Last updated: March 28th, 2020 7:26 PM

Last updated: March 28th, 2020 7:26 PM

Unutilised Input Tax Credit Refund under GST

An inverted tax structure could lead to accumulation of input tax credit on the taxpayers GST account. For example, input tax credit would get accumulated if an entity purchases an input that is charged 12% GST rate and sells the item after processing at 5% GST rate. In such a scenario, the taxable person registered under GST can apply for refund of unutilised input tax credit due to an inverted tax structure. In this article, we look at the procedure for applying for unutilised input tax credit refund under GST.Requirements for Filing GST Refund Application

Before filing the application for GST refund, ensure that you have filed GSTR 1 and GSTR 3B return for the relevant tax period for which refund application is made. Normal taxpayers having a turnover of more than Rs.1.5 crores can file for GST refund every month after filing the relevant GSTR 1 and GSTR 3B return. In case of taxpayers opting to file quarterly GST returns, GST refund application can be filed every quarter after filing of GSTR 1 and GSTR 3B return. Note: Since GSTR 2 and GSTR 3 return have been temporarily suspended, there is no requirement for filing such returns to claim GST refund. Click here to file GST return.Amount of Refund Claimed

The maximum amount of refund that can be claimed by a taxpayer on account of an inverted tax structure can be calculated using the following formula:Refund Amount = (Turnover of inverted rated supply of goods X Net input tax credit / Adjusted total turnover) – Tax payable on such inverted rated supply of goods

In the above formula:

- "Refund amount" means the maximum refund that is admissible.

- "Net ITC" means input tax credit availed on inputs and input services during the relevant period

- "Turnover of inverted rated supply of goods" means the value of inverted supply of goods made during the relevant period without payment of tax under bond or letter of undertaking.

- "Tax payable on such inverted rated supply of goods" means tax payable on such inverted rated supply of goods under the same head i.e. IGST, CGST, SGST.

- "Adjusted Total turnover" means the turnover in a State or a Union territory, as defined under clause (112) of section 2 of CGST Act, excluding the value of exempt supplies other than inverted-rated supplies, during the relevant period

- “Relevant period” means the period for which the claim has been filed.

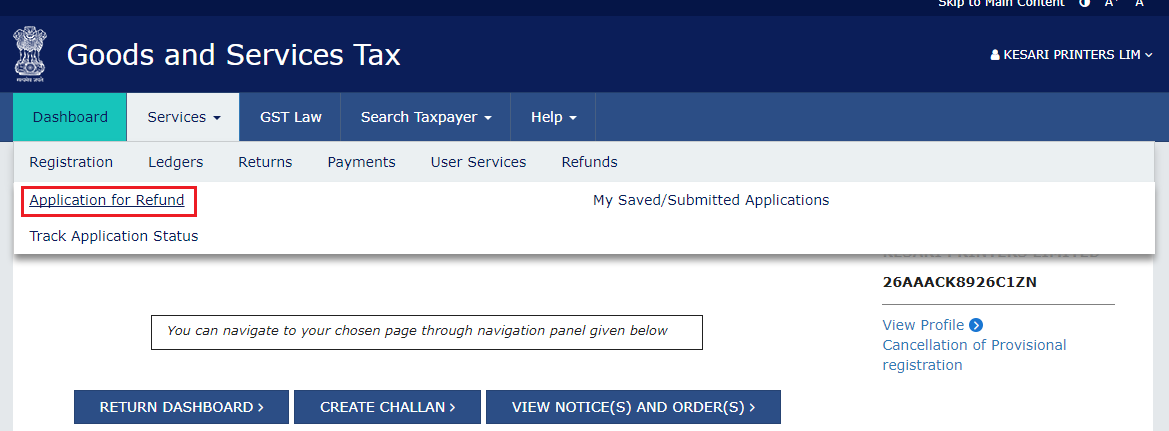

Step 1: Select Application for Refund

- Login to your GST account on the GST Portal.

- Navigate to the Services > Refunds > Application for Refund option.

- Click on Application for Refund.

Step 1 - Unutilised Input Tax Credit Refund

Step 1 - Unutilised Input Tax Credit Refund

Step 2: Select Type & Period for Refund Application

- In the refund application page, select the Refund on account of ITC accumulated due to Inverted Tax Structure radio button. You can also select and apply for other types of GST refunds from this page.

- Select the tax period (year and month) for which the refund application needs to be filed below the GST refund types.

- Click the CREATE button corresponding to your selected refund type.

Step 2 - Unutilised Input Tax Credit Refund

Step 2 - Unutilised Input Tax Credit Refund

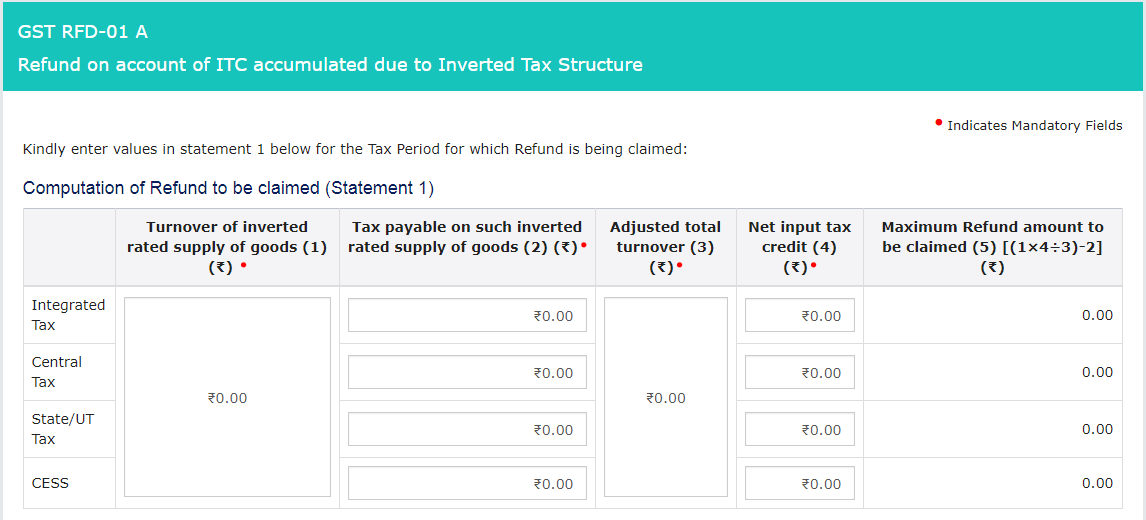

Step 3: Refund Computation

This is the most important step in making the GST refund application. In the table computation for refund, the following information must be provided:- In column-1 (Turnover of inverted rated supply of goods), enter the turnover of inverted rated supply of goods by referring to column-3.1(a) of the Form GSTR-3B.

- In column-2 (Tax payable on such inverted rated supply of goods), enter the tax payable on such inverted rated supply of goods under the four major heads – IGST, CGST, SGST / UTGST, and CESS.

- In column-3 (Adjusted total turnover), enter the adjusted total turnover.

- In column-4 (Net input tax credit), enter the Net Input Tax credit figures for the major heads – IGST, CGST, SGST / UTGST, and CESS separately. The figures of Net Input Tax Credit (ITC) in column-4 may be taken from column-4(C) of the Form GSTR-3B respectively.

Step 3 - After filling the appropriate figures in the above table, the refund amounts will get auto-populated for all the four major heads, in the “Amount Eligible for Refund” Table. The individual can verify the refund amount as provided by the Government in the Refund Claimed table.

Step 3 - After filling the appropriate figures in the above table, the refund amounts will get auto-populated for all the four major heads, in the “Amount Eligible for Refund” Table. The individual can verify the refund amount as provided by the Government in the Refund Claimed table.

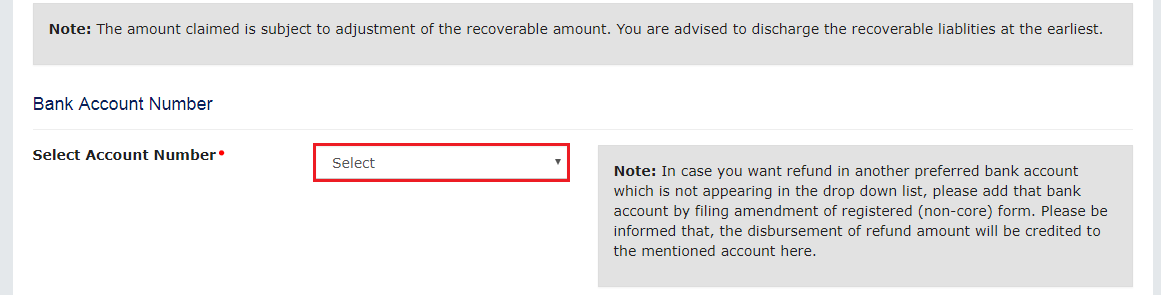

Step 4: Select Bank Account and Submit Application

The applicant shall receive the refund amount to one of the registered bank accounts in the GST Portal and linked with the taxpayers GST account. At the time of filling-out form RFD-01A, you will be required to select a bank account from the list of your linked / registered accounts in the GST Portal. In case the taxpayer requires receipt of refund in a different bank account, he/she may add that bank account in GST registration details by way of non-core amendment. Step 4 - Unutilised Input Tax Credit Refund

The individual should save the refund application before filing. Hence, save the refund application by clicking on the Save Button. Once, the system displays a confirmation message upon saving the application, the proceed button will be activated.

Now agree by selecting the checkbox and click the PROCEED button to begin the e-signing process.

Note: All GST refund applications that have been saved can be retrieved using the My Saved / Submitted Applications option under Refunds. Saved applications are stored in the system for 15 days, after which they get deleted automatically.

Step 4 - Unutilised Input Tax Credit Refund

The individual should save the refund application before filing. Hence, save the refund application by clicking on the Save Button. Once, the system displays a confirmation message upon saving the application, the proceed button will be activated.

Now agree by selecting the checkbox and click the PROCEED button to begin the e-signing process.

Note: All GST refund applications that have been saved can be retrieved using the My Saved / Submitted Applications option under Refunds. Saved applications are stored in the system for 15 days, after which they get deleted automatically.

Step 4A - Unutilised Input Tax Credit Refund

Step 4A - Unutilised Input Tax Credit Refund

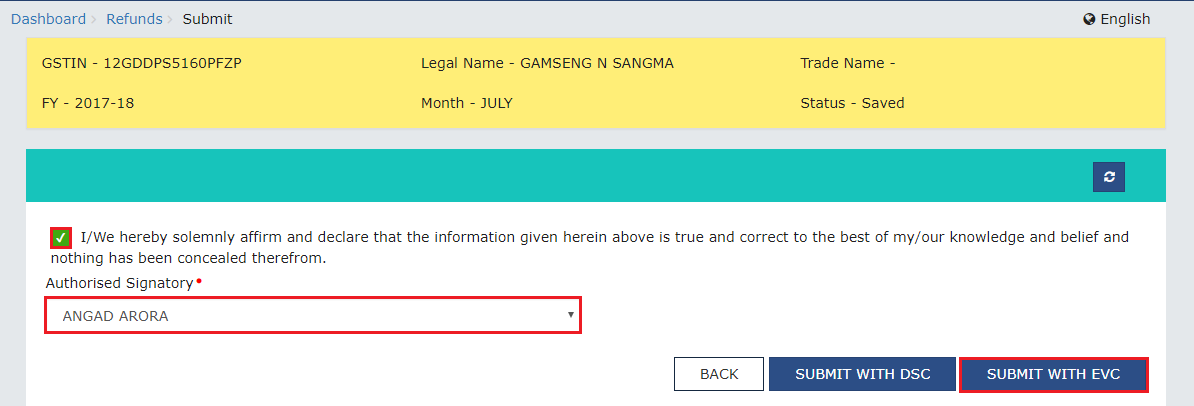

Step 5: Sign the Refund Application

On clicking the PROCEED button, the steps for digitally signing the GST refund will be initiated. You can now sign with a digital signature or EVC to complete and submit the application. Step 5 - Unutilised Input Tax Credit Refund

Step 5 - Unutilised Input Tax Credit Refund

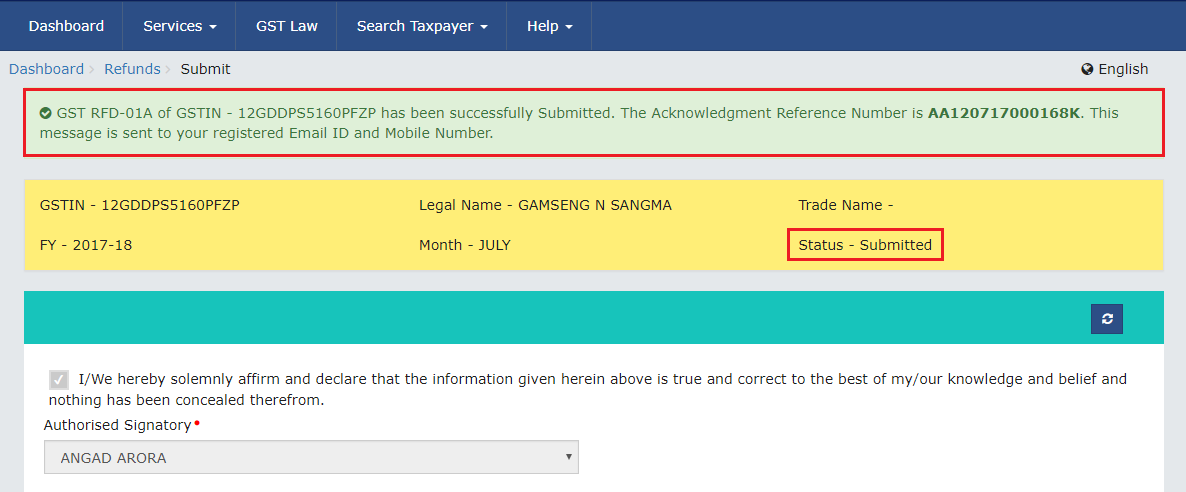

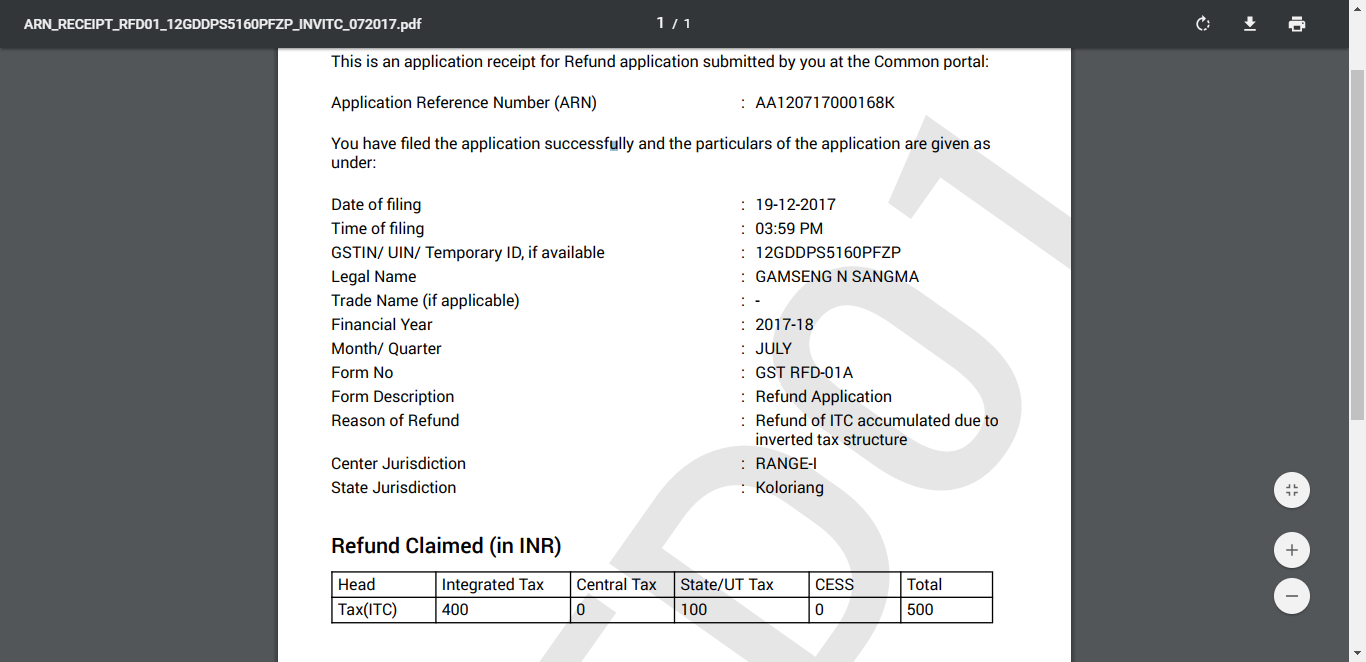

Step 6: Download ARN Receipt, Sign and Submit to Tax Officer

Step 6 - Unutilised Input Tax Credit Refund

On signing the refund application, a success message would be displayed, and the status of the application is changed to submitted. An Application Reference Number (ARN) is also generated and an ARN receipt would be downloaded.

Open the refund ARN receipt downloaded as a PDF document, take a print of application and submit to the Jurisdictional Authority manually along with other relied upon documents as required under RFD-01.

Step 6 - Unutilised Input Tax Credit Refund

On signing the refund application, a success message would be displayed, and the status of the application is changed to submitted. An Application Reference Number (ARN) is also generated and an ARN receipt would be downloaded.

Open the refund ARN receipt downloaded as a PDF document, take a print of application and submit to the Jurisdictional Authority manually along with other relied upon documents as required under RFD-01.

Step 6A - Unutilised Input Tax Credit Refund

Click here to download GST Software for Maintaining Accounts

Step 6A - Unutilised Input Tax Credit Refund

Click here to download GST Software for Maintaining Accounts

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...