Last updated: December 17th, 2019 3:48 PM

Last updated: December 17th, 2019 3:48 PM

What is the value of my business? - Business Valuation Explained

Business valuation is an important concept in corporate finance and business management. Supposing a business is for sale, how does one know what is the real value that that business is worth? More basically, how does a business owner know the net value of his business, or how is valuing a business for sale accomplished? If he receives an offer, for example, from someone who would like to purchase his business, how does he accurately estimate how much his business is worth, so that he is not cheated, and after knowing the true value, is readily able to charge the appropriate profit premium he desires?

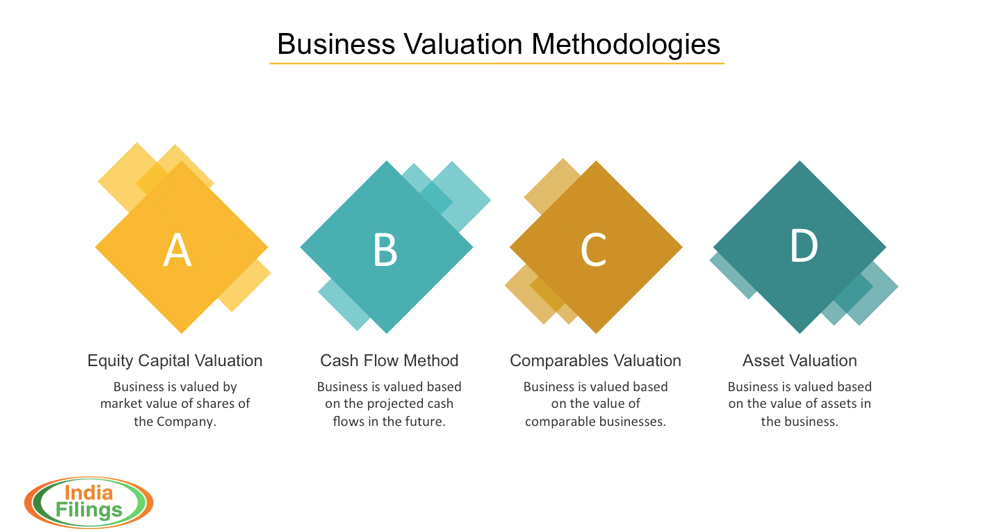

[caption id="attachment_2130" align="aligncenter" width="716"] Business Valuation Methodology

Business Valuation Methodology

Share or Equity Capital

For a publicly traded company, the answer would seem easy. Assuming markets are efficient, then the total value (called market capitalization) is simply the price of each individual share times the number of shares outstanding. E.g. if each share is priced at Rs. 5,000, and there are 100,000 shares held on the market, then the value of the business should be Rs. 50 Crore. This is the value that can be obtained by any individual without much analysis. For a private limited company by analogy, it would seem total owner’s equity is a good enough approximation of the true value of the company.

But there is more to it than this, because, first of all markets are inefficient, and analysts may want to study precisely by how much a certain company’s equity is undervalued or overvalued from its true amount. Secondly, owner’s equity is not as such the true value of the company, because beside the fact that owners by engaging in a business are looking for substantial return on their original investment, so that it is almost certain that the true value of a worthwhile business exceeds significantly the owner’s equity, this entire method is insufficient for other reasons, which we will analyze below.

Cash Flow Method

Think of a project. How do we determine its value to the company? We analyze the project in detail and sum up the total cash flows it is expected to generate, in order to determine the payback period when the project will break even.

Therefore, a more exact understanding of true value, which we can by analogy apply to the whole business considered as a unit, comes from this simple concept – a business’ value is determined as that amount precisely which is equal to the present value of the sum of all expected future cash flows. To take a simple example as an illustration, with the market rate of return is 10%, the business expected to continue functioning for 10 years, and generate a turnover of 10 lakh every year than the Business’ value today will be approximately equal to 6.15 lakh today.

[i.e 10,00,000 {1+1/1.1+1/(1.1)^2 .... 1/(1.1)^10}=6,14,456.7]

In other words, a fair price for the company today is about 6.14 lakh given the expected cash flows the business is likely to generate. Therefore, if the company turns out to be interested in the offer, they can charge an appropriate price. This is a more appropriate and justifiable way of arriving at true value.

Comparables Valuation

Another way of valuing a business is by comparison. Most of us value products in this way, for example, if we learn a set of a table with 4 chairs is worth 10,000, we might be willing to pay about 2 times that amount for a bigger table with more chairs. This basic concept can be used for valuing a businesses in industries where the value of other businesses are known. For example, if it is known that Company A is worth 1 Crore, then, by an examination of its financials, and some justifiable assumptions, we can arrive at the true value of our own business, Company B. In other words, we value Company B no more absolutely and without a parameter of reference but rather completely relatively, in other words, we value it in comparison to Company A. Thus, the meaning and origin of comparables valuation.

Now, to continue on with our example, supposing all other factors are relatively constant, and Company A’s earnings before tax alone is about 2 times our own. In that case, it would be likely our own business would have a value of about 45-55 lakh (Half of Company A’s). Suppose on the other hand its net profit is a mere half of our own, and other variables nearly the same in both cases. Then, it would be justifiable to estimate the value of our own business at around 1.95 to 2.05 Crore (Twice that of Company A’s). This is a quicker and more intuitive method, but it should be borne in mind that the value arrived at is approximate, and usually a more detailed comparison of several parameters is necessary, before we can be morally certain we have zeroed in on the true value, for this many iterations are necessary. For example, if the valuation computed by varying different comparables over a period of time turns out to be more or less the same, then we can be confident we have arrived at value close to what the business is truly worth. Most investors, traders and those on the lookout for purchasing businesses value business in this way. Therefore, it is necessary for all small and medium business owners who might be interested in such an offer to have an idea of the same.

Other Methods for Valuing a Business

Finally, other businesses use the concept of free cash flow to arrive at final value. Free Cash flow is the operating cash flow less all capital expenditures and is considered by some to be a closer gauge of the real periodic cash inflow that a business is generating. Therefore, they argue, that this is the measure that must be taken into account, nonetheless comparables and discounted cash flow valuation are very common in the industry today. There are some lesser important methods also used in the industry. They are mostly trial and error methods aimed to arrive at an approximation of true value. One cannot rely on them to give an absolutely reliable figure but only a rough or approximate estimate. In conclusion, then, if you are looking one day to sell your business and move on to bigger and better things, this would be important to keep in mind. It is also a good idea for all businesses to have a general idea of the estimated value of their business, so that they can progressively strive year on year to try and boost the true value their company is worth. Thus, a working knowledge of how valuable your business can be is something important for any entrepreneur to know.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...