Last updated: December 17th, 2019 6:05 PM

Last updated: December 17th, 2019 6:05 PM

Uttarakhand Property Registration

Section 17 of the Indian Registration Act, 1908 governs the property registration process in Uttarakhand. Any transactions that require the sale of the immovable property should be registered to ensure explicit transfer of title to the property owner. Property registration process involves the preparation of documents, paying the applicable stamp duty and registration fee for the property deed to be legally recorded at the sub-registrar’s office. Department of Stamps and Registration, Government of Uttarakhand manages the registration or transfer of property in Uttarakhand. In this article, we look at the Uttarakhand property registration procedure in detail.Section 17 of Indian Registration Act

Section 17 of the Indian Registration Act, 1908 indicates that all transactions that involve a sale of immovable property, gift of immovable property and lease for a period exceeding twelve months of immovable property for a value Rs.100 and above should be registered with concerned sub-Registrar office.Purpose of Property Registration (Deed Registration)

Filing of a document of transfer of immovable property (deed registration) furnishes the below-mentioned benefits.- The report of transfer of a property i.e. deed registration will be a permanent public record, once it’s registered with the concerned Sub-Registrar.

- Anyone and copy of the document can examine the public record of deed registration can be obtained from Sub –Registrar office.

- Listing of property is providing the information to the general public that the owner has transferred to the buyer by the owner.

- If any person intends to buy a property, they can verify the record-index available in the sub-Registrar office. (It can be done online through UK registration portal). Such a person can examine in whose name the last transfer deed has been registered.

- If the land is an agriculture land you can check revenue record as khata,khatoni / khasra of that land and Title Deed

Documents Required

Documents required for registering deeds in Uttarakhand is explained in detail here.- Original Document

- A print copy of e-Challan Duty /Fee

- Stamp Duty, Registration Fee, Document Handling charges

- A print copy of PDE details

- Revenue record of land as Khasra, Khatoni as applicable indeed

- Passport Size photographs of parties

- Photograph of the transferred property

- Pan card is compulsory when valuation is above five lakhs

- For sale of only Agriculture lands whose consideration amount is more than 50 lakh, TDS challan under Income Tax Act required

- If the buyer and his family members are the owners of an immovable property before the date 12.09.2003 in Uttarakhand is the corresponding deed/evidence must be presented for khatauni and another authenticator.

- Identity Proof – Voter ID, Kisan Bahi, Bank Passbook, Employer ID, an ID of an educational institution, ration card of all the parties and witnesses for the appearance of admission of the document.

- Map of transferred property - Registration of Conveyance Sale, Gift deed and Sale Deed

- Map of leasehold property – Registration of lease and Mortgage Deed

Time Frame

After the presentation of the deed, registration proceedings be settled on the same day.Stamp Duty for Property Registration

Stamp duty is a legal tax payable as proof for any transaction involving immovable property. Rates of stamp duty and registration fee of various operations in Uttarakhand are given here:Calculate Stamp Duty and Registration Fee Online

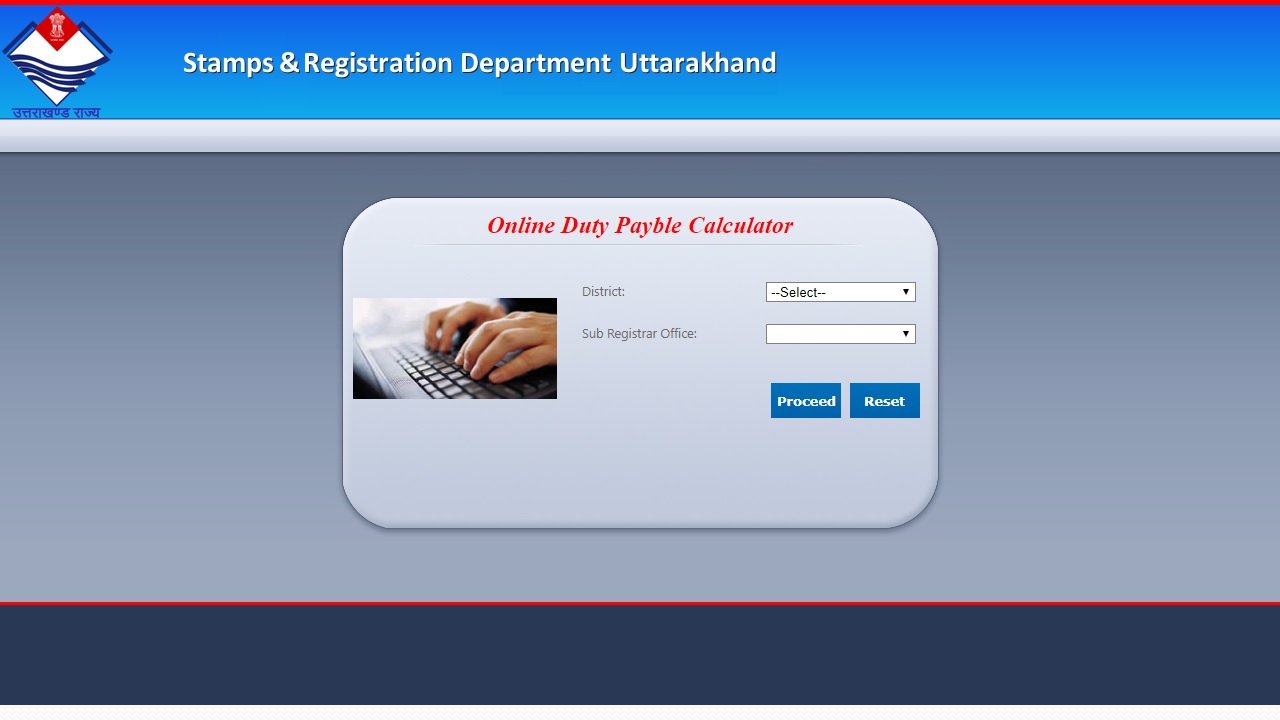

You can calculate stamp duty for deed registration via online Duty Payable Calculator available in stamps and registration department portal by following the steps described here. Step 1: To calculate the applicable stamp duties and registration fee access the homepage of Department of Stamps and Registration, Uttarakhand. Step 2: Click on e-Valuation option from home. By clicking on this, the page will be redirected to the new page. Image 1 Uttarakhand Property Registration

Step 3: Select the appropriate District from the drop-down menu and correspondingly select Sub-registrar office and click on proceed.

Image 1 Uttarakhand Property Registration

Step 3: Select the appropriate District from the drop-down menu and correspondingly select Sub-registrar office and click on proceed.

Image 2 Uttarakhand Property Registration

Step 4: Enter Transaction Value in Rupee, and you have to select Municipality & category such as General, Women, Disable, and Ex-serviceman. Stamp duty calculation will be varied on the types.

Step 4: After providing land related details and captcha code. Amount of stamp duty & Registration fee will be shown.

Note: Stamp Duty can also be automatically calculated while registering deed online.

Image 2 Uttarakhand Property Registration

Step 4: Enter Transaction Value in Rupee, and you have to select Municipality & category such as General, Women, Disable, and Ex-serviceman. Stamp duty calculation will be varied on the types.

Step 4: After providing land related details and captcha code. Amount of stamp duty & Registration fee will be shown.

Note: Stamp Duty can also be automatically calculated while registering deed online.

Online Property Registration Procedure

Follow the step by step guidelines given here to register immovable property in Uttarakhand.Access UK registration portal

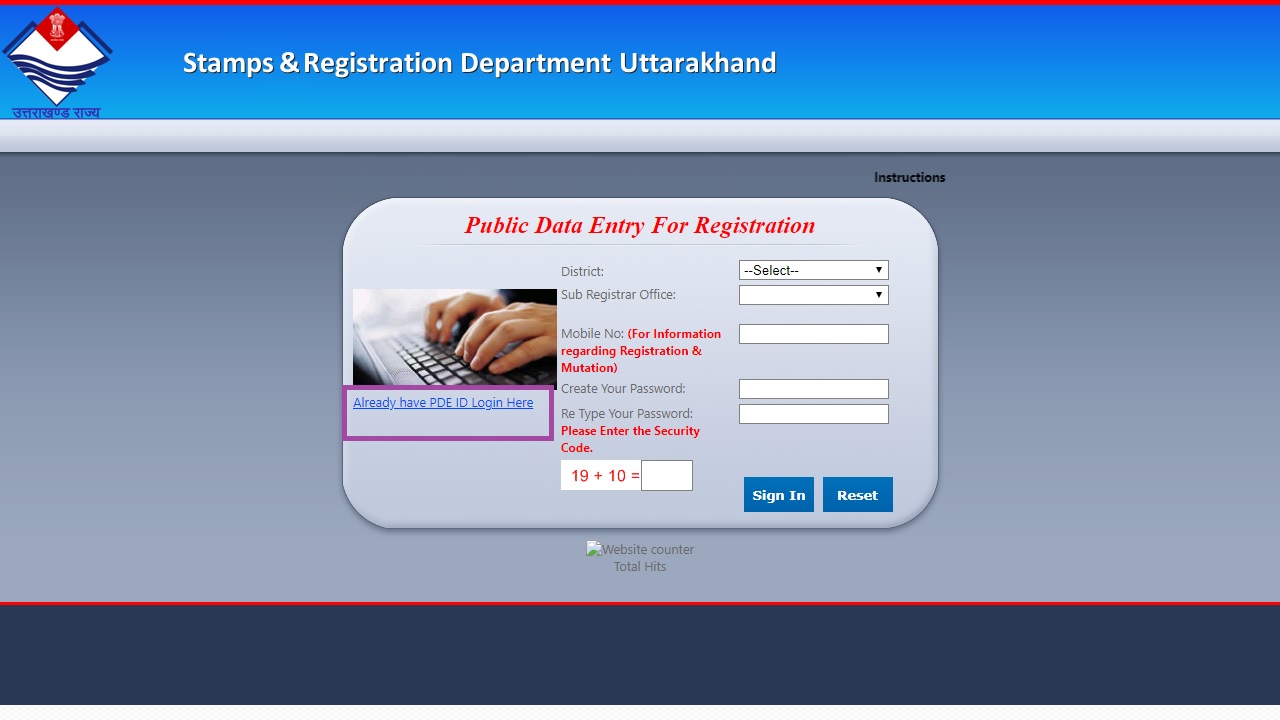

Step 1: For registering property in Uttarakhand, you have to visit the official website of Registration and Stamp department.User Registration

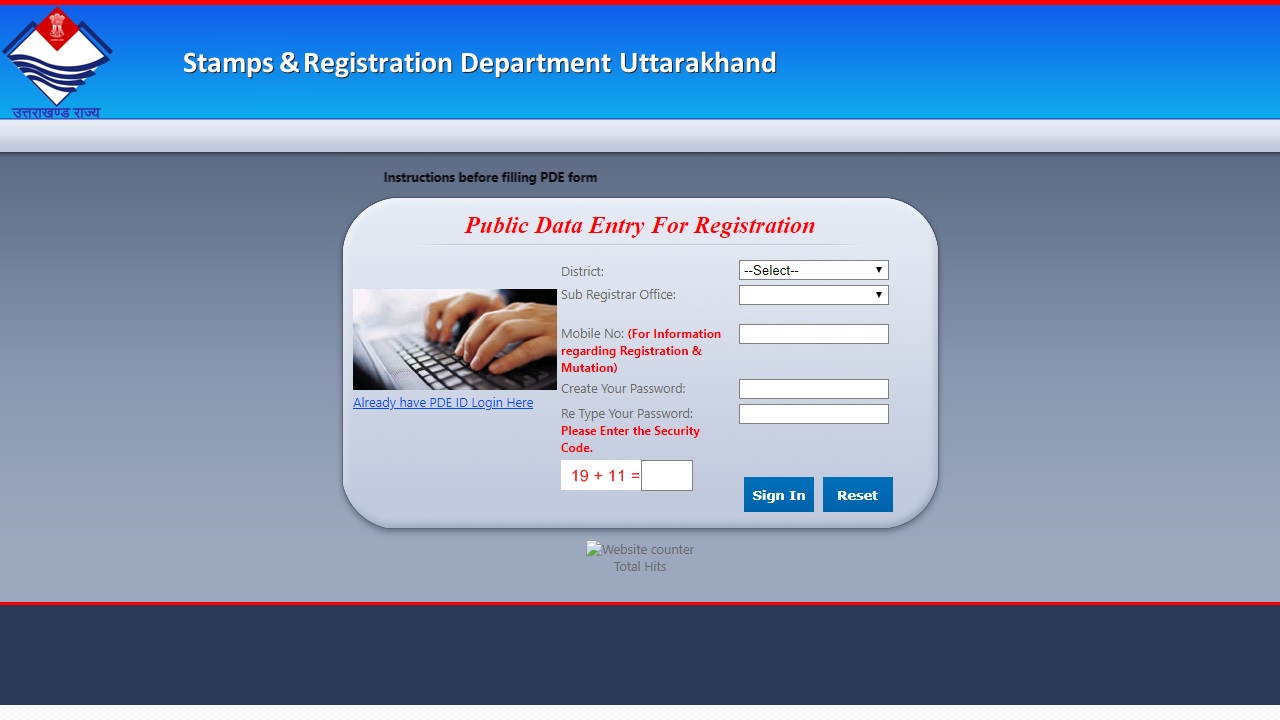

Step 2: Select free date entry (PDE) option from the home page. The link will redirect to the new page. Image 3 Uttarakhand Property Registration

Step 3: Select the concerned District and sub-registrar's office from the drop-down menu. For registering in PDE, you have to provide the following details:

Image 3 Uttarakhand Property Registration

Step 3: Select the concerned District and sub-registrar's office from the drop-down menu. For registering in PDE, you have to provide the following details:

- Mobile No

- Create Your Password

- Re-Type Your Password

- Please Enter the Security Code

Image 4 Uttarakhand Property Registration

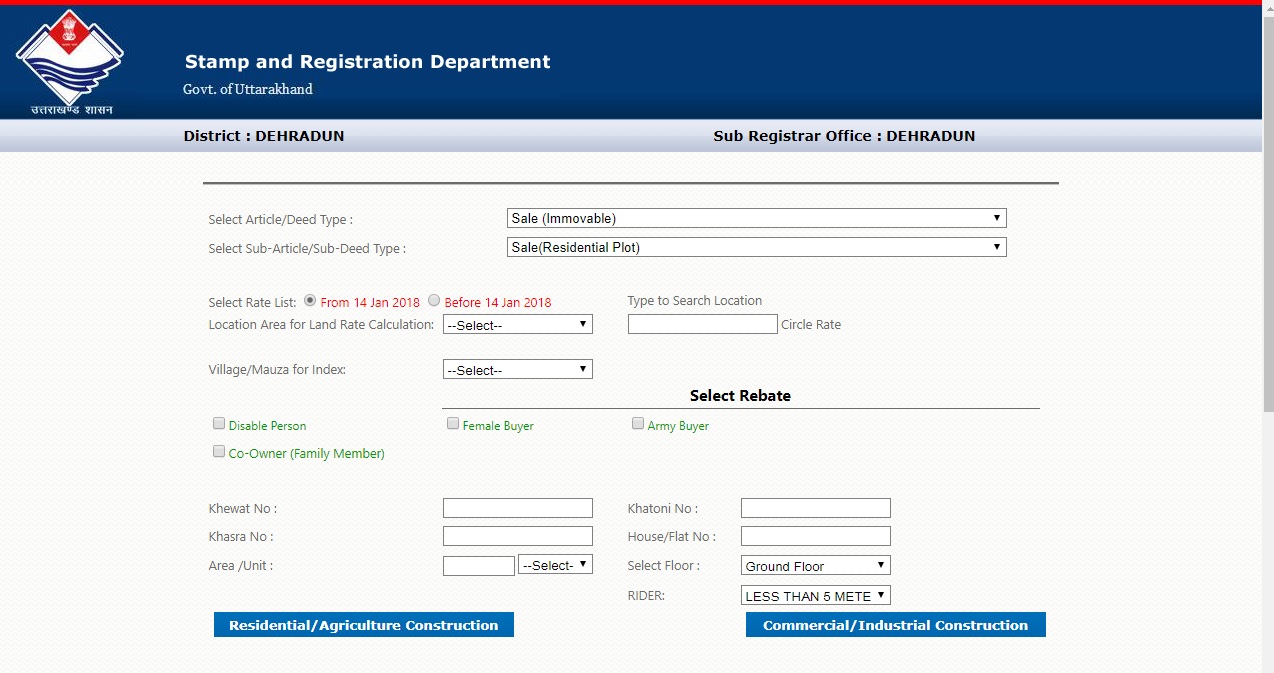

Step 5: After sign in, you will be redirected to the application page, select deed and sub-deed type from the drop-down menu.

Image 4 Uttarakhand Property Registration

Step 5: After sign in, you will be redirected to the application page, select deed and sub-deed type from the drop-down menu.

Provide Property Details

Provide following property details for registration and stamp duty calculation- Rate List

- Location Area for Land Rate Calculation.

- Village or Mauza for Index

- Khewat No, Khasra No and Khatoni No

- Area /Unit, House/Flat Number and Select Floor

- Details of RIDER and Deed writer name

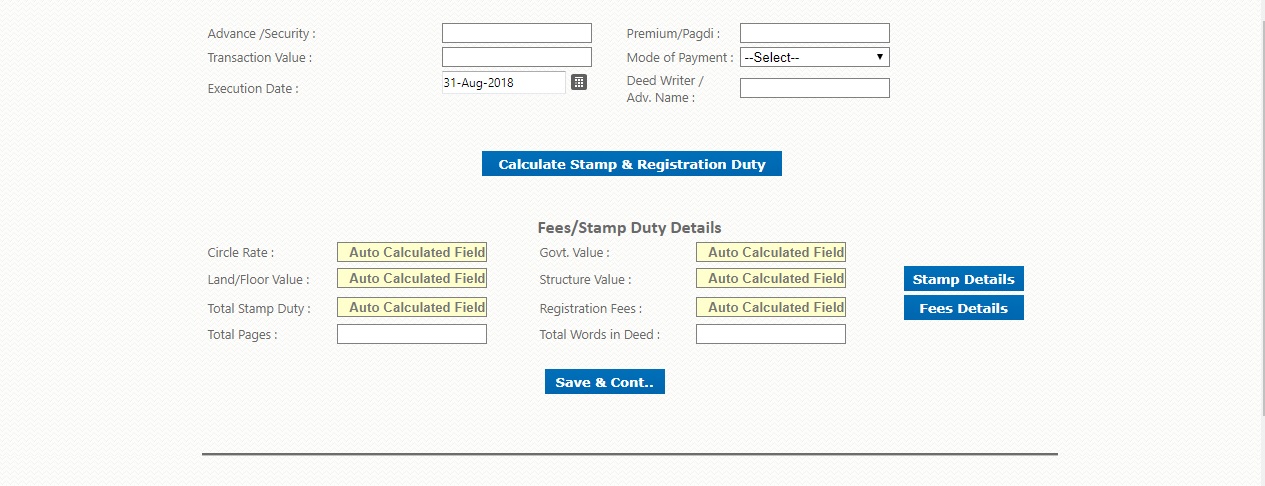

Image 5 Uttarakhand Property Registration

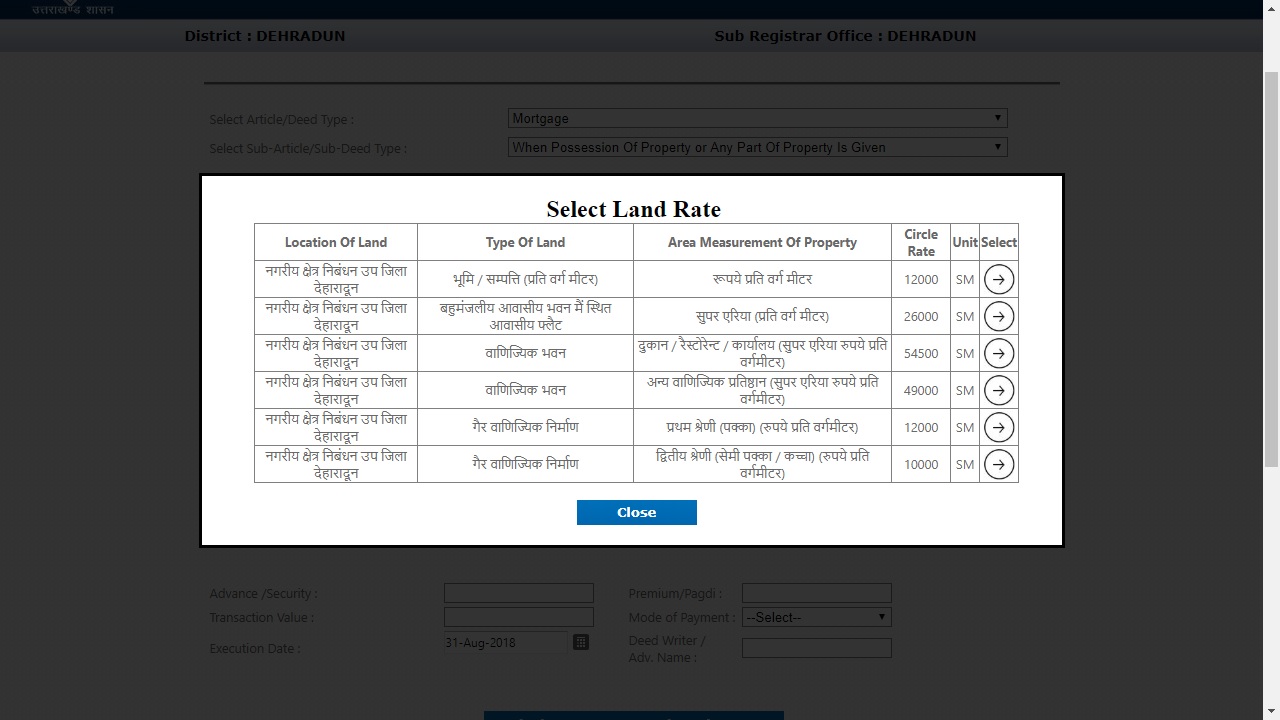

Once location Area from the drop-down list selected, land rate table will be displayed. Select appropriate from the list by clicking on the select option.

Note: Land rate will be varied according to rate list from 14 Jan 2018 and Before 14 Jan 2018.

Image 5 Uttarakhand Property Registration

Once location Area from the drop-down list selected, land rate table will be displayed. Select appropriate from the list by clicking on the select option.

Note: Land rate will be varied according to rate list from 14 Jan 2018 and Before 14 Jan 2018.

Image 6 Uttarakhand Property Registration

Step 6: Select appropriate Rebate option (Disabled Person, Female Buyer, Army Buyer, Co-Owner (Family Member)

Step 7: Enter residential construction/ Industrial Construction Details if the property type is building or flat.

Step 8: Provide Transaction details, Select Mode of payment from the drop-down menu, you can pay the fee by any of the following methods:

Image 6 Uttarakhand Property Registration

Step 6: Select appropriate Rebate option (Disabled Person, Female Buyer, Army Buyer, Co-Owner (Family Member)

Step 7: Enter residential construction/ Industrial Construction Details if the property type is building or flat.

Step 8: Provide Transaction details, Select Mode of payment from the drop-down menu, you can pay the fee by any of the following methods:

- Cash

- Cheque

- Draft

- RTGS

Calculate stamp and Registration Duty

Step 9: After providing all details related to property click on Calculate stamp duty and registration duty. Step 10: Provide details of deed such as Total pages, and total words in the deed documents. Image 9 Uttarakhand Property Registration

Step 11: Details will be displayed, now click on Stamp details, Select mode of payment from the drop-down menu. Provide details of challan or e-payment reference number and click on Add

Step 12: Click on Registration fee details (blue button), Select mode of payment from a drop-down menu. Provide challan details and e-payment date. Make e-Payment online through registration department portal.

Step 13: Once the details are entered click on Save and continue option. In the next page, you will get a message as ‘Your data has been saved on PDE Number’.

Image 9 Uttarakhand Property Registration

Step 11: Details will be displayed, now click on Stamp details, Select mode of payment from the drop-down menu. Provide details of challan or e-payment reference number and click on Add

Step 12: Click on Registration fee details (blue button), Select mode of payment from a drop-down menu. Provide challan details and e-payment date. Make e-Payment online through registration department portal.

Step 13: Once the details are entered click on Save and continue option. In the next page, you will get a message as ‘Your data has been saved on PDE Number’.

Add Party Details

Step 14: Again go to login PDE page, and select ‘Already has PDE ID Login Here’. Provide mobile number and password for login to the portal. Image 10 Uttarakhand Property Registration

Step 15: Click on Add party details, you have to provide two party details: Provide details such as Name, Address, Occupation, ID card details and Mobile Number. By clicking on next, you can give witness details.

Image 10 Uttarakhand Property Registration

Step 15: Click on Add party details, you have to provide two party details: Provide details such as Name, Address, Occupation, ID card details and Mobile Number. By clicking on next, you can give witness details.

Print and Submit Application

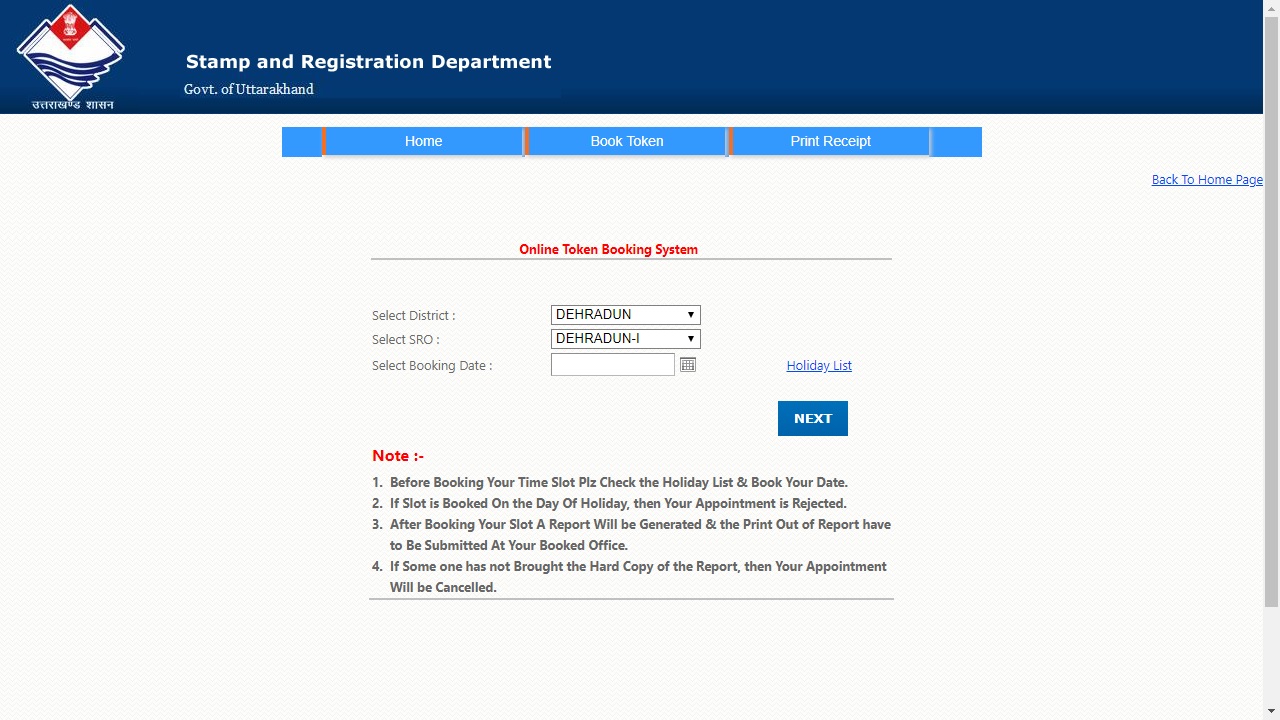

Step 16: After proving party and witness details, click on the printout option and download the application. Step 17: After the PDE report is printed, go to view PDE status option and submit the application through Unique Id Number to SRO.Online Time Slot Booking

Take online appointment through e-Stepin option which is available in Home Page of registration site. Image 11 Uttarakhand Property Registration

In the new page, select timing according to your district as per your convenient. Now you can Book token.

Image 11 Uttarakhand Property Registration

In the new page, select timing according to your district as per your convenient. Now you can Book token.

Image 12 Uttarakhand Property Registration

Selected district and SRO will be shown, select date as per your convenience. Click on next.

Image 12 Uttarakhand Property Registration

Selected district and SRO will be shown, select date as per your convenience. Click on next.

Image 13 Uttarakhand Property Registration

Provide PDE number and Click on OK. You can now download the receipt.

Image 13 Uttarakhand Property Registration

Provide PDE number and Click on OK. You can now download the receipt.

Approach Sub - Registrar Office

Visit the Sub Registrar Office on the crucial date and time with original documents (refer above) and fee receipt.Verification by SRO

Sub registering officer will verify the following details. Upon checking, the SRO will update details online in online land records website. Note: If SRO rejects the application, Return Deed with reasons for rejection will be updated online through the portal.Recording Photo and Bio-Metrics

Once the Sub-Registrar marked the deed it will be fetched into the online land records and deed data and Photograph of the buyer, seller, witnesses and identifiers will be recorded in the system. SRO officer will regularise the party details form by obtaining the sign and Biometrics of the buyer & seller.Pay applicable Duty

If you have preferred fee payment mode as cash, SRO will send the notification to RC for fee collection. Pay applicable duty and fee for registration, R.C will generate fee receipt. After making this receipt, deed Number can be obtained. Note: Kindly note it for future referenceGet Registered Deed

After approval and successful registration, you can get the property registration document. Once Again, login to the portal for downloading the registration certificate.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...