Last updated: March 12th, 2020 2:49 PM

Last updated: March 12th, 2020 2:49 PM

Uttar Pradesh Solvency Certificate

Solvency certificate is an important legal document which is issued based on the documents depicting the ownership of a property lying in the concerned state. Solvency certificate certifies the creditworthiness of an individual and helps to verify the solvency of a person while applying for loans from the bank. An individual can obtain a solvency certificate from the concerned Collector and District Magistrate. In this article, we look at the procedure for obtaining the Uttar Pradesh solvency certificate in detail.Need for Obtaining Solvency Certificate

The following are the various reasons to obtain a solvency certificate in Uttarakhand.- Solvency certificate is necessary for seeking admission in Government Medical and Engineering colleges.

- Solvency certificate is mandatory for court matters, like obtaining bails.

- Solvency certificate act as proof of finance in support of education and also helps in visa interviews.

- Solvency certificate is used as a document of surety by various government and semi-government offices.

- Solvency certificate helps to know about individual loan-related statements that can be obtained from a bank.

Eligibility Criteria

The following are the person eligible to get a solvency certificate:- Any individual is residing in the state of Uttar Pradesh.

- Any person having his/her land property in Uttar Pradesh state entitles to obtain a Solvency Certificate or Status certificate.

Documents Required

Furnish the following documents along with the application form.- Applicant voter ID or Aadhaar card.

- Copy of passport.

- Copy of income certificate.

- Copy of residence certificate.

- Copy of bank statement.

- Copy of Return on Revenue.

- List of immovable properties.

- Copy of character certificate.

- Two passport size photograph.

- Copy of encumbrance certificate.

- GN Certified copies of 7/12 and GN-6

- copy of the assessment card / CT survey's property card

- Any other document in support or claim.

Validity of Solvency Certificate

The solvency certificate is valid for two years from the date of issue. Hence it has to be renewed after two years.Applicable Fee

The applicant can collect application form of Uttar Pradesh solvency certificate or Status certificate by without remitting any fee for it. But additionally, the service charge will be acquired from the applicant depending upon the purpose of the solvency certificated applied.Processing Time

The entire process for processing your application for solvency certificate will be completed within fifteen days from the submission of application.Concerned Authority

After submitting the application form with the above documents, the request will be forwarded to the Tehsildar office. The collector and District magistrate will verify the documents and submit his report to the concerned authority of the department that is authorised to issue the Solvency certificate.Offline Application Procedure for Solvency/ Status Certificate

To register for the solvency or status certificate, the applicant has to follow the below-mentioned steps.Approach District Magistrate Office

Step 1: The applicant should approach the nearby District Magistrate office to collect the application form for a solvency certificate. The application form of solvency certificate is below for quick reference.Complete the Details

Step 2: Then, the application form has to be filled carefully with the appropriate details without any errors.Attach the Documents

Step 3: Attach the necessary documents along with the duly filled application form.Submit the Application

Step 4: Now submit the duly filled application form to the Concerned authority of District Magistrate office.Collect the Solvency Certificate

Step 5: After verification, the certificate will be provided to the applicant that can be received from the same district magistrate office or can be downloaded online as well.Online Application Procedure for Solvency/ Status Certificate

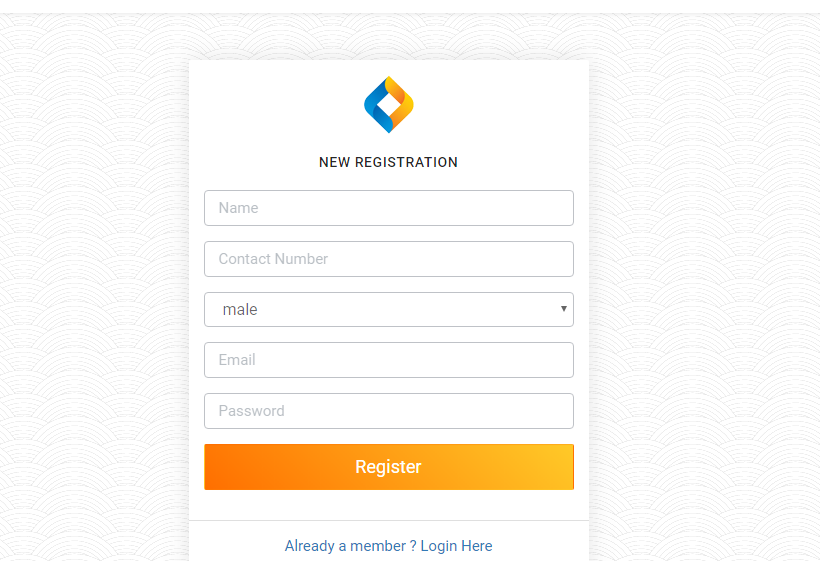

Follow the below procedure to obtain solvency/Status certificate in the Uttar Pradesh: Step 1: Visit the official website of the Solvency management system of Uttar Pradesh Government. Step 2: The user has to click on "User login" which is on the homepage of the portal. Step 3: On the next page, the user login screen will open up.New User Registration

Step 4: If you are logging for the first time into the website, then click on "Register here" option to register as the user. Step 5: You have to fill out the new registration form with the details like- Username

- Contact number

- Gender

- Email id

- Password

Uttar-Pradesh-Solvency-Certificate-New-Registration

Step 6: After providing the required information, then click on the "Register" button.

Uttar-Pradesh-Solvency-Certificate-New-Registration

Step 6: After providing the required information, then click on the "Register" button.

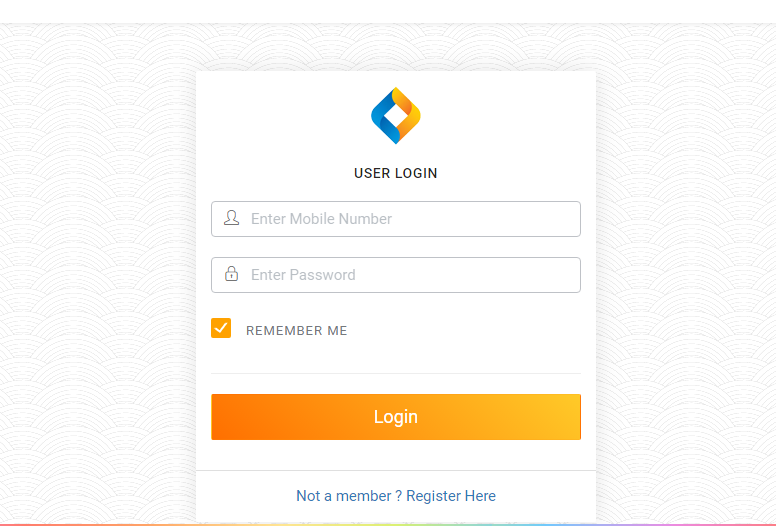

Provide User Login Details

Step 7: Next, the user redirects to the login page, enter the mobile number and password and click "Login" button. [caption id="attachment_62225" align="aligncenter" width="776"] Uttar-Pradesh-Solvency-Certificate-Login-Details

Step 8: On the next page, the instructions for filling the application form of solvency certificate will be displayed.

Step 9: The user has to select "Status certificate application form" from the list of services.

Uttar-Pradesh-Solvency-Certificate-Login-Details

Step 8: On the next page, the instructions for filling the application form of solvency certificate will be displayed.

Step 9: The user has to select "Status certificate application form" from the list of services.

Application Form for Solvency Certificate

Step 10: Then, the application form for solvency or Status certificate will open on the next screen. [caption id="attachment_62226" align="aligncenter" width="695"] Uttar-Pradesh-Solvency-Certificate-Application-Form

Step 11: Fill the application form with the necessary details like

Uttar-Pradesh-Solvency-Certificate-Application-Form

Step 11: Fill the application form with the necessary details like

- Applicant name

- Details of Address

- Property details

- Bank details

Track Application Status

This portal also facilitates the applicant to check the status of the application online:- The user can revisit the solvency management website.

- Click on "Status of status application" from the drop-down list.

- On approving the status of the application, the applicant can download the solvency certificate by clicking on the respective application number.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...