Updated on: April 16th, 2019 4:56 AM

Updated on: April 16th, 2019 4:56 AM

Venture Capital Assistance Scheme

The Small Farmer’s Agri-Business Consortium (SFAC) has launched the scheme named Venture Capital Assistance (VCA) Scheme for the welfare of farmer-entrepreneur to develop their agri-business. This scheme intends to assist in the form of the term loan to the qualifying projects of the farmers to meet their capital requirements for the implementation of the project. In this article, we look at the Venture Capital Assistance Scheme in detail.Objectives of the Scheme

The objective of the venture capital assistance scheme is explained as below:- To support the entrepreneurs in setting up an agribusiness venture which is approved by the banks, financial institutions regulated by the RBI.

- To help farmers, producer groups, and agriculture graduates to participate in the value chain through the Project Development Facility.

- To strengthen the previous stages of state and central SFAC.

- To promote training and visits of agri-entrepreneurs in setting up agribusiness projects.

- To provide assured markets to the producers to increase rural income and employment.

- To assist the backward linkages of agribusiness projects with producers.

Features of the Scheme

The features of the venture capital assistance scheme are as follows:- The venture capital will be provided only for the projects qualified by the banks/ financial institution funding the project.

- As per the repayment schedule, the venture capital has to be repaid to the SFAC within the stipulated period.

- The SFAC will provide the venture capital to the agri-business projects in the form of soft loans.

Eligibility Criteria

The following are the entities specified to avail the loan from the SFAC.- Individual

- Farmers

- Producer group

- Partnership Firm

- Self Help Groups

- Company

- Agripreneuers

- Agri-export zones units

- Agricultural graduates

Quantum of Loan

The quantum of loan for the venture capital assistance will be provided depending upon the project cost. The minimum and maximum loan amount are specified here.- The quantum of loan will be 26% of the promoter’s equity.

- The maximum amount of loan provided under this scheme will be Rs.50 lakhs.

- The quantum of loan will be 40% of the promoter’s equity.

- The maximum amount of loan provided under this scheme will be Rs.50 lakhs.

Terms and Conditions

The following are the conditions to be satisfied to avail loan under this scheme.- The project must be in the agriculture sector or any other sector related to the agriculture practices.

- The project must give the assured market to the producer or farmers.

- The project must be sanctioned by the banks or financial institution for the grant of loan to the project.

- The project should encourage the farmers in yielding high-value crops for the increase in the income of the farmer.

High Venture Capital

The Executive Committee under SFAC has the power to authorise the project for the recommendation of high venture capital, only when the following conditions are satisfied:- If the net value of the project is not more than Rs. 10 crore.

- If the projects are located in the northeastern region, hilly states which are declared as backward regions by the planning commission backward regions grant fund scheme.

- If the sanctioning authority approves the provision for the high venture capital to a maximum of Rs.3 crore

Documents Required

The following are the documents are to be furnished along with application form.- Promoter’s request letter

- Sanction letter of the sanctioning authority

- Banks' approved appraisal

- The current statement of the account

- In case of partnership firm the copy of partnership firm certificate

- Equity certificate

- Farmer’s backward linkage duly supported by the agreement

- Affidavit of promoter stating that VCA was not availed earlier

- In case of unsecured loans acquired by the promoter, the CA certificate has to be furnished

- Copy of current bank inspection report

- Bank’s confirmation is stating that they will not release collateral security without the SFAC approval

- Justification of margin on working capital was taken in project cost

Application Procedure for the Scheme

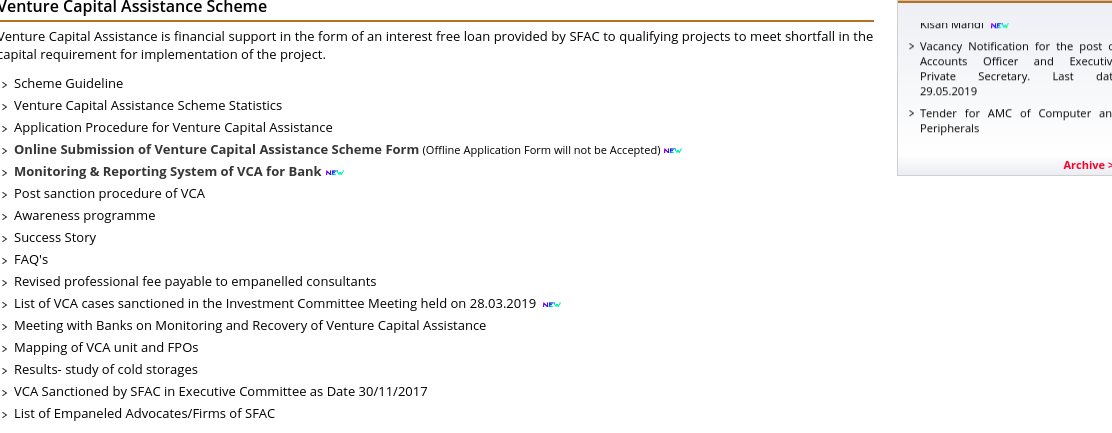

To apply for the venture capital assistance scheme, follow the procedure which is mentioned below: Visit Official Portal Step 1: The applicant has to visit the official portal of the SFAC, Government of India. [caption id="attachment_78571" align="aligncenter" width="592"] Venture Capital Assistance Scheme-Image 1

Venture Capital Assistance Scheme

Step 2: Click on “ Venture Capital Assistance Scheme (VCA)” tab which is visible on the homepage of the portal.

[caption id="attachment_78572" align="aligncenter" width="630"]

Venture Capital Assistance Scheme-Image 1

Venture Capital Assistance Scheme

Step 2: Click on “ Venture Capital Assistance Scheme (VCA)” tab which is visible on the homepage of the portal.

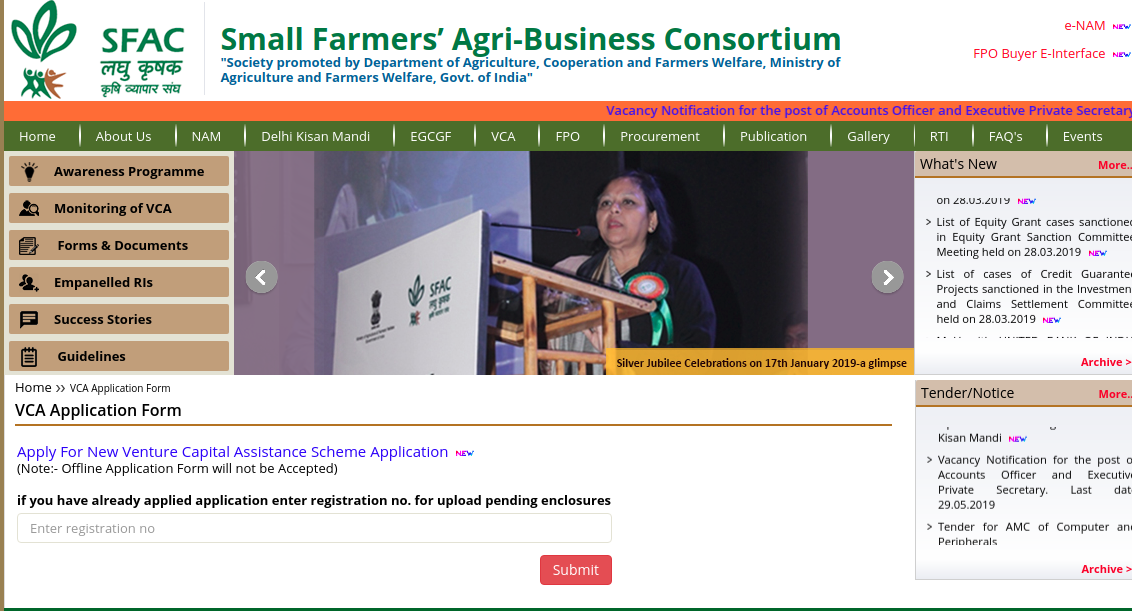

[caption id="attachment_78572" align="aligncenter" width="630"] Venture Capital Assistance Scheme-Image 2

Select the Scheme

Step 3: At the same page, select “Online submission of venture capital assistance scheme Form” from the list of options to apply for the scheme through online mode.

[caption id="attachment_78574" align="aligncenter" width="554"]

Venture Capital Assistance Scheme-Image 2

Select the Scheme

Step 3: At the same page, select “Online submission of venture capital assistance scheme Form” from the list of options to apply for the scheme through online mode.

[caption id="attachment_78574" align="aligncenter" width="554"] Venture Capital Assistance Scheme-Image 3

Apply for the Scheme

Step 4: On the next page, Click on “Apply for New venture capital assistance scheme Application” link.

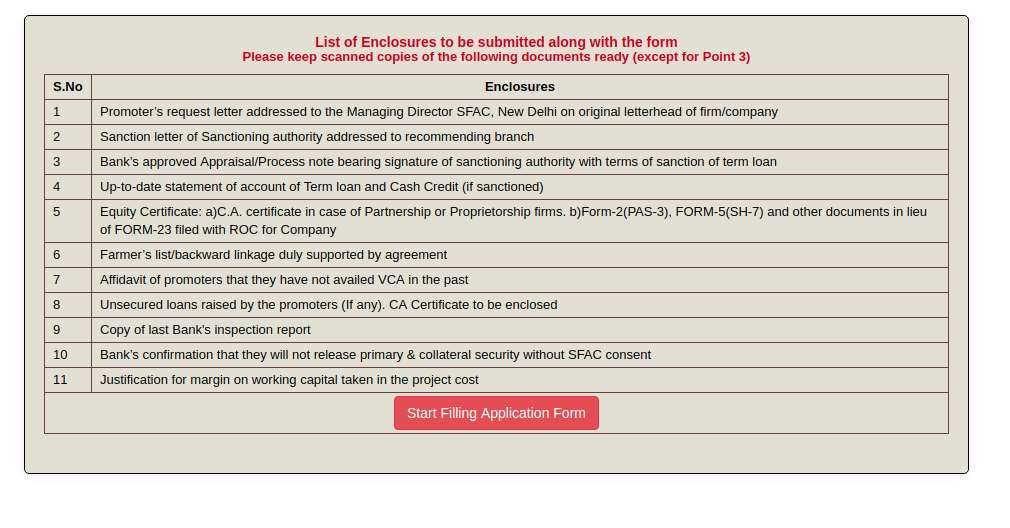

Complete the Details

Step 5: Click on “Start Filing Application Form” button, then the application form the venture capital assistance scheme will open up.

[caption id="attachment_78575" align="aligncenter" width="584"]

Venture Capital Assistance Scheme-Image 3

Apply for the Scheme

Step 4: On the next page, Click on “Apply for New venture capital assistance scheme Application” link.

Complete the Details

Step 5: Click on “Start Filing Application Form” button, then the application form the venture capital assistance scheme will open up.

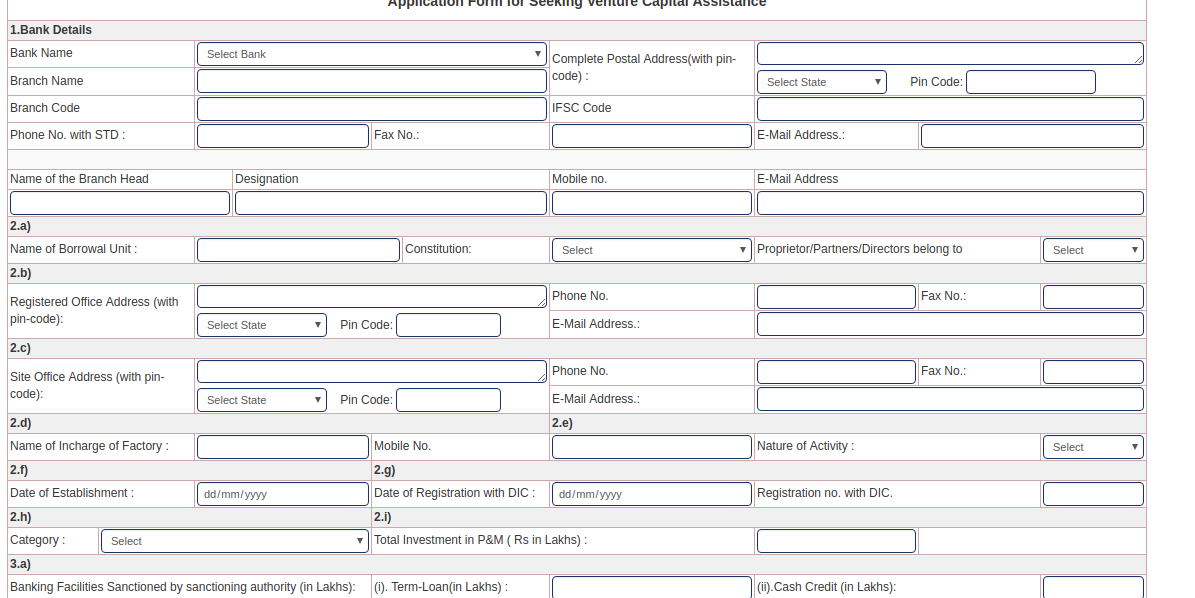

[caption id="attachment_78575" align="aligncenter" width="584"] Venture Capital Assistance Scheme-Image 4

Step 6: Fill the application form with the required details such as

Venture Capital Assistance Scheme-Image 4

Step 6: Fill the application form with the required details such as

- Bank details

- Name and Address of controlling office of the branch

- Status of Accounts

- Cost of projects

- Name of the consultant

-

[caption id="attachment_78576" align="aligncenter" width="1195"]

Venture Capital Assistance Scheme-Image 5

Venture Capital Assistance Scheme-Image 5

Sanction of Loan

Upon submission of application, the bank or financial institution is liable for the approval of the loan amount. The bank or financial institution if satisfied with the above criteria will forward its approval of the project to the SFAC. The SFAC will process the loan amount for qualified projects.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...