Last updated: April 22nd, 2022 11:58 AM

Last updated: April 22nd, 2022 11:58 AM

Uttarakhand Road Tax

In India, road tax is a tax levied by the respective state government on individuals for the use of their vehicle in public places. The tax imposed differs from state to state due to different tax rates set by the particular state government based on the vehicles. Road tax has to be paid by the vehicle owners at the time of registering their vehicle with Regional Transport Office. In this article, we view the various aspects of Uttarakhand Road Tax in detail.Uttarakhand Motor Vehicle Taxation Act

As per the provisions under the Uttarakhand Motor Vehicle Taxation Act, Transport department is responsible for the collection of Road tax from vehicle owners in the state. The road tax payment is made either annually or onetime tax. The registered owner or person who has possession of the vehicle has to fill a declaration form stating the particulars of the vehicle and its use in the state to the taxation authority.Calculation of Road Tax

In Uttarakhand, road tax is calculated based on the various factors such as the type of Vehicle (Two wheelers, Four wheelers) and purpose of use (personal, transportation of goods). It also depends on the make, model, seating capacity, engine capacity, etc. of the vehicle. The vehicle owner has to pay the tax according to the rate mentioned in the Taxation Act specified below.Time Limit of Tax Payment

The tax levied under section 4 has to be paid at the time of registration of the vehicle under the Motor vehicle Act, 1988 in respect of old motor vehicle then the tax has to be paid in advance on or before the fifteenth day of January in each year.Tax Rate on Private Vehicle

The tax slabs for private vehicles in the state of Uttarakhand are tabulated below:| S.No | Description of Vehicles | One Time Tax (Rs) |

| 1. | Motor Vehicles costing up to Rs.10 Lakhs | 6% of the Cost of Vehicle |

| 2. | Motor Vehicles costing above than Rs.10 Lakhs | 8% of the Cost of Vehicle |

- Cost of the Vehicle should mean the ex-showroom cost of the vehicle and shall include the necessary manufacturing cost, the excise duty and all taxes including VAT.

- The Motor Vehicles driven by an electric battery or Solar Power shall be exempted from Tax and in respect of the motor vehicle driven by Ethanol mixed fuel the exemption of tax shall be the per cent of the One Time tax due on such Vehicles.

- One Time tax for the vehicles registered already will be possessed after 5% exemption of One Time Tax, payable on such vehicle, for every year but such exemption will not extend above 75% of such tax. For this cause, the age of the vehicle should be computed from the date of its original registration and period less than one year shall be ignored.

- Except where the owner of the Vehicle is transferred on the death of Registered owner of the Vehicle to his successor, an amount equivalent to 10% of One-time Tax leviable on such vehicle shall be charged on transfer of ownership of motor vehicle.

Tax other than One-time Tax under the provision to subsection (1) of section 4

| S.No | Description of Vehicles | Annual Rate of Tax on Old Vehicles (In Rs.) |

| 1. | Motor Cycle | 200 |

| 2. | Vehicle Unladen Weight is not exceeding 1000 kilograms. | 1000 |

| 3. | Vehicle Unladen Weight is exceeding 1000 kilograms but not exceeding 5000 kilograms. | 2000 |

| 4. | Vehicle Unladen Weight is exceeding 5000 kilograms. | 4000 |

| 5. | Trailers have drawn by these vehicles | 200 |

Transport Vehicles

The tax slabs for transport vehicles in the state of Uttarakhand are tabulated below:| S.No | Description of Vehicles | Rates of Tax per Seat | |||

| Tax Rate per month | Tax per quarter | Tax per year | One Time Tax | ||

| Two Wheeler, Three Wheeler and Goods Vehicle under Section 4 | |||||

| 1. | Two and Three Wheeler Motor Cab with seating capability but not more than 3 Persons exclusive of the driver for every seat. | Nil | Nil | 730 | 10,000 |

| 2. | Three Wheeler Motor Cab with the seating capacity of more than 3 Persons but not more than 6 Persons exclusive of the driver for every seat. | Nil | Nil | 730 | 10,000 |

| 3. | Three Wheeler Motor Cab with the seating capacity of more than 3 Persons but not more than 7 Persons exclusive of the driver for every seat. | Nil | Nil | 1700 | 10,000 |

| 4. | Goods Vehicle, the Gross Vehicle Weight not extending 3000 Kilograms for every metric ton of the Gross vehicle weight. | Nil | Nil | 1000 | 10,000 |

- Tax on Vehicles mentioned in column (2) which are registered earlier and exercise the option of one-time tax, shall be determined after 8% exemption on the One-time Tax leviable on such Vehicle for each year. But such exemption will not be more than 75%. For this cause, the age of the Vehicle should be computed from the date of its original registration and period of less than one year will be ignored.

- In case of any Vehicle mentioned in column (2) is found carrying passengers or overload on hire or reward a tax at the rate of Rs. Two thousand two hundred only for each passenger will be charged in addition to the tax specified in respect of the tax per year and one-time tax.

Transport Vehicles under Section 4

| (Taxi Cab/Goods Vehicle/Maxi Cab(Gross Vehicle Weight extending 3000 Kilograms)/Educational Institution/Private Service Vehicle) | |||||

| S. NO | Description of Vehicle | Rates of Tax per Seat | |||

| Tax rate per month | Tax Per Quarter | Tax Per Year | One-TimeTax | ||

| 1. | Motor Cab (excluding 2 Wheeler and 3 Wheeler Motor Cab), for every seat. | Nil | 430 | 1700 | Nil |

| 2. | Maxi Cab, for every seat. | Nil | 510 | 1900 | Nil |

| 3. | Good Vehicle is extending 3000 kilograms for each metric ton of the GVW. | Nil | 230 | 850 | Nil |

| 4. | The tractor which is used for commercial purposes other than agriculture purposes for each metric ton of the ULW. | Nil | 500 | 1800 | Nil |

| 5. | Construction Equipment Vehicle or Vehicle constructed for a particular purpose or special design registered or used for commercial purposes for each metric ton of ULW. | Nil | 500 | 1800 | Nil |

| 6. | Goods Vehicles registered under motor vehicle act, 1988 in any other state or in any other country under any other law enforce at that time with which reciprocal arrangements in the matter of road transport have been made and which are authorized to ply in Uttarakhand under the countersignature of their permits for each metric ton of the ULW. | Nil | 130 | 500 | Nil |

| 7. | Motor Vehicles owned by Driving Schools and which are exclusively used for imparting instructions to the drivers for each metric ton of the ULW. | Nil | 500 | 1800 | Nil |

| 8. | Educational Institution Bus or Private Service Vehicle or School Cab, for every seat. | Nil | 90 | 320 | Nil |

Public Service Vehicles under sub-section (2a) of section 4

(Contract/Stage Carriage Buses)

| S.NO | Description of Vehicles | Rates of tax per seat | |||

| Tax rate per month | Tax per Quarter | Tax per year | One Time Tax | ||

| 1. | Contract Carriage having seating capacity for more than 12 persons except for motor cab and maxi cab. | 100 | 300 | 1100 | Nil |

| 2. | Stage Carriage, a whose covered area in a month, is up to 1500 kilometers, for all seat. | ||||

| (a) for Plane Route | 85 | 3 Times of Monthly Tax mentioned in Column (3). | 11 Times of Monthly Tax mentioned in Column (3). | - | |

| (b) for Hill Route | 75 | ||||

| 3. | Stage Carriage, whose covered distance in a month exceeds 1500 kilometres, for every seat - for every extra kilometre. | Rs. 0.04 for every seat for every kilometre will be added on monthly tax mentioned in S.No. (ii)(a), column (3). | |||

| 4. | Stage Carriages particularly operating within the limits of the municipal corporation or municipality. | 85 | |||

| 5. | Stage Carriages registered under motor vehicle act 1988 in any other state or any other country under any other law enforce at that time with which reciprocal arrangements in the matter of road transport have and which are authorised to ply in Uttarakhand under the countersignature of their permits, for every seat and covered distance. | ||||

| (a) up to 1500 kilometres | 75 | 3 Times of Monthly Tax mentioned in Column (3) | 11 Times of Monthly Tax mentioned in Column (3) | Nil | |

| (b) exceeds 1500 kilometre - for every extra kilometre. | Rs. 0.04 for every seat for every kilometre will be added on monthly tax mentioned in S.No. (iv) (a), Column (3). | ||||

| 6. | Motor Vehicle which operates on the route whose both the starting point and the terminal point situate within the state of India excluding Uttarakhand but part of such routes lies in within Uttarakhand, and the length of such parts does not exceed sixteen kilometres, for every seat. | 60 | 180 | 650 | Nil |

Online Payment of Uttarakhand Road Tax

To make an online payment for road tax in the state of Uttarakhand, follow the steps mentioned below:Visit Official Portal

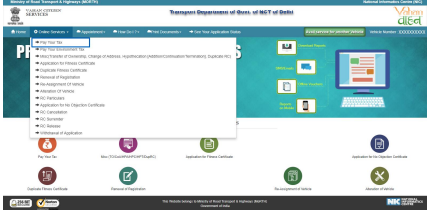

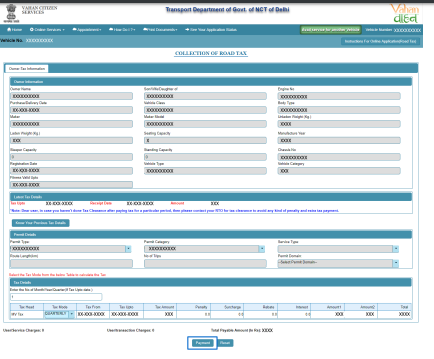

Step 1: The applicant should visit the official website of Ministry of Road Transport and Highways, Uttarakhand. Step 2: The applicant has to enter the Vehicle Registration number which is visible on the homepage of the portal to avail “Pay Your Tax” service. And move the application to the next stage. [caption id="attachment_71018" align="aligncenter" width="624"] Uttarakhand Road Tax-Image 1

Uttarakhand Road Tax-Image 1

Click on the Proceed Button

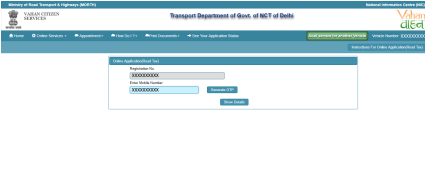

Step 3: Click on the proceed button and enter the next stage. [caption id="attachment_71019" align="aligncenter" width="625"] Uttarakhand Road Tax-Image 2

Uttarakhand Road Tax-Image 2

Select Pay Your Tax

Step 4: Selects the “Pay Your Tax” service from the drop-down “Online Services” menu. [caption id="attachment_71020" align="aligncenter" width="427"] Uttarakhand Road Tax-Image 3

Enter Mobile Number

Step 5: Now, applicant enters the mobile number and enter the next stage.

[caption id="attachment_71021" align="aligncenter" width="427"]

Uttarakhand Road Tax-Image 3

Enter Mobile Number

Step 5: Now, applicant enters the mobile number and enter the next stage.

[caption id="attachment_71021" align="aligncenter" width="427"] Uttarakhand Road Tax-Image 4

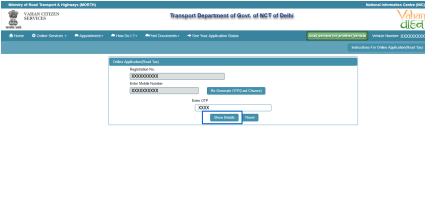

Click on the Generate OTP

Step 6: Click on the “Generate OTP”, button, and you can proceed further.

[caption id="attachment_71022" align="aligncenter" width="432"]

Uttarakhand Road Tax-Image 4

Click on the Generate OTP

Step 6: Click on the “Generate OTP”, button, and you can proceed further.

[caption id="attachment_71022" align="aligncenter" width="432"] Uttarakhand Road Tax-Image 5

Enter Generated OTP

Step 7: Enter the received OTP as given below.

Uttarakhand Road Tax-Image 5

Enter Generated OTP

Step 7: Enter the received OTP as given below.

Clicks on Show Details

Step 8: Click on the show details button to proceed further.

[caption id="attachment_71024" align="aligncenter" width="430"]

Clicks on Show Details

Step 8: Click on the show details button to proceed further.

[caption id="attachment_71024" align="aligncenter" width="430"] Uttarakhand Road Tax-Image 7

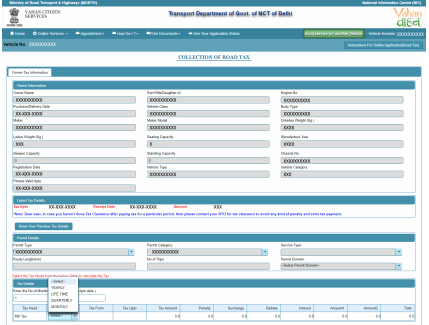

Select Tax Mode

Step 9: Select the tax mode such as yearly, lifetime, Quarterly, monthly from the drop-down list.

[caption id="attachment_71025" align="aligncenter" width="429"]

Uttarakhand Road Tax-Image 7

Select Tax Mode

Step 9: Select the tax mode such as yearly, lifetime, Quarterly, monthly from the drop-down list.

[caption id="attachment_71025" align="aligncenter" width="429"] Uttarakhand Road Tax-Image 8

Click on Payment

Step 10: Now click on the payment button to proceed the online payment through the payment gateway.

[caption id="attachment_71027" align="aligncenter" width="434"]

Uttarakhand Road Tax-Image 8

Click on Payment

Step 10: Now click on the payment button to proceed the online payment through the payment gateway.

[caption id="attachment_71027" align="aligncenter" width="434"] Uttarakhand Road Tax-Image 89PNG

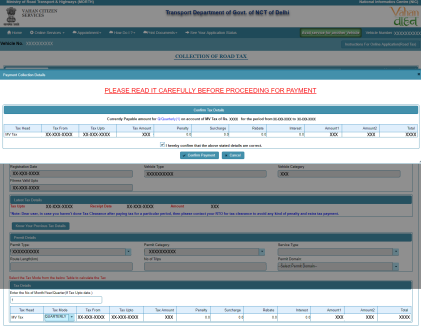

Click on Confirm Payment

Step 11: Confirmation box will be shown to the applicant. Confirm the details and proceed further.

[caption id="attachment_71028" align="aligncenter" width="421"]

Uttarakhand Road Tax-Image 89PNG

Click on Confirm Payment

Step 11: Confirmation box will be shown to the applicant. Confirm the details and proceed further.

[caption id="attachment_71028" align="aligncenter" width="421"] Uttarakhand Road Tax-Image 10

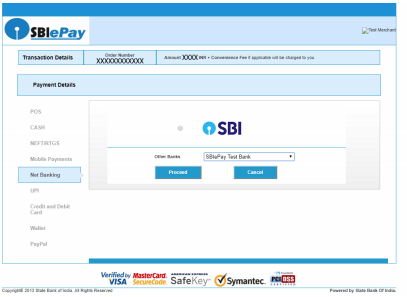

Select Payment Gateway

Step 12: Make the payment button will allow you to select a payment gateway. Select “Direct Payment (SBIePAY)” payment gateway for the e-payment.

[caption id="attachment_71029" align="aligncenter" width="440"]

Uttarakhand Road Tax-Image 10

Select Payment Gateway

Step 12: Make the payment button will allow you to select a payment gateway. Select “Direct Payment (SBIePAY)” payment gateway for the e-payment.

[caption id="attachment_71029" align="aligncenter" width="440"] Uttarakhand Road Tax-Image 11

Click on Continue

Step 13: Select your bank and then click on the “Continue” button.

[caption id="attachment_71056" align="aligncenter" width="636"]

Uttarakhand Road Tax-Image 11

Click on Continue

Step 13: Select your bank and then click on the “Continue” button.

[caption id="attachment_71056" align="aligncenter" width="636"] Uttarakhand Road Tax-Image 12

Payment Gateway-Selecting Bank

Step 14: Now, this will open a new page containing a list of banks associated with SBIePAY.

[caption id="attachment_71057" align="aligncenter" width="407"]

Uttarakhand Road Tax-Image 12

Payment Gateway-Selecting Bank

Step 14: Now, this will open a new page containing a list of banks associated with SBIePAY.

[caption id="attachment_71057" align="aligncenter" width="407"] Uttarakhand Road Tax-Image 13

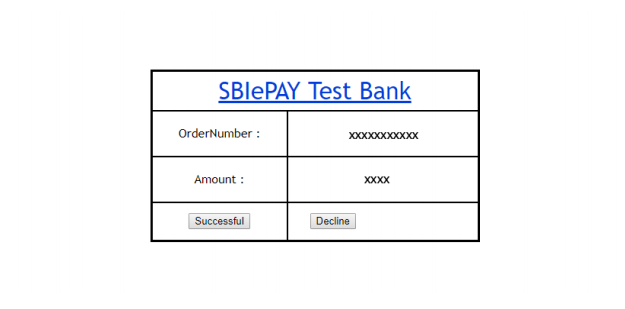

Click on Proceed Button

Step 15: Select your bank and then click on the “proceed” button.

[caption id="attachment_71058" align="aligncenter" width="517"]

Uttarakhand Road Tax-Image 13

Click on Proceed Button

Step 15: Select your bank and then click on the “proceed” button.

[caption id="attachment_71058" align="aligncenter" width="517"] Uttarakhand Road Tax-Image 14

Successful Message Box appears

Step 16: In this sample page, select “Successful” option.

[caption id="attachment_71059" align="aligncenter" width="625"]

Uttarakhand Road Tax-Image 14

Successful Message Box appears

Step 16: In this sample page, select “Successful” option.

[caption id="attachment_71059" align="aligncenter" width="625"] Uttarakhand Road Tax-Image 15

Fees Receipt Generated

Step 17: If bank status is a success then transactions get approved, and fee receipt will be generated.

[caption id="attachment_71060" align="aligncenter" width="628"]

Uttarakhand Road Tax-Image 15

Fees Receipt Generated

Step 17: If bank status is a success then transactions get approved, and fee receipt will be generated.

[caption id="attachment_71060" align="aligncenter" width="628"] Uttarakhand Road Tax-Image 16

Print Application letter

Step 18: Then the application letter generated, now applicant can take the Print as required.

[caption id="attachment_71061" align="aligncenter" width="424"]

Uttarakhand Road Tax-Image 16

Print Application letter

Step 18: Then the application letter generated, now applicant can take the Print as required.

[caption id="attachment_71061" align="aligncenter" width="424"] Uttarakhand Road Tax-Image 17

Penalty

In case of any violation of the provisions under the Act or rules then the penalty which may exceed Five hundred rupees and if the same offence is continued by the person then the fine imposed which will be One thousand rupees or more.

Know more about Delhi Road Tax Click Here

Uttarakhand Road Tax-Image 17

Penalty

In case of any violation of the provisions under the Act or rules then the penalty which may exceed Five hundred rupees and if the same offence is continued by the person then the fine imposed which will be One thousand rupees or more.

Know more about Delhi Road Tax Click Here

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...