Updated on: July 26th, 2024 11:35 AM

Updated on: July 26th, 2024 11:35 AM

Union Budget 2024 Highlights

Finance Minister Nirmala Sitharaman presented the Union Budget 2024 in Parliament today, emphasising support for the poor, women, youth, and farmers. The budget includes increased spending, job creation initiatives, and tax relief for the middle class. Key changes in taxation were announced, including a hike in Securities Transaction Tax (STT) on the F&O segment and rationalisation of taxes on short-term and long-term capital gains. Additionally, modifications to the personal income tax slabs in the New Tax Regime, along with an increase in Standard Deduction, were introduced, aiming to provide further relief to taxpayers.Major Focus Areas of Union Budget 2024

The Union Budget 2024 emphasises several key areas to foster inclusive growth and economic development. The primary focus areas are as follows:- Key Areas of Focus: The budget prioritises the middle class, employment, skilling, and MSMEs.

- Women-Centric Initiatives: Allocation of ₹3 lakh crore announced for women-centric schemes.

- Employment Generation: Nine priorities are outlined for generating employment, including productivity, jobs, social justice, urban development, energy security, infrastructure, and reforms.

- Support Packages: A ₹2 lakh crore package was announced for five key schemes.

- Focus on Vulnerable Groups: The budget emphasises support for the poor, women, youth, and farmers.

Budget 2024 Direct Tax Proposals

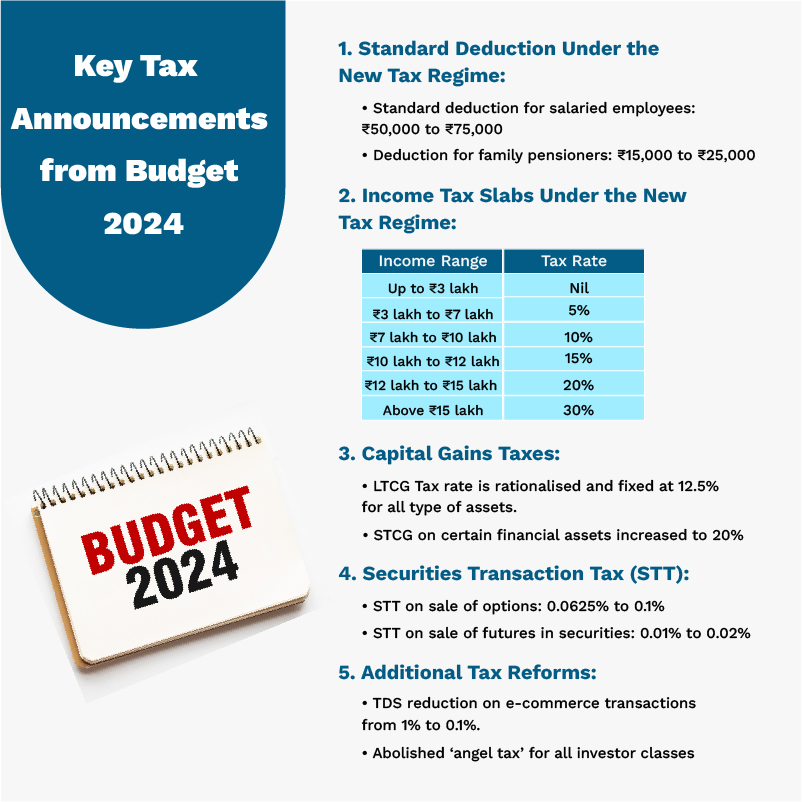

Here are several key announcements for direct taxes in Budget 2024: Budget-2024-key-tax-announcements

Budget-2024-key-tax-announcements

Standard Deduction under the New Tax Regime

Finance Minister Nirmala Sitharaman made two significant announcements regarding personal income tax rates for those opting for the new tax regime.- First, the standard deduction for salaried employees is proposed to be increased from ₹50,000 to ₹75,000.

- For family pensioners, the standard deduction has been increased from ₹15,000 to ₹25,000.

New Tax Slabs Under the New Tax Regime

Income Tax slabs for FY 2024-25 for the new tax regime have been revised. The new tax regime tax slabs are:| Income Range | Tax Rate |

| Up to ₹3 lakh | Nil |

| ₹3 lakh to ₹7 lakh | 5% |

| ₹7 lakh to ₹10 lakh | 10% |

| ₹10 lakh to ₹12 lakh | 15% |

| ₹12 lakh to ₹15 lakh | 20% |

| Above ₹15 lakh | 30% |

Increase in Employer’s Contribution to NPS

Section 80CCD allows a deduction for an employer's contribution to a pension scheme up to 10% of an employee's salary. Under the New Tax Regime, the ceiling limit for an employer’s contribution to NPS for private sector employees is increased from 10% to 14%.Changes in Capital Gains Taxes

The Finance Minister today announced significant changes to the capital gains tax structure in India:- Simplified Capital Gains Classification: For classifying capital gains between LTCG/STCG, there will be only two holding periods: 12 months for all listed securities and 24 months for all other assets.

- Long-Term Capital Gains (LTCG)

- Increased Tax Rate: The tax on long-term capital gains has been increased from 10% to 12.5%.

- Holding Period for Listed Financial Assets: The holding period to qualify for long-term capital gains for listed financial assets remains more than one year.

- Classification of Assets:

- As mentioned, Listed financial assets held for more than one year will be classified as long-term.

- Unlisted and non-financial assets must be held for at least two years to be classified as long-term.

-

- Exemption Limit: The exemption limit for capital gains on certain listed financial assets has been increased from ₹1 lakh to ₹1.25 lakh per year.

- Removal of Indexation Benefits: Indexation benefits under the second proviso to section 48, which are currently available for property, gold, and other unlisted assets, are proposed to be removed for calculating long-term capital gains.

- Increased Tax on Short-Term Capital Gains: Tax on short-term capital gains under section 111A on STT-paid equity shares, and units of equity-oriented mutual funds increased to 20% from the current rate of 15%. Other STCG will continue to be taxed at applicable tax rates.

- Unlisted Bonds and Debentures: Unlisted bonds, debentures, debt mutual funds, and market-linked debentures will attract capital gains tax at applicable rates, irrespective of the holding period.

Securities Transaction Tax (STT) Revision

In the Union Budget 2024, the Finance Minister proposed an increase in the rates of Securities Transaction Tax (STT):- STT on the sale of options has been increased from 0.0625 % to 0.1 %

- STT on the sale of futures in securities has been increased from 0.01 % to 0.02 % of the transaction price.

Corporate Taxes on Foreign Companies

In Budget 2024, Finance Minister Nirmala Sitharaman proposed reducing the corporate tax rate for foreign companies from 40% to 35%.Abolition of Angel Tax

Angel tax is proposed to be abolished. The Angel tax provisions of Section 56(2)(viii) have been proposed to be removed. Angel tax is imposed on companies that issue new shares to investors at a price exceeding the company's Fair Market Value (FMV). Previously, any amount by which the issue price surpassed the FMV was taxable under section 56(2)(viii) as Angel tax in the hands of the company. This provision is now slated for removal.Increase in Remuneration Limit for Working Partners

Increase in limit of remuneration to workingpartners of a firm allowed as deduction under Income Tax Act.Changes in Tax Treatment of Share Buybacks

In the existing income tax regime, beneficiary shareholders are not required to pay income tax on earnings from a company's buyback offer. Finance Minister Nirmala Sitharaman introduced a new rule: Starting from FY2025, beneficiary shareholders will be obligated to pay taxes on their income derived from such buyback benefits.Amendment to Section 28

Section 28 of the Act is proposed to be amended to clarify that any income from letting out of a residential house or a part of the house by the owner shall not be chargeable under the head “Profits and gains of business or profession” and shall be chargeable under the head “Income from house property”.Rationalization of TDS Rates

Budget 2024 has lowered the TDS rates on certain payments to support business operations and enhance taxpayer compliance. These revised TDS rates will take effect either from October 1, 2024, or April 1, 2025. The specified payments affected by these changes are listed in the table below.| Section | Present TDS Rate | Proposed TDS Rate | With effect from |

| Section 194H - Payment of commission or brokerage | 5% | 2% | 1.10.2024 |

| Section 194-IB - Payment of rent by certain individuals or HUF | 5% | 2% | 1.10.2024 |

| Section 194M - Payment of certain sums by certain individuals or Hindu undivided family | 5% | 2% | 1.10.2024 |

| Section 194-O - Payment of certain sums by e-commerce operator to e-commerce participant | 1% | 0.1% | 1.10.2024 |

| Section 194F relating to payments on account of repurchase of units by Mutual Fund or Unit Trust of India | Proposed to be omitted | 1.10.2024 | |

New TDS Section 194T

Budget 2024 has introduced a new Tax Deducted at Source (TDS) provision under section 194T, applicable to payments made by firms—including both partnership firms and Limited Liability Partnerships (LLPs)—to their partners. This covers payments such as salary, remuneration, interest, bonus, or commission. Now, any payment of this nature exceeding Rs. 20,000 will be subject to TDS at a rate of 10%.TCS on Notified Luxury Goods

- A levy of TCS at 1% will be applied to notified goods with a value exceeding ₹10 lakh.

- TDS on Floating Rate Savings (Taxable) Bonds (FRSB) 2020

- TDS is proposed on interest exceeding ₹10,000 on Floating Rate Savings (Taxable) Bonds (FRSB) 2020 or any other notified security of the Central or State Governments.

Other Direct Tax Updates

- Comprehensive Review of Income Tax Act 1961: In the Union Budget 2024, Finance Minister Nirmala Sitharaman announced a comprehensive review of the Income Tax Act 1961 to relieve the middle class. Significant changes have been made under the New Tax Regime, introducing new tax slabs.

- Budget 2024 Reintroduces Vivaad se Vishwas Scheme: The Budget 2024 proposes to reintroduce the Vivaad se Vishwas Scheme, a direct tax dispute resolution initiative. This scheme aims to resolve disputed direct tax issues and eliminate litigation at a minimal cost to the government.

- Reopening of Income Tax Returns: Under the new guidelines, an income tax return can be reopened only if there is an income of Rs 50 lakh or more. In such cases, assessments can be reopened up to three years but not exceeding five years from the end of the assessment year. For cases involving a search, the period for reopening has been shortened from ten years to six years.

- Income Tax Appeals: To decrease the backlog of pending cases, the monetary thresholds for filing appeals in tax disputes at tax tribunals, high courts, and the Supreme Court have been raised to Rs. 60 lakh, Rs. 1 crore, and Rs. 2 crore, respectively.

Budget 2024 Indirect Tax Proposals

Budget 2024 introduces several key adjustments and proposals in indirect taxes to streamline compliance, encourage local industries, and support green energy initiatives. Key highlights include:Custom Duty Changes

Key Announcements on Custom Duties under Budget 2024:- Medicines: Customs duty will be entirely removed on three additional medication to provide relief to cancer patients.

- Mobile Phones and Accessories: Basic customs duty on mobile phones, mobile PCBAs, and mobile chargers will be reduced to 15%.

- Critical Minerals: Twenty-five critical minerals will be exempt from customs duties, and the basic customs duty on two of them will be reduced.

- Solar Manufacturing: The list of exempted capital goods for use in manufacturing solar cells and panels will be expanded.

- Manufacturing Materials: Customs duty will be removed on oxygen-free copper used to manufacture resistors, and certain parts used to manufacture connectors will be exempt.

| Particulars | From | To |

|---|---|---|

| Mobile phone, mobile PCBA, and chargers | 20% | Basic customs duty reduced to 15% |

| Gold and silver | 15% | Customs duty reduced to 6% |

| Platinum | 15.4% | Customs duty reduced to 6.4% |

| Broodstock, polychaete worms, shrimp, and fish feed | 10%, 30%, and 15% respectively | Basic customs duty reduced to 5% |

| Alkali or alkaline earth metals, 25 rare earth minerals (like lithium) | 5% | Exempted from customs duty |

| Capital goods for manufacturing of solar panels | 7.5% | Exempted from customs duty |

| Cancer drugs (Trastuzumab Deruxtecan, osimertinib, and Durvalumab) | 10% | Exempted from customs duty |

| Ferro nickel and blister copper | 2.5% | Nil BCD |

| Ammonium nitrate | 7.5% | 10% |

| PVC flex banners | 10% | 25% |

| PCBA of specific telecom equipment | 10% | 15% |

Changes in GST Law by Union Budget 2024

In the Union Budget 2024, Finance Minister Nirmala Sitharaman announced several significant legislative changes in GST laws to streamline tax processes and facilitate trade. These changes, which will be implemented based on the recommendations of the GST Council and in coordination with the States, include various amendments to enhance trade facilitation, regularise tax practices, and clarify tax provisions.Key GST Amendments:

- Extra Neutral Alcohol: Amendment to keep Extra Neutral Alcohol outside the purview of Central Tax.

- Non-Levy and Short-Levy: Amendment to regularise non-levy and short-levy of Central Tax due to general practice.

- Input Tax Credit:

- Amendment to relax the time limits to avail of Input Tax Credit.

- Amendment to enable availment of transitional credit by Input Services Distributor.

- Amendment to restrict blockage of Input Tax Credit for tax paid under Section 74.

- Demand Notices and Orders: Insertion of a new section to provide a standard time limit for the issuance of demand notices and orders.

- Pre-Deposit for Appeals: Amendment to reduce the maximum pre-deposit required for filing appeals.

- Interest or Penalty Waiver: Amendment to provide a conditional waiver of interest or penalty for specific tax periods.

- GST Appellate Tribunal: Amendment to empower the Government to notify the GST Appellate Tribunal for anti-profiteering cases and provide a sunset clause.

- Insurance Sector Clarification: Amendment to clarify certain insurance sector activities as neither a supply of goods nor services.

- Time of Supply in Reverse Charge: Amendment to clarify the time of supply of services in reverse charge supplies.

- Registration Cancellation: Amendment to provide conditions and restrictions for revocation of cancellation of registration.

- Invoice Issuance: Amendment to prescribe the time period for the issuance of invoices by recipients in reverse charge mechanism supplies.

- Monthly Returns by TDS Deductors: Amendment to make the filing of monthly returns by TDS deductors mandatory.

- Refund Prohibition: Amendment to prohibit refund in the zero-rated supply of goods subject to export duty.

- Authorised Representative Appearance: Amendment to allow appearance by an authorised representative on behalf of a summoned person.

- Principal Bench of GST Appellate Tribunal: Amendment to empower the Government to notify cases to be heard only by the Principal Bench of the GST Appellate Tribunal.

- Penal Provisions for Electronic Commerce Operators: Amendment to restrict the applicability of penal provisions under Section 122(1B) to Electronic Commerce Operators who deduct TCS.

- Consequential Amendments: Consequential amendments due to the insertion of new Section 74A in the CGST Act.

Budget Announcements for MSMEs

The 2024 Budget has unveiled a series of measures aimed at bolstering Micro, Small, and Medium Enterprises (MSMEs), focusing on manufacturing, especially labour-intensive sectors. These initiatives encompass financing, regulatory changes, and technological support, ensuring that MSMEs can grow and compete globally. Below are the key announcements made in the budget:- Mudra Loan Eligibility Limit: The limit for Mudra loans has been increased from ₹10 lakh to ₹20 lakh for those who have availed and successfully repaid loans under the TARUN category.

- Trade Receivables Discounting System (TReDS): To help MSMEs unlock their working capital by converting trade receivables into cash, the turnover threshold for mandatory onboarding on the TReDS platform has been reduced from ₹500 crore to ₹250 crore. This measure will bring 22 more CPSEs and 7000 more companies onto the platform.

- Credit Guarantee Schemes: New credit guarantee schemes for MSMEs will be introduced, providing a guarantee cover of ₹100 crore for higher loan amounts.

- SIDBI Expansion: SIDBI will open 24 new branches within three years to expand its reach and better serve MSMEs.

- Financial Support for Food Irradiation Units and Testing Labs: Financial support will be provided to establish 50 multi-product food irradiation units and 100 food quality and safety testing labs.

- E-Commerce Export Hubs: E-commerce export Hubs will be set up in public-private partnership (PPP) mode to enable MSMEs and traditional artisans to sell their products in international markets.

Budget 2024 Downloads

- To download the Finance Bill 2024, click here.

- For the Budget 2024 speech, click here.

Other Announcements in the Union Budget 2024

Here are other key announcements made in the Union Budget 2024:Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...