Last updated: December 17th, 2019 5:04 PM

Last updated: December 17th, 2019 5:04 PM

Weather Based Crop Insurance Scheme

Weather-based Crop Insurance Scheme (WBCIS) is designed to provide insurance protection against losses in crop yield resulting from adverse weather incidences. This unique weather-based insurance product provides payout against adverse rainfall incidence (both deficit and excess) during Kharif and adverse impact in weather parameters during Rabi. In this article, we will look at the Weather Based Crop Insurance Scheme in detail. Know more about the National Agricultural Insurance SchemeObjective of the Scheme

Weather Based Crop Insurance Scheme aims to alleviate the hardship of the insured farmers against the likelihood of financial loss on account of the anticipated crop loss resulting from incidence of adverse conditions of weather parameters like un-seasonal rainfall, temperature, frost, relative humidity etc. Weather Based Crop Insurance Scheme (WBCIS) uses weather parameters as a proxy for crop yields in compensating the cultivators for deemed crop losses. Payout structures will be developed to the extent of losses deemed to have been suffered using the weather triggers.Eligibility Criteria

The eligibility criteria to obtain the insurance benefit of the Weather Based Crop Insurance Scheme are explained in detail below:Eligible Farmers

- All farmers, including the sharecroppers and tenant farmers growing the notified crops in the notified areas, are eligible for this Scheme.

- All farmers availing the Seasonal Agricultural Operations (SAO) loans from Financial Institutions (. loanee farmers) for the notified crops are eligible

- The Weather Based Crop Insurance Scheme is optional for the non-loanee farmers.

- Special importance will be provided for SC/ ST/ Women farmers under this Scheme.

Eligible Crops

The following crops are covered under the Weather Based Crop Insurance Scheme:- Food Crops - Cereals, Millets and Pulses

- Oilseeds

- Commercial or Horticultural crops

Weather Perils

The major weather perils, which are deemed to cause adverse weather incidence leading to crop loss, will be covered under this Scheme:- Rainfall – Excess rainfall, Deficit Rainfall, Unseasonal Rainfall, Rainy days, Dry-spell and Dry days

- Temperature– High temperature (heat), Low temperature

- Relative Humidity

- Wind Speed

- A combination of the above weather perils

- Hailstorm, cloud-burst will be covered as Add-on/Index-Plus products for those farmers who have already taken normal coverage under WBCIS

Prescribed Authority

The Panchayat Raj Institutions (PRIs) is the implementing agency for the crop insurance scheme. The PRI involves in various stages such as identification of the crops and beneficiaries, extension and awareness creation amongst farmers, obtaining feedback of the farmers while assessing the claim for prevented sowing/ planting risk, localized perils, post-harvest losses and advance payment of claims.Insurance Period

The insurance period will ideally be from sowing period to maturity of the crop. The insurance period is depending on the duration of the crop and weather parameters chosen could vary with individual crops and reference unit areas and would be notified by State Level Co-ordination Committee on Crop Insurance (SLCCCI) before the commencement of risk periodSelection of Areas and Crops

State Level Co-ordination Committee on Crop Insurance (SLCCCI) will select the areas and crops by considering the factors such as availability of historical weather data, minimum cropped area, weather perils capable of causing significant and quantifiable losses by the change in measurable weather parameters.- State Government convenes meetings with insurance providers and experts of Agro-meteorology from State Agriculture Universities, Research Institutes for finalization of triggers, term-sheets and payout before SLCCCI meeting.

- A Technical Committee constituted by the Government will perform the following :

- Selection of crop, area, weather triggers

- Examination of proposals received from the Insurance Company

- Finalization of term-sheets for the proposed crop or area based on demonstrated correlation with historical weather and yield data

- Evaluation of product and benefits to the farmers on insurance principles

Sum Insured

The Sum Insured for each notified crops are pre-defined, and it's same for loanee and non-loanee farmers, which will be based on the Scale of finance as decided by the District Level Technical Committee.- If DLTC does not declare the scale of finance, the sum insured is broadly based on the cost of cultivation of the crop and will be decided by the State Government.

- Sum Insured for the individual farmer is equal to the Sum insured multiple by acreage of the notified crop. The area under cultivation will always be expressed in ‘hectare’.

- The Sum Insured of the crop will be distributed among the critical phases of the crops based on the accumulating input cost in its growth path of the crop during that phase.

- The sum insured assigned to the subsequent phases will be the summation of its previous phases to provide adequate compensation on the damage of crop at later stages

Premium Rates and Premium Subsidy

The Actuarial Premium Rate (APR) will be charged under WBCIS by implementing agency (IA). The rate of Insurance Charges payable by the farmer will be as per the following table:|

Sl.No |

Season |

Crops |

Maximum Insurance charges payable by the farmer (% of Sum Insured) |

|

1 |

Kharif | All food grain and Oilseeds crops (all Cereals, Millets, Pulses and Oilseeds crops) | 2% of SI or Actuarial rate, whichever is less |

|

2 |

Rabi | All food grain and Oilseeds crops (all Cereals, Millets, Pulses and Oilseeds crops) | 1.5% of Sum Insured or Actuarial rate, whichever is less |

|

3 |

Kharif and Rabi | Annual Commercial/ Annual Horticultural crops | 5% of SI or Actuarial rate, whichever is less |

Insurance Premium Calculator

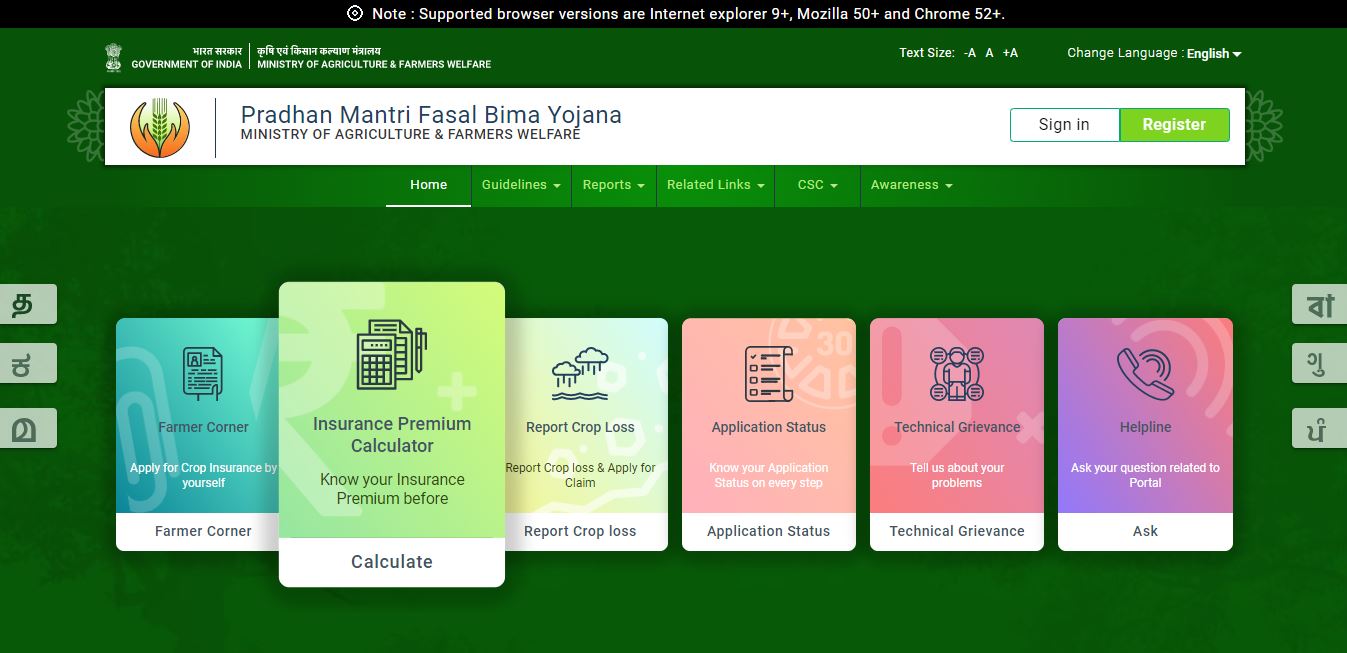

The farmer can get the insurance premium detail through the official website of PMFBY, Ministry of Agriculture and Farmer Welfare Department. Image 2 Weather Based Crop Insurance Scheme

Click on the Insurance Premium Calculator option.

Image 2 Weather Based Crop Insurance Scheme

Click on the Insurance Premium Calculator option.

Image 1 Weather Based Crop Insurance Scheme

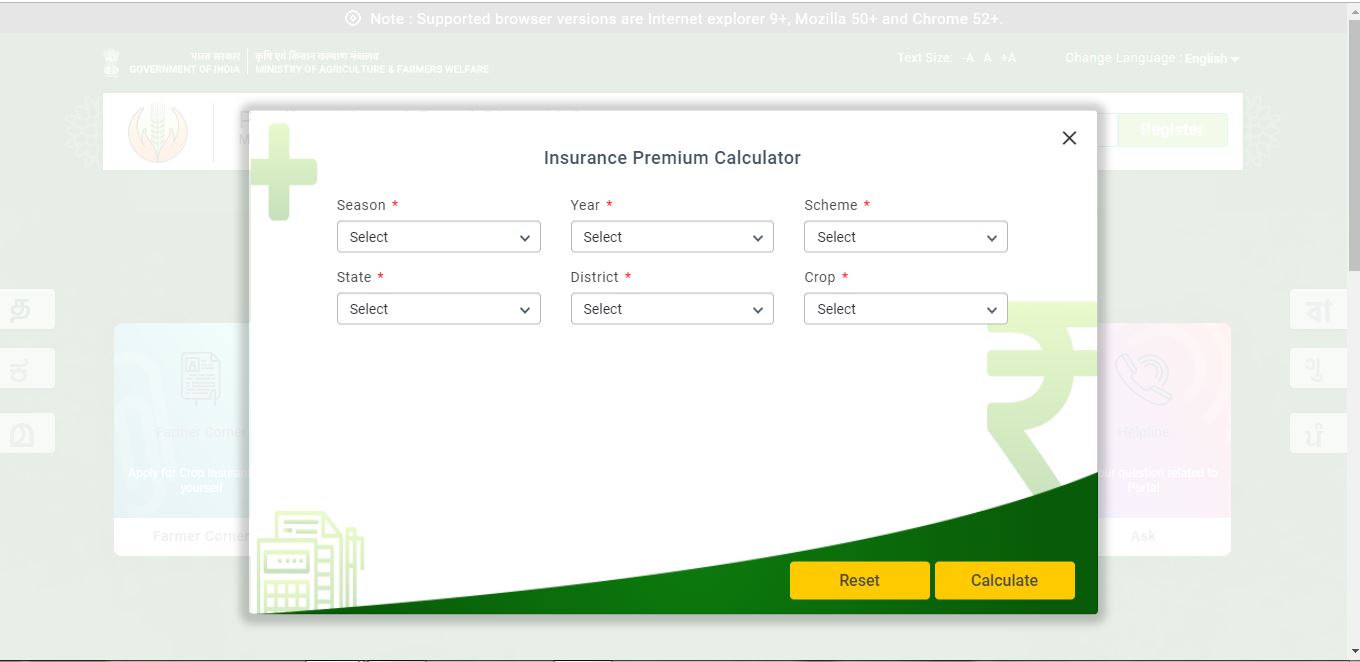

Provide the following details in the Insurance Premium Calculator. By clicking on the calculate option, the insurance details will be displayed.

Image 1 Weather Based Crop Insurance Scheme

Provide the following details in the Insurance Premium Calculator. By clicking on the calculate option, the insurance details will be displayed.

- Season

- Year

- Scheme

- State

- District

- Crop

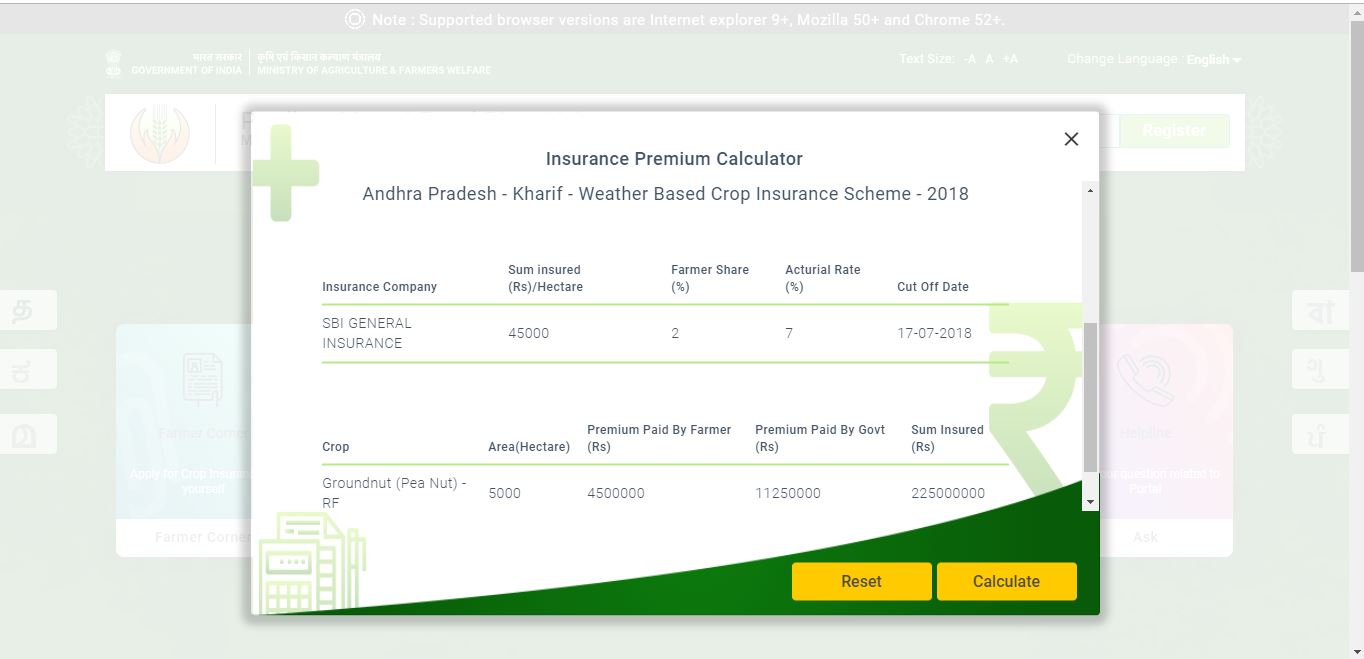

Image 3 Weather Based Crop Insurance Scheme

Image 3 Weather Based Crop Insurance Scheme

Insurance Providers

The following companies are designated to provide insurance services with respect to the scheme:- Agriculture Insurance Company

- Cholamandalam MS General Insurance Company

- Reliance General Insurance Co. Ltd.

- Bajaj Allianz

- Future Generali India Insurance Co. Ltd.

- HDFC ERGO General Insurance Co. Ltd.

- IFFCO Tokio General Insurance Co. Ltd.

- Universal Sompo General Insurance Company

- ICICI Lombard General Insurance Co. Ltd.

- Tata AIG General Insurance Co. Ltd.

- SBI General Insurance

- United India Insurance Co.

Documents Required

The non-loanee farmers are required to submit the following documentary evidence of land records to avail the benefit of Weather Based Crop Insurance Scheme:- Records of Right (RoR)

- Land possession Certificate (LPC)

- Applicable contract documents

- Agreement detail documents

- Other documents notified by concerned State Government (in case of sharecroppers or tenant farmers).

Application Procedure

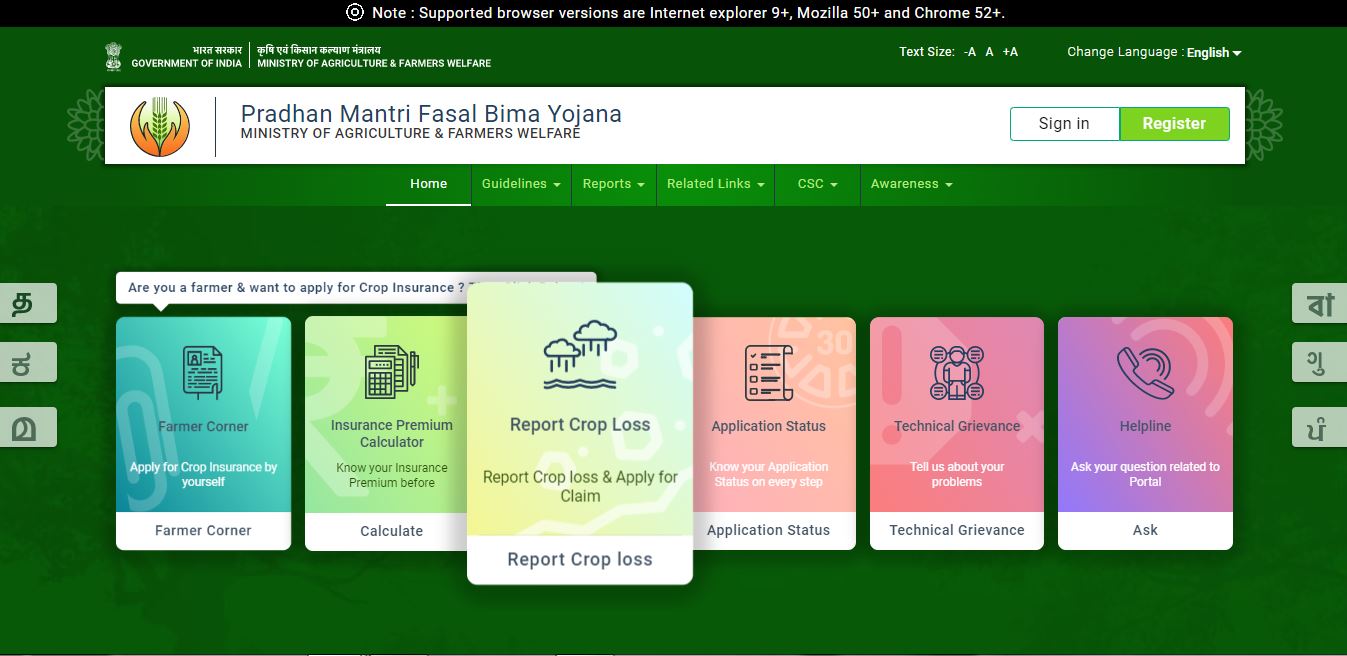

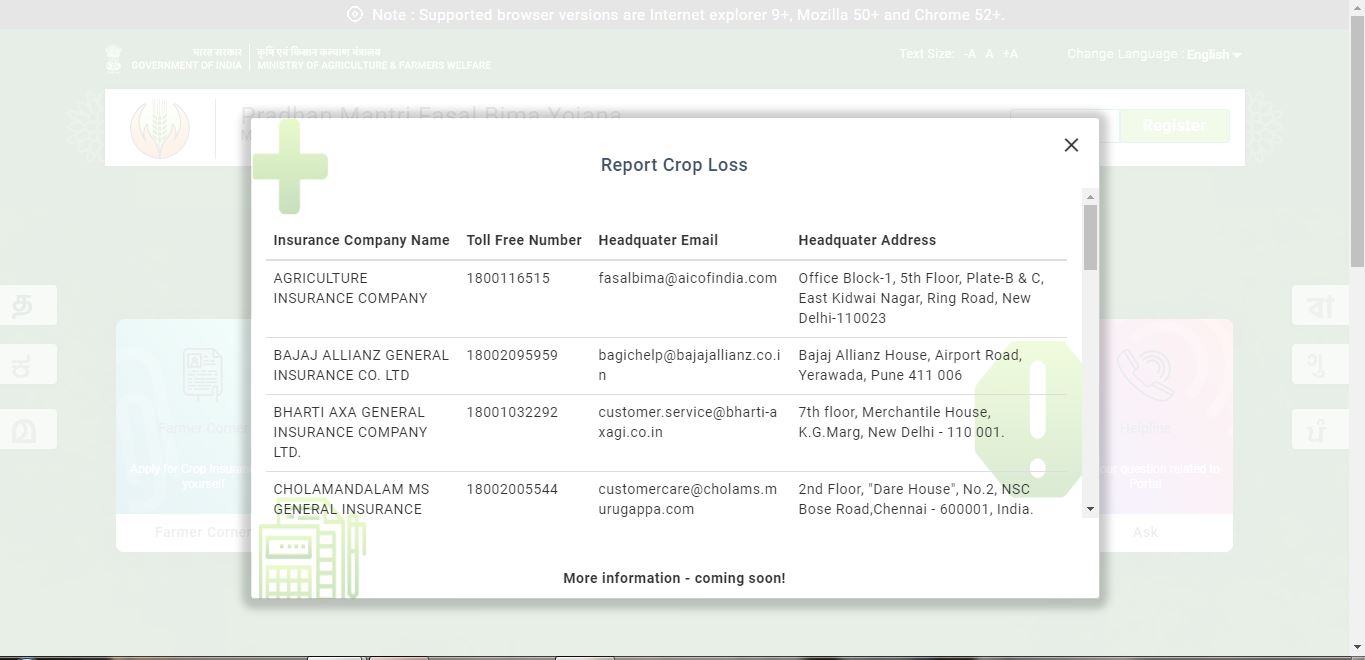

The farmer can report crop loss and apply for insurance through the official website of PMFBY, Ministry of Agriculture and Farmer Welfare Department. Image 4 Weather Based Crop Insurance Scheme

The detail of the Insurance Company will be displayed; the farmer can contact the insurance company directly.

Image 4 Weather Based Crop Insurance Scheme

The detail of the Insurance Company will be displayed; the farmer can contact the insurance company directly.

Image 5 Weather Based Crop Insurance Scheme

The procedure of assessment and settlement of claims are automated processes, and the claim amount is credited to the insured farmers’ bank account.

Image 5 Weather Based Crop Insurance Scheme

The procedure of assessment and settlement of claims are automated processes, and the claim amount is credited to the insured farmers’ bank account.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...