Updated on: May 18th, 2020 1:40 AM

Updated on: May 18th, 2020 1:40 AM

Vivad se Vishwas - Filing of DTVSV Form

During the Union Budget, 2020 the Direct Tax Vivad se Vishwas (DTVSV) Scheme was launched to provide for dispute resolution in respect of pending income tax litigation. The Central Board of Direct Taxes has enabled an online filing system for e-Filing of DTVSV Form. The taxpayers willing to avail of the direct tax dispute resolution need to file five online forms through the official website of the Income-tax department and the Designated Authority will issue the certificate and order electronically.Direct Tax Vivad se Vishwas (DTVSV) Scheme

The objective of the DTVSV scheme is to reduce pending income tax litigation, generate timely revenue for the Government of India. This scheme provides benefits to taxpayers by providing peace of mind, confidence, and savings on account of time and resources. The disputes covered under the Direct Tax vivad se vishwas (DTVSV) scheme is as follows:- Disputed tax

- Disputed penalty

- Disputed interest

- Disputed Fee

- Disputed Tax Deducted at Source (TDS) or tax collected at source (TCS)

Period of DTVSV Scheme Extended - COVID 19

Considering the COVID 19 Pandemic across the country, Smt. Nirmala Sitharaman, the Hon’ble Finance Minister, announced that the Period of DTVSV Scheme for making payment without additional amount has been extended till December 31st, hence the taxpayer will not be required to pay the 10% additional disputed tax.DTVSV Forms

As mentioned above, the taxpayer needs to file five DTVSV Forms to avail of the direct tax dispute resolution. The Designated Authority will also issue the certificate and order online.- DTVSV Form-1: The taxpayer needs to file a declaration under the DTVSV Scheme in Form-1 and relevant schedules.

- DTVSV Form-2: The applicant needs to file the undertaking in DTVSV Form-2 along with Form-1.

- DTVSV Form 3: The Designated Authority will intimate the tax payable or refundable amount to the tax=payer in Form 3.

- DTVSV Form-4: The taxpayer needs to intimate the details of payment in Form-4 along with proof of withdrawal of relevant appeal, writ, and arbitration for dispute resolution.

- DTVSV Form-5: The Designated Authority will issue the order regarding the full and final settlement of the dispute in Form-5.

e-Filing of DTVSV Form

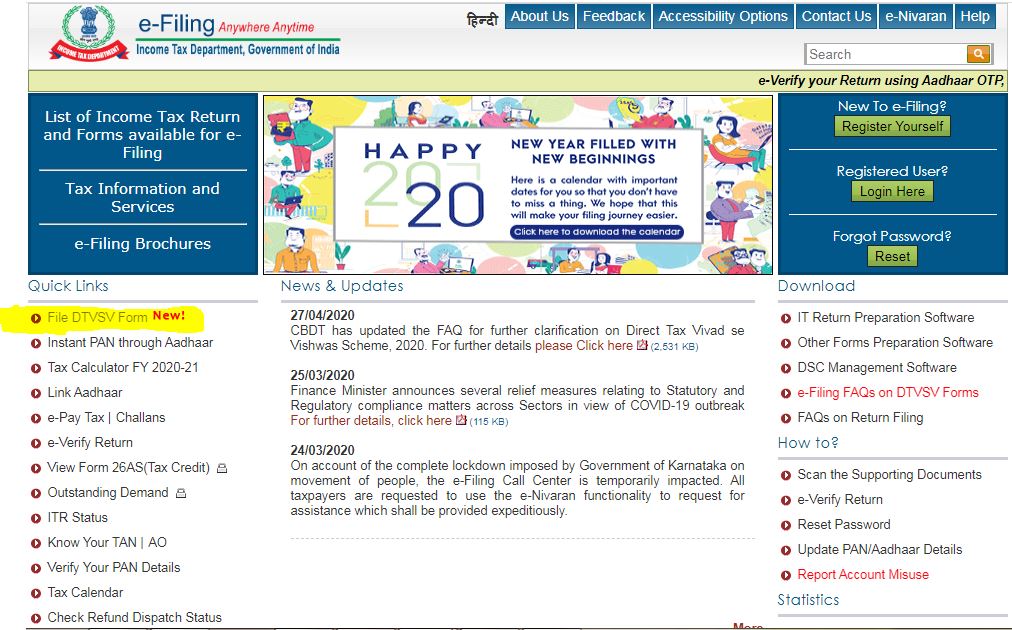

To prepare and submit the DTVSV Form, The applicant needs to access the official web-page of the Income Tax Department after that Login to the portal using Permanent Account Number (or TAN as applicable) and password. e-Filing of DTVSV Form - Home Page

Once login to the portal, Select the Vivad se Vishwas tab and click on the Prepare and Submit DTVSV Forms. The Forn 1 and Form 2 will be available for data entry and preparation online to the applicant after login.

e-Filing of DTVSV Form - Home Page

Once login to the portal, Select the Vivad se Vishwas tab and click on the Prepare and Submit DTVSV Forms. The Forn 1 and Form 2 will be available for data entry and preparation online to the applicant after login.

e-Filing of DTVSV Form - Login Page

e-Filing of DTVSV Form - Login Page

Online Filing of Form – 1

After login to the portal, select the Form 1 and Assessment year is applicable for Tax Deduction at source related cases. After that, click on the filing type (revised or original) from the drop-down menu. The DTVSV form -1 contains the specific schedules and the applicants are required to file the relevant schedules and tables under the schedules with validation for submission of the declaration. The applicant needs to provide the details under the following five sections.- PART A - General Information

- PART B – Information Relating To Dispute

- PART C – Information Related To Tax Arrear

- PART D – Information Related To Amount Payable

- PART E – Details Related To Payments against Tax Arrear

Online Filing of Form – 2

The DTVSV can also be submitted electronically through the Income Tax Department official webpage as stated above. Provide the following information in DTSVS Form-2- Designation of the taxpayer

- Details of PAN, Aadhaar, and TAN

Get Acknowledge number

After the submission of form 1 and 2, an acknowledgement number will be provided to the applicant.Issue of Forn - 3

Once the declaration made by the taxpayer is accepted by the designated authority, Form 3 will be issued and the assesses need to pay the amount determined within 15 days of receipt of the certificate and need to intimate the details of such payment to the designated authority.Filing of Form – 4

The taxpayer needs to intimate the details of payment in Form-4 along with proof of withdrawal of relevant appeal, writ, arbitration for dispute resolution. After login to the portal, click on the Form 4 option, the following information will be auto-populated:- According to the certificate received from the designated authority in Form-3 vide certificate number

- PAN/TAN and Aadhaar Number

- Assessment year / Financial Year

- Basic Statistical Return Code of Bank

- Serial Number of Challan

- Amount (Rs)

- Date of Deposit (DD/MM/YYYY)

Viewing Submitted Forms

The submitted DTVSV forms will be available for view and download, after login to the portal select “View DTVSV Forms” to access the submitted forms.Issue of Order in Form -5

The Designated Authority will issue the order regarding the full and final settlement of the dispute in Form-5.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...