Last updated: December 17th, 2019 5:04 PM

Last updated: December 17th, 2019 5:04 PM

Unemployed Youth Employment Generation Programme (UYEGP)

The Micro, Small and Medium Enterprises Department of Government of Tamil Nadu has introduced the scheme Unemployed Youth Employment Generation Programme (UYEGP). The key objective of this UYEGP scheme is to diminish the unemployment problems of socially and economically weaker section of the society, particularly among the educated and unemployed to become self-employed by setting up Service, Manufacturing, Business enterprises by availing loan with subsidy assistance from the State Government. In this article, we will look at the Unemployed Youth Employment Generation Programme (UYEGP) scheme in detail.Eligibility Criteria

The eligibility criteria to obtain the loan under the Unemployed Youth Employment Generation Programme (UYEGP) is explained in detail below:- The entrepreneur should have a minimum qualification of eight standard

- Any individual, above 18 years of age can apply for UYEGP. Upper age limit for the special category is 45 years and for General Category is 45 years

- The family income of the entrepreneur along with the spouse should not exceed Rs.1,50,000 per annum.

- The entrepreneur should be a resident of the place for not less than three years.

- EDP training is compulsory to get a loan under the Unemployed Youth Employment Generation Programme

- The beneficiary should not have availed loan or subsidy under any other State/Central Government scheme to apply for the UYEGP scheme.

Activities/area covered under UYEGP scheme

The scheme applies to all cities in the Tamil Nadu including the rural and urban areas. All economically viable Service, Manufacturing and Business activities excluding direct Agricultural operations like raising of crops,Project Cost

the maximum project cost under the Unemployed Youth Employment Generation Programme (UYEGP) for each category is listed as follows:- Rs. 10.00 lakhs for Manufacturing Sector

- lRs.3.00 lakhs for Service Sector

- lRs.1.00 lakh for Business Sector.

Promoter’s Contribution

As per Unemployed Youth Employment Generation Programme (UYEGP), 10% on the Project Cost for General Category as Promoter’s contribution and 5% on the Project Cost for Special Category (viz. Scheduled Tribe/Scheduled Caste/ Backward Classes / Most Backward Classes / Minorities / Women / Ex-servicemen / Physically Challenged / Transgender) as owners’ contribution. Note: Cost of land and building should not be included in the project costRate of Subsidy

Quantum of Maximum Government subsidy under the Unemployed Youth Employment Generation Programme (UYEGP), Government provides 25% subsidy on project cost with a maximum limit of Rs.125000. Amount of the Bank Loan will be 90-95% loan of the project cost. (Including Government Subsidy of 25%). The bank should release 90-95% of the project cost as a loan and then claim the subsidy.Collateral Security

As per RBI guidelines, the Project Cost up to Rs 10.00 lakhs under UYEGP loans are free from Collateral Security.Rate of Interest

The rate of interest is charged as per the guidance of Reserve Bank of India.Repayment Tenure

Repayment tenure will be five years or as fixed by the bank in accordance with the guidance of RBI.Lock in Period

The lock-in period for Government subsidy is three years.Prescribed Authority

Beneficiaries will be selected through the interview process by the District Task Force Committee headed by the General Manager (GM) of the concerned District Industries Centre or Regional Joint Director, Chennai.Documents Required

The beneficiary shall submit an application along with project profile and the Quotation at the respective District Industries Centre with the certificates in proof of following documents:- Educational qualification certificate (Transfer Certificate / School Record Sheet copy)

- Quotation and Project Report

- Nativity certificate ( Copy of Ration card or Nativity certificate obtained from Revenue Department authority)

- Community Certificate

- Ex-Serviceman /Differently abled /Transgenders should apply with a valid certificate

- Valid Quotations (Original & Duplicate ) with GST number

- Affidavit

Application Procedure for Unemployed Youth Employment Generation Programme (UYEGP)

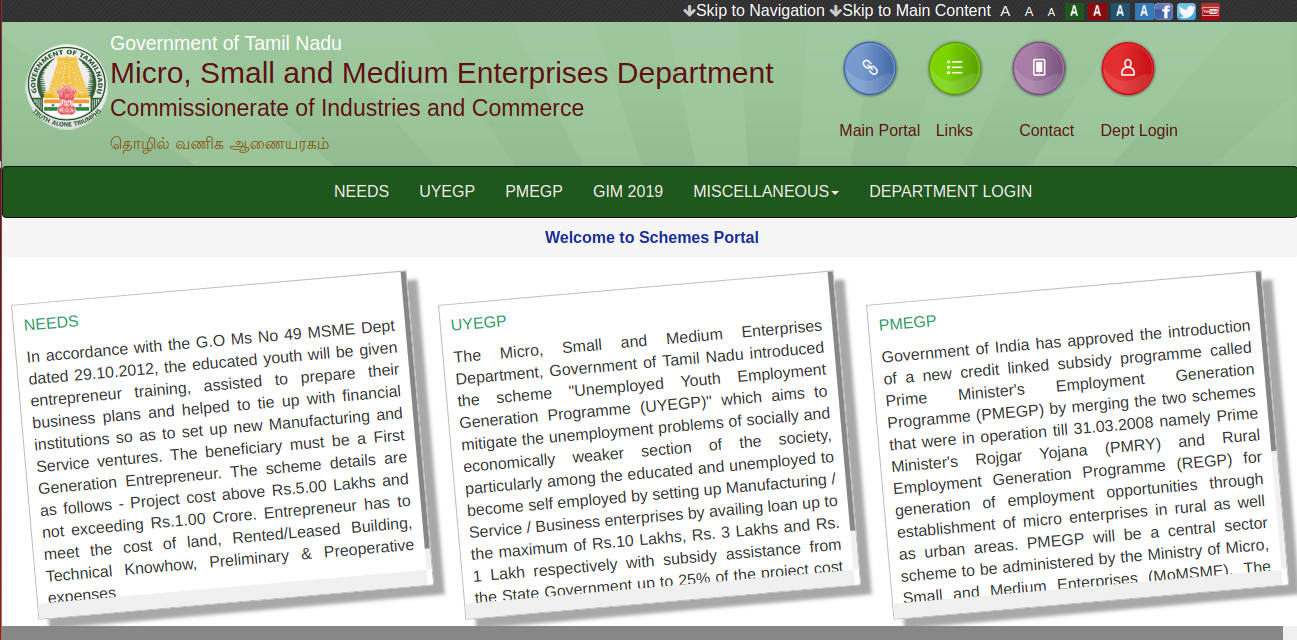

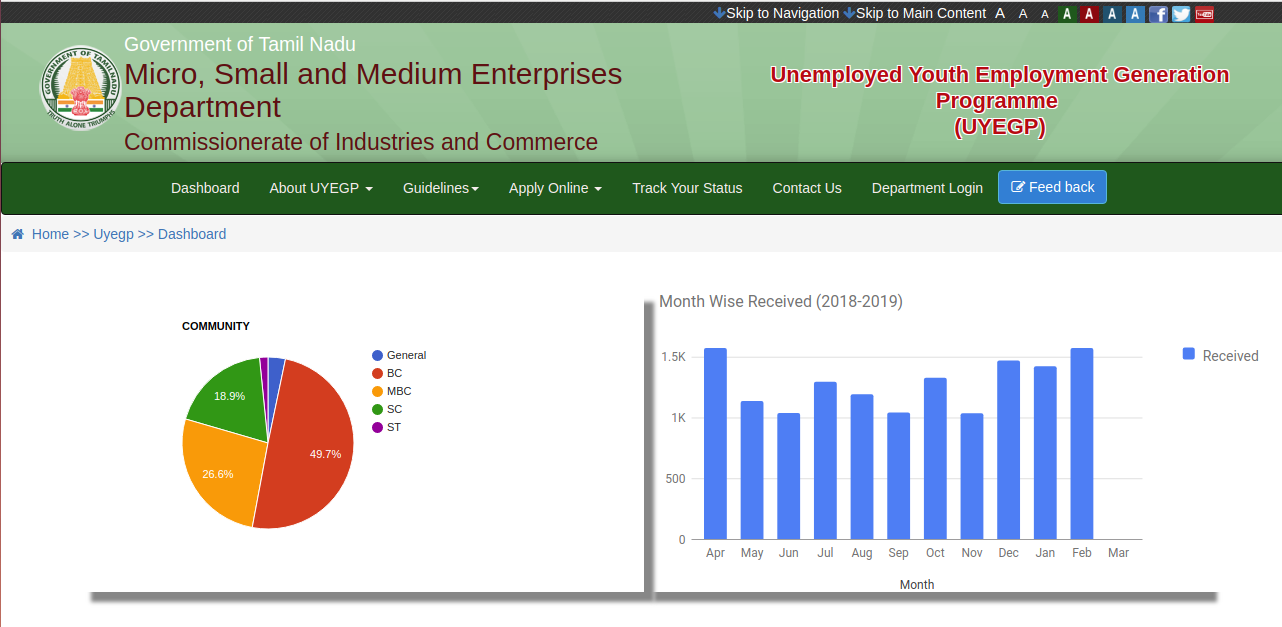

The procedure for applying for the Unemployed Youth Employment Generation Programme (UYEGP) is explained in detail below: Step 1: Applicant willing to avail loan under UYEGP scheme should fill up the online application available in the official web portal of Micro, Small and Medium Enterprises Department. Step 2: From the MSME home page, select the UYEGP option. The link will be redirected to the new page. Image 1 Unemployed Youth Employment Generation Programme (UYEGP)

Step 3: In this new page click on the Apply Online option and then select New Application. The application for the Unemployed Youth Employment Generation Programme (UYEGP) scheme will be displayed.

Image 1 Unemployed Youth Employment Generation Programme (UYEGP)

Step 3: In this new page click on the Apply Online option and then select New Application. The application for the Unemployed Youth Employment Generation Programme (UYEGP) scheme will be displayed.

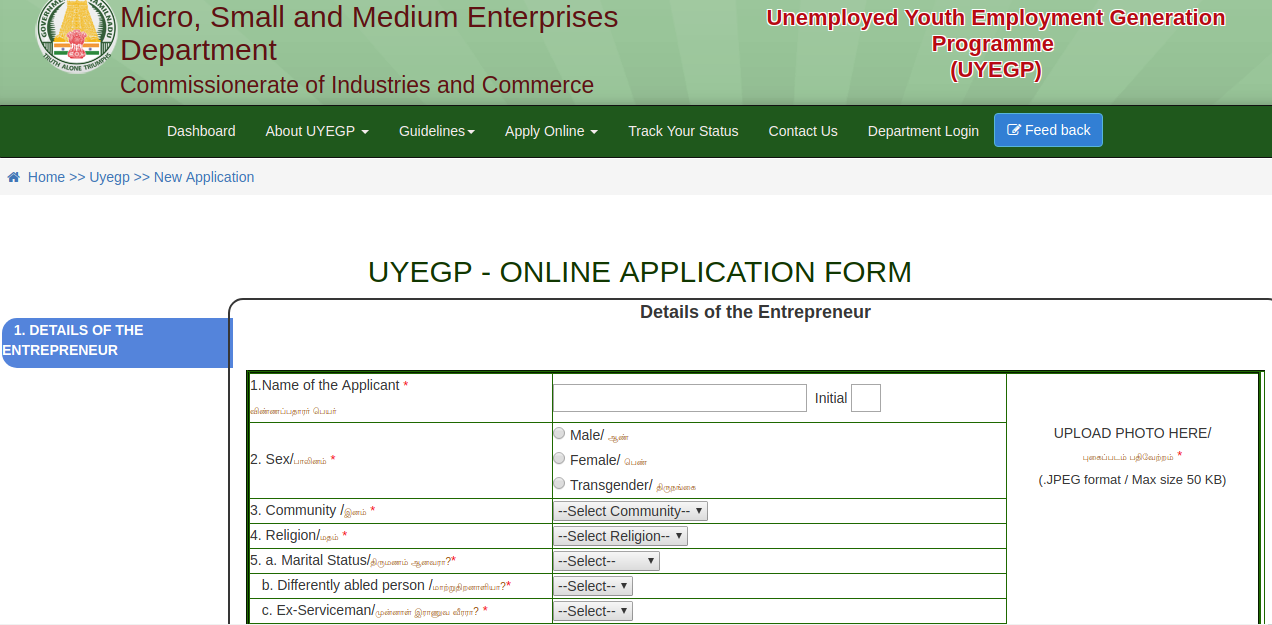

Image 2 Unemployed Youth Employment Generation Programme (UYEGP)

Image 2 Unemployed Youth Employment Generation Programme (UYEGP)

Provide Entrepreneur Details

Step 4: The applicant needs to provide the following details of the entrepreneur:- Name of the Applicant

- Gender & Community

- Religion & Marital Status

- Date of birth

- Communication Details

- Adhaar/Mobile / E-Mail Details

- Qualification details

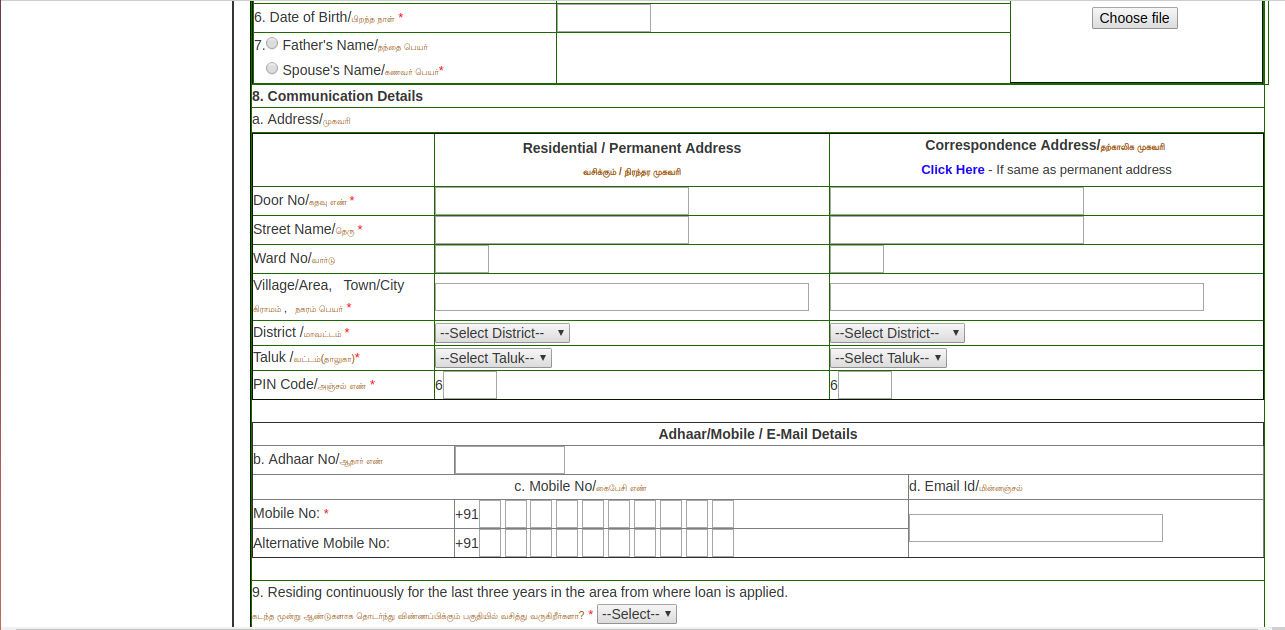

Image 3 Unemployed Youth Employment Generation Programme (UYEGP).png

Step 5: After providing the details mentioned above, upload photographs of the entrepreneur.

Image 3 Unemployed Youth Employment Generation Programme (UYEGP).png

Step 5: After providing the details mentioned above, upload photographs of the entrepreneur.

Image 4 Unemployed Youth Employment Generation Programme (UYEGP).png

Image 4 Unemployed Youth Employment Generation Programme (UYEGP).png

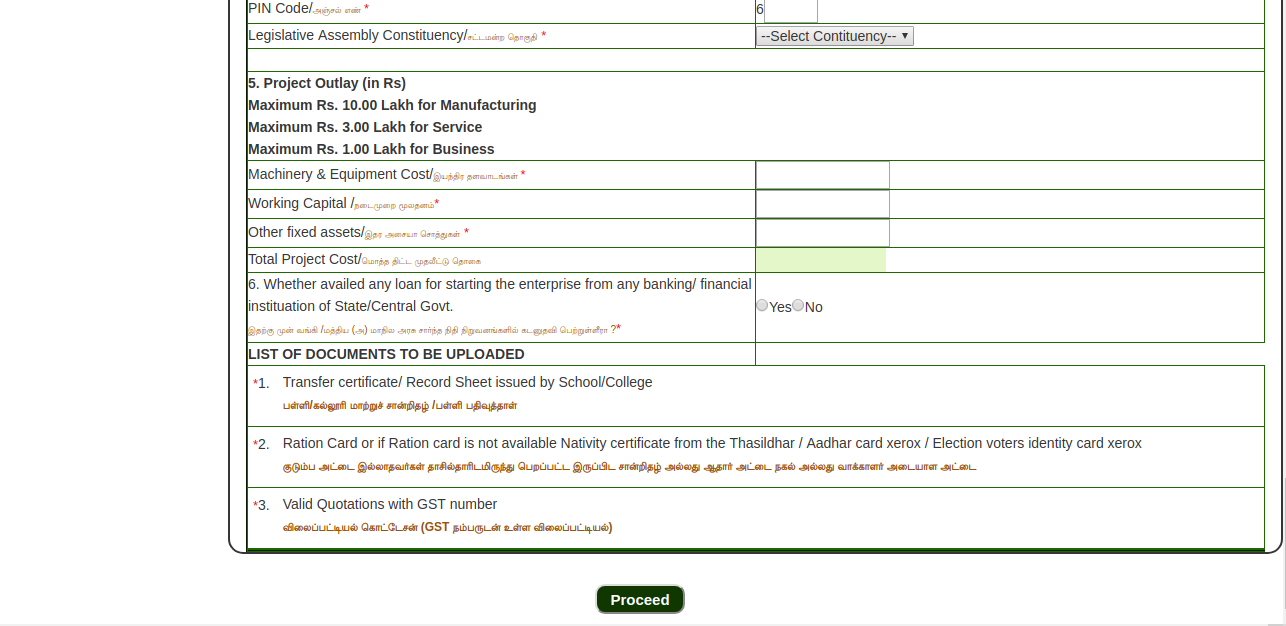

Provide Unit Details

Step 6: You need to provide details of Line of Activity, Category of the Venture, Address where the activities are proposed to be started and Project Outlay. Image 5 Unemployed Youth Employment Generation Programme (UYEGP).png

Step 7: Once the information is furnished, you can go through the list of documents to be uploaded.

Image 5 Unemployed Youth Employment Generation Programme (UYEGP).png

Step 7: Once the information is furnished, you can go through the list of documents to be uploaded.

Image 6 Unemployed Youth Employment Generation Programme (UYEGP).png

Image 6 Unemployed Youth Employment Generation Programme (UYEGP).png

Get Application ID

Step 8: Click on the proceed button for further processing of the application. On submission of application, you will be provided with an application ID. Note it for future reference.Upload Documents

Step 9: From the Micro, Small and Medium Enterprises Department, select upload documents option under the apply online option. Image 7 Unemployed Youth Employment Generation Programme (UYEGP).png

Step 10: Provide the application ID and click on the submit button. You can upload all the documents.

Step 11: By clicking on the submit button, the application will be forwarded to the concerned department.

Image 7 Unemployed Youth Employment Generation Programme (UYEGP).png

Step 10: Provide the application ID and click on the submit button. You can upload all the documents.

Step 11: By clicking on the submit button, the application will be forwarded to the concerned department.

Verification by DIC

Step 12: The DIC will verify the eligibility of the applicant and the application. On verification, the applicant will receive a call letter for attending an interview. Step 13: If the applicant is passed an interview, the recommendation for sanction the loan will be sent to the concerned bank.Get the EDP completion certificate.

Step 14: The bank will accord the loan sanctions. The applicant will receive a call letter for attending the EDP training. Step 15: You need to submit the EDP training certificate. The affidavit should be typed in an Rs.20/- Non Judicial Stamp Paper duly Certified and Signed by the Notary Publics and then submit the affidavit along with a copy of Rental or Lease Agreement to the bank while sanctioning of the loan.Subsidy Disbursement

The subsidy will be disbursed under TDR for three years by DIC. After completion of three years, the subsidy will be adjusted in the loan amount.Application Status Verification

The applicant can verify the UYEGP application status from the Micro, Small and Medium Enterprises Department official webpage. Image 9 Unemployed Youth Employment Generation Programme (UYEGP).png

Click on the Track Your Status option, enter the application number or registered phone number. By clicking on the submit button, the status of the application will be displayed.

Image 9 Unemployed Youth Employment Generation Programme (UYEGP).png

Click on the Track Your Status option, enter the application number or registered phone number. By clicking on the submit button, the status of the application will be displayed.

Image 10 Unemployed Youth Employment Generation Programme (UYEGP).png

Note: The entrepreneur can also apply to e-service centres located in Taluk offices, Municipal offices and Primary Agriculture Cooperative Credit Society (PACCS).

Image 10 Unemployed Youth Employment Generation Programme (UYEGP).png

Note: The entrepreneur can also apply to e-service centres located in Taluk offices, Municipal offices and Primary Agriculture Cooperative Credit Society (PACCS).

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...