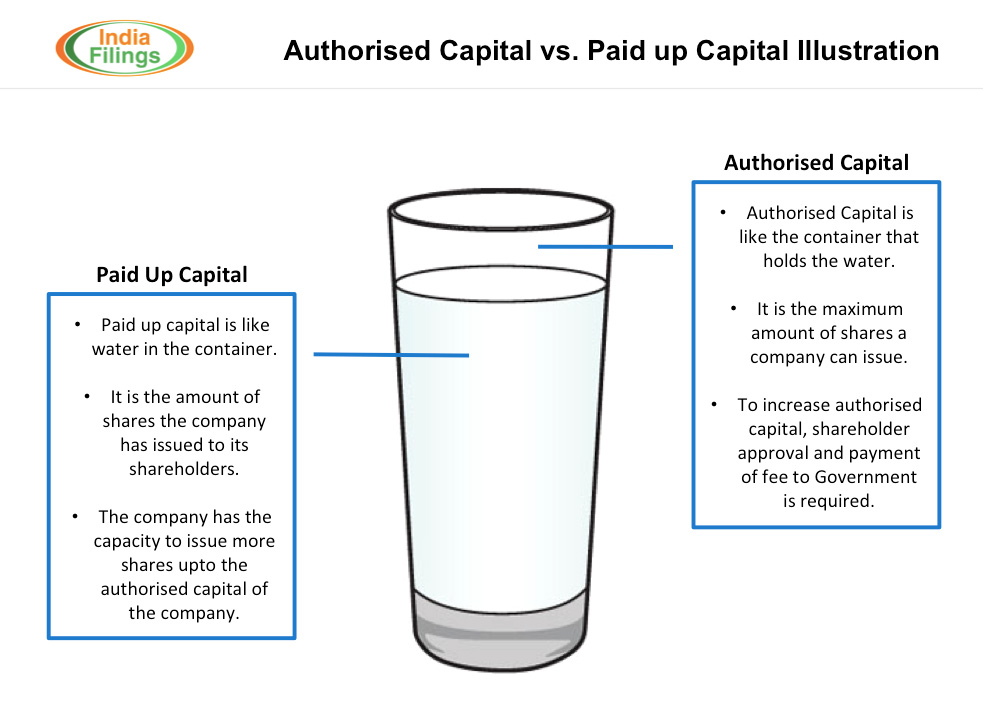

Issued Capital is issued by the company from time to time. The issued capital has to be within the limits of the authorized capital as stated in the memorandum. The issued share capital is either equal to or less than the authorized capital. It can never be more than the authorized capital of the company. It is also called as called-up capital. Authorised Capital vs Paid Up Capital Illustration

Authorised Capital vs Paid Up Capital Illustration

Subscribed Share Capital

Subscribed capital is increased when members have subscribed to the shares of the company. Subscribed share capital should also be equal to or less than the issued share capital. The un-allotted capital out of the subscribed share capital is called unsubscribed share capital.Paid-Up Share Capital

Paid-up share capital is the aggregate amount of money received from shareholders for shares issued. Hence, the capital allotted and paid by shareholders is called paid-up capital. This shows the amount received either in cash or in kind by the company from the allottees of shares subscribed by them. That part of the subscribed capital that remains to be paid is called "Calls in Arrears" or "unpaid share capital". Therefore, paid-up share capital is shown after deducting from the subscribed capital and the unpaid share capital.Presenting Share Capital on Financial Statements

While presenting the share capital of a company on the financial statements, the following information must be presented:- The number and the amount of shares are authorized.

- The number of shares issued/ subscribed and fully paid /subscribed but not fully paid.

- Par value per share.

- A reconciliation of the number of shares outstanding at the beginning and at the end of the reporting period.

- The rights, preferences, and restrictions attached to each class of shares including restrictions on the distribution of dividends and the repayment of capital.

- Shares in respect of each class in the company held by its holding company or its ultimate holding company including shares held by subsidiaries or associates of the holding company or the ultimate holding company in aggregate.

- Shares in the company held by each stakeholder holding more than 5 percent shares specifying the number of shares held.

- Shares reserved for issue under options and contracts/commitments for the sale of shares/disinvestments including terms and amounts.

- Terms of any securities convertible into equity/preference shares issued along with the earliest date of conversion in descending order starting from the farthest date.

- Calls unpaid by directors and officers.

- Forfeited shares showing originally paid up shares.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...