Last updated: February 29th, 2020 5:02 PM

Last updated: February 29th, 2020 5:02 PM

Uttar Pradesh Property Registration

All transactions that involve the sale of the immovable property should be registered in India to ensure the transfer of clean title to the owner. The registration of property requires preparation of documents and paying the applicable stamp duty registration charges for the sale deed to be legally recorded at the Sub-Registrar's office. Department of Stamps and Registration manages the registration and transfer of property in Uttar Pradesh. In this article, we look at the procedure for Uttar Pradesh property registration with stamp duty charges. To know more about Uttar Pradesh Society Registration, click here.Uttar Pradesh Registration Act, 1908

Registration Act provides details regarding the method of registering documents, information regarding legal rights and obligations affecting the particulars property.Section 17 of Uttar Pradesh Registration Act

Under section 17 of the Registration Act, 1908, all transactions that involve the sale of immovable property for a value exceeding Rs. 100, should be registered, i.e. all transactions of sale of the immovable property that has to be registered. Additionally, all transactions of a gift of immovable property, as well as a lease deed for a duration exceeding 12 months are also mandatorily needed to be registered in Uttar Pradesh.Purpose of Property Registration (Deed Registration)

Transfer of immovable property can only be effected by way of registration. Registration of a document of transfer of immovable property provides the following benefits:- The document of transfer of a property in the state, i.e. Deed registration will be a permanent public record, once it's's registered with the concerned Sub-Registrar.

- A public record of the transfer of property can be inspected by anyone and a copy of the document that can be obtained from the Sub –Registrar office.

- Listing of the property is providing the information to the general public that the owner has transferred to the buyer by the owner.

- If any person intends to buy a property, they can verify the record-index available in the sub-Registrar office. Such a person can examine in whose name the last transfer deed has been registered.

- If the land is agriculture land, you can check the revenue record as khata, khatoni / khasra of that land and title deed.

Documents Required

Documents required for registering deeds in Uttar Pradesh is explained in detail here.- Original and duplicate copy of the document is necessary for the registration.

- Two passport size photographs of all parties, each of the buyer, the seller and all the witnesses.

- Photo Identity Proof - voter's ID card and passport of the buyer, the seller and all the witnesses.

- Certified copies of Certificate of Incorporation of both seller and buyer, in case of a company and not an individual buyer

- Copy of the property register card to indicate that the property does not belong to the Government (It can be obtained from the City Survey Department)

- Copy of municipal tax bill to mention the year in which the property was built or constructed.

- Copy of the PAN Cards of all the parties is mandatory (to be annexed along with the Sale Deed)

- Photographs and signatures of all parties, the buyer, the seller and the two witnesses are obligatory.

Time Frame

After the presentation of the property/deed, registration proceedings be settled on the same day.Concerned Authority

The parties can submit the application forms relating to property registration services at the Sub-Registrar's Offices of Stamps & the Registration Department, Government of Uttar Pradesh.Time Limit and Fee Applicable

The property that has to be mandatorily registered within four months from the date of their execution, along with the needed fee. The registration fee for the property documents is 1% of the value of the property, subject to a maximum of Rs 30,000.Stamp Duty Charges in Uttar Pradesh

Stamp duty is a legal tax payable in full and acts as a proof for any sale or purchase of a property. Rates of stamp duty of various transactions in Uttar Pradesh are here:| S.No. | Type of Deed | Stamp Duty Charges |

| 1. | Sale Deed | 7% |

| 2. | Gift Deed | Rs. 60 to Rs.125 |

| 3. | Lease Deed | Rs. 200 |

| 4. | Will | Rs. 200 |

| 5. | General Power of Attorney | Rs. 10 to Rs. 100 |

| 6. | Special Power of Attorney | Rs. 100 |

| 7. | Conveyance | Rs. 60 to Rs. 125 |

| 8. | Notarial Act | Rs. 10 |

| 9. | Affidavit | Rs. 10 |

| 10. | Agreement | Rs. 10 |

| 11. | Adoption | Rs. 100 |

| 12. | Divorce | Rs. 50 |

| 13. | Bond | Rs. 200 |

Appointment for Property Registration

Before the registration of property, the citizens who are interested, they have to make an appointment first on the website. For an appointment, fix the date and time online. Apply for an appointment by the following steps below: Step 1: Applicant has to visit the official website of Registration and Stamp department. Step 2: Now enter your application number and password. Step 3: Further, enter the captcha code and click on the submit button. Step 4: Then select the available date and visit the Sub – Registrar Office (SRO) on the fixed date.Online Property Registration Procedure

In Uttar Pradesh, to register a property/land in the state, kindly follow the step by step procedures given: Step 1: For registering property in Uttar Pradesh, visit the official website of Registration and Stamp department. [caption id="attachment_59317" align="aligncenter" width="819"] Uttar-Pradesh-Property-Registration-Home-Page

Step 2: Click on the "Apply" option under the Property Registration.

Uttar-Pradesh-Property-Registration-Home-Page

Step 2: Click on the "Apply" option under the Property Registration.

New User Registration

Step 3: To register on the website for the first time, start a new entry or "Log in" to the account with the already created user id and password. [caption id="attachment_59318" align="aligncenter" width="901"] Uttar-Pradesh-Property-Registration-User-Registration

Step 4: Select your district, Tehsil and Registrar.

Step 5: Now give the mobile number and create a password.

Step 6: Enter the Captcha Code and click on the 'Go Ahead' button.

Uttar-Pradesh-Property-Registration-User-Registration

Step 4: Select your district, Tehsil and Registrar.

Step 5: Now give the mobile number and create a password.

Step 6: Enter the Captcha Code and click on the 'Go Ahead' button.

Property Registration

Step 7: After creating login Online property registration form will be displayed on the screen. [caption id="attachment_59323" align="aligncenter" width="794"] Uttar-Pradesh-Property-Registration-Registration-Form

Step 8: Select the nature of the document(Select the relevant Deed Category from different options available in the drop-down).

Step 9: Enter deed presenter name and mobile number.

Uttar-Pradesh-Property-Registration-Registration-Form

Step 8: Select the nature of the document(Select the relevant Deed Category from different options available in the drop-down).

Step 9: Enter deed presenter name and mobile number.

Provide Property Details

Step 10: Provide the following property details for registration and stamp duty calculation.- Relevant tehsil of the district.

- Area type, Rural or Urban.

- Sub Area type of the tehsils

- Ward from the sub-area type already selected

- Property type from Plot / Building / Agriculture Land

Uttar-Pradesh-Property-Registration-Property-Details

Uttar-Pradesh-Property-Registration-Property-Details

Provide Property Valuation

Step 11: Now, provide all the property details for the valuation. Step 12: Select the type of Building and then click on the Next button. [caption id="attachment_59326" align="aligncenter" width="718"] Uttar-Pradesh-Property-Registration-Property-Valuation

Step 13: Select the type of property and enter the details of the independent Building by filling the residential area and total area.

Step 14: Select the applicable sub-clause, if any, related to the property under consideration.

Uttar-Pradesh-Property-Registration-Property-Valuation

Step 13: Select the type of property and enter the details of the independent Building by filling the residential area and total area.

Step 14: Select the applicable sub-clause, if any, related to the property under consideration.

Stamp Duty Calculation

Step 15: Based on the selection of Deed and the other details filled, the software will auto calculate the applicable Stamp Duties and Registration fees. Note: Multiple Properties can also be added, for adding more property, select from "Add More Property" button or click on the Next button to proceed.Upload Required Documents

Step 16: Now, upload all the mandatory documents like ID Proofs, PAN number, etc. [caption id="attachment_59327" align="aligncenter" width="833"] Uttar-Pradesh-Property-Registration-Upload-Documents

Step 17: After adding all the mandatory documents, the user has to proceed to add details of other parties involved in the transaction and two witnesses.

Uttar-Pradesh-Property-Registration-Upload-Documents

Step 17: After adding all the mandatory documents, the user has to proceed to add details of other parties involved in the transaction and two witnesses.

Prepare Deed Document

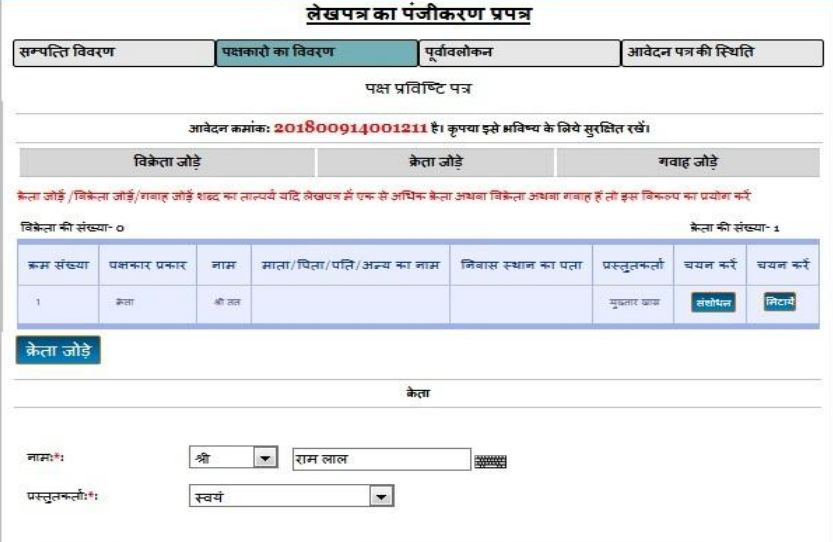

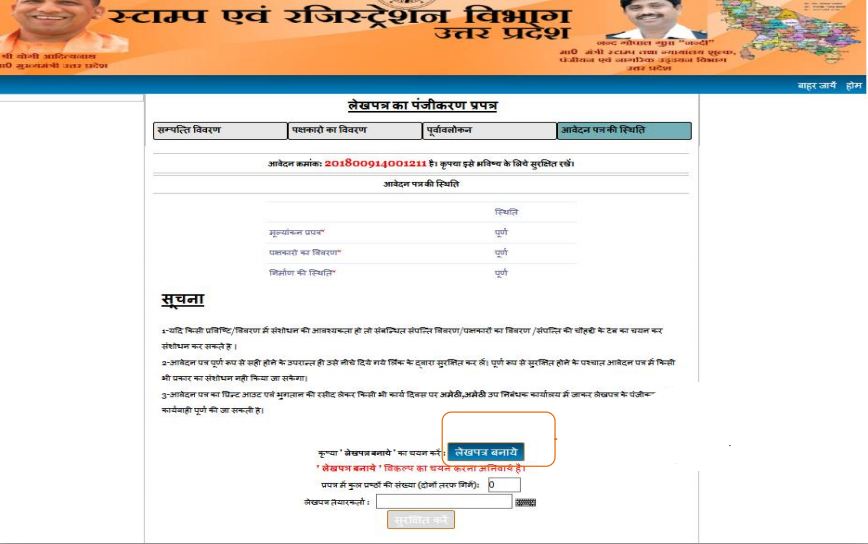

Step 18: Select "deed document" button to prepare the deed document and then click on the Save button. [caption id="attachment_59329" align="aligncenter" width="868"] Uttar-Pradesh-Property-Registration-Prepare-Deed-Documents

Step 19: Enter the number of pages, and the name of the document presenter then click save button to submit finally. Save button is enabled only after preparing the deed document.

Uttar-Pradesh-Property-Registration-Prepare-Deed-Documents

Step 19: Enter the number of pages, and the name of the document presenter then click save button to submit finally. Save button is enabled only after preparing the deed document.

Payment Service Type

Step 20: Select payment service type E-stamp, stamp, E-payment, and make the specified payment. Step 21: Now select the user consent and then click on the Save button to proceed. Step 22: Enter displayed captcha and confirm that everything is correct by clicking the save button to save the process. [caption id="attachment_59330" align="aligncenter" width="788"] Uttar-Pradesh-Property-Registration-Payment-service-Type

Uttar-Pradesh-Property-Registration-Payment-service-Type

Approach Sub – Registrar Office (SRO)

Step 23: Finally take a print out of application and fee receipt. Then visit the sub-registrar office on any working days. Step 24: Once the registration application is made, use the application ID for reference. Also use the same ID to book a time slot in the application, based on convenience can visit the Sub-Registrar office to complete the registration process.Verification by SRO

Step 25: The registration process shall be completed at the Sub Registrar Office (SRO). Sub registering officer will verify the following details. Upon checking, the SRO will update details online in the online land records website. Note: If SRO rejects the application, Return Deed with reasons for rejection will be updated online through the portal.Get Registered Deed

After approval and successful registration, get the property registration document. Once Again, login to the portal for downloading the registration certificate.Verify Property Details

Applicants can check/verify the details of any land that has been registered in Uttar Pradesh using the District Name, Tehsil Name, Village Name and Khata Number or Khasra Number or Name in the official website. [caption id="attachment_59331" align="aligncenter" width="911"] Uttar-Pradesh-Property-Registration-Verify-Property-Details

Enter the registered office details, registration number, and registration year and captcha code. Then click on the see details button to verify your property/land details.

Uttar-Pradesh-Property-Registration-Verify-Property-Details

Enter the registered office details, registration number, and registration year and captcha code. Then click on the see details button to verify your property/land details.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...