Last updated: November 15th, 2024 2:54 PM

Last updated: November 15th, 2024 2:54 PM

West Bengal Liquor License

A liquor license is a document that permits a business to sell alcoholic beverages at a particular place. Liquor license is issued by the Excise Department of the respective state. It is illegal for any individual to manufacture, dispense or sell intoxicating alcohol without a valid state license. The state government has established various rules and regulations under the Bengal Excise Act 2012, making it mandatory to acquire a liquor license for restaurants, hotels, clubs etc. In this article, we look at the procedure for obtaining West Bengal Liquor License in detail.Eligibility Criteria for West Bengal Liquor License

To apply for a Liquor license in the state of West Bengal, the applicant needs to satisfy the following conditions:- The individual should be age twenty-one years or above and should be an India citizen or a Person of Indian Origin (in case of individuals the application can be made by a single individual or multiple individuals jointly).

- A firm which is regulated by the Indian Partnership Act, 1932.

- A company which is regulated by the Companies Act, 1956.

- A society which is registered under the West Bengal Co-operative Act, 1983 or the West Bengal Societies Registration Act, 1961.

- A person who has been convicted by a criminal court of a non-bailable offence.

- An existing license holding person who has violated the terms and conditions of his license.

- A person who was a defaulter in the payment of excise revenue to the State Government.

- A person who is interested, either directly or indirectly, in the manufacture or sale of any intoxicant in foreign territory or any bordering State of West Bengal.

Categories of License

Any eligible person can obtain a Liquor license based on the following categories. They are:Temporary License

The following types of temporary license that are valid only for six months.Restaurant-cum-Bar

This license issued for the retail sale of foreign liquor for consumption on the premises of any restaurant and attached bar.Hotel-cum-Restaurant-cum-Bar

This license issued for the retail sale of foreign liquor for consumption on the premises of any hotel and restaurant and attached bar.Hotel-cum-Bar

This license issued for the retail sale of foreign liquor for consumption on the premises of any hotel and attached bar. Note: While applying for the above categories of temporary licenses the applicant can request for additional bar licenses. In such cases, all additional bars must be clearly explained in the Site Plan that has to be submitted at the time of application.Regular License

The following listed categories can make application for the regular licenses.- License for the retail sale of beer, wine and low alcoholic beverage (LAB) for consumption off the premises from existing Departmental Stores with a minimum floor area of one thousand and five hundred square feet, having departments for the retail sale of various commodities.

- License for the retail sale of foreign liquor for consumption on the premises of theatre, club, canteen, Dak-bungalow, Railway refreshment room, dining car, steamer, customs airport or any place of public resort and entertainment and attached bar.

Minimum Requirements for Site Plan

The site plan for categories mentioned above like Restaurant-cum-Bar, Hotel-cum-Restaurant-cum-Bar, Hotel-cum-Bar should contain the layout of the site, main entrance, seating arrangements, restrooms, bar counters, foreign liquor store or go down, kitchen etc. Also the same should be duly signed by the applicant and the landlord or owner of the premises.Applicable Fee

The applicable charge for the types of liquor license and site location in West Bengal are given below:Restaurant-cum-Bar License:

| Location of the Site | Non-refundable application fee | Monthly nonrefundable fee for temporary bar license | Initial Grant Fee | Security Deposit (1/3rd of Initial Grant Fee) | Fee for Grant of License for the Next period of settlement |

| Panchayat Area | Rs. 8,000 | Rs. 5,000 | Rs. 3,00,000 | Rs. 1,00,000 | Rs. 20,000 |

| Municipal / Notified Area | Rs. 12,000 | Rs. 10,000 | Rs. 4,50,000 | Rs. 1,50,000 | Rs. 40,000 |

| Municipal Corporation Area | Rs. 25,000 | Rs. 20,000 | Rs. 6,00,000 | Rs. 2,00,000 | Rs. 50,000 |

Hotel-cum-Restaurant-cum-Bar License (below 3-Star category Hotel):

| Location of the Site | Non-refundable application fee | Monthly nonrefundable fee for temporary bar license | Initial Grant Fee | Security Deposit (1/3rd of Initial Grant Fee) | Fee for Grant of License for the Next period of settlement |

| Panchayat Area | Rs. 8,000 | Rs. 5,000 | Rs. 6,00,000 | Rs. 2,00,000 | Rs. 30,000 |

| Municipal / Notified Area | Rs. 12,000 | Rs. 10,000 | Rs. 8,00,000 | Rs. 2,66,667 | Rs. 50,000 |

| Municipal Corporation Area | Rs. 25,000 | Rs. 20,000 | Rs. 10,00,000 | Rs. 3,33,334 | Rs. 70,000 |

Hotel-cum-Restaurant-cum-Bar License (below 4-Star category Hotel):

| Location of the Site | Non-refundable application fee | Monthly nonrefundable fee for temporary bar license | Initial Grant Fee | Security Deposit (1/3rd of Initial Grant Fee) | Fee for Grant of License for the Next period of settlement |

| Panchayat Area | Rs. 8,000 | Rs. 5,000 | Rs. 12,50,000 | Rs. 4,16,667 | Rs. 50,000 |

| Municipal / Notified Area | Rs. 12,000 | Rs. 10,000 | Rs. 15,00,000 | Rs. 5,00,000 | Rs. 80,000 |

| Municipal Corporation Area | Rs. 25,000 | Rs. 20,000 | Rs. 18,00,000 | Rs. 6,00,000 | Rs. 1,00,000 |

Hotel-cum-Restaurant-cum-Bar License ( 5-Star or above category Hotel):

| Location of the Site | Non-refundable application fee | Monthly nonrefundable fee for temporary bar license | Initial Grant Fee | Security Deposit (1/3rd of Initial Grant Fee) | Fee for Grant of License for the Next period of settlement |

| Panchayat Area | Rs. 8,000 | Rs. 5,000 | Rs. 15,00,000 | Rs. 5,00,000 | Rs. 15,00,000 |

| Municipal / Notified Area | Rs. 12,000 | Rs. 10,000 | Rs. 20,00,000 | Rs. 6,66,667 | Rs. 15,00,000 |

| Municipal Corporation Area | Rs. 25,000 | Rs. 20,000 | Rs. 25,00,000 | Rs. 8,33,334 | Rs. 15,00,000 |

Hotel-cum-Bar License:

| Location of the Site | Non-refundable application fee | Monthly nonrefundable fee for temporary bar license | Initial Grant Fee | Security Deposit (1/3rd of Initial Grant Fee) | Fee for Grant of License for the Next period of settlement |

| Panchayat Area | Rs. 8,000 | Rs. 5,000 | Rs. 6,00,000 | Rs. 2,00,000 | Rs. 30,000 |

| Municipal / Notified Area | Rs. 12,000 | Rs. 10,000 | Rs. 8,00,000 | Rs. 2,66,667 | Rs. 50,000 |

| Municipal Corporation Area | Rs. 25,000 | Rs. 20,000 | Rs. 10,00,000 | Rs. 3,33,334 | Rs. 70,000 |

Retail beer, wine and low alcoholic beverage (LAB) license for consumption off the premises from existing Departmental Stores:

| Location of the Site | Non-refundable application fee | Monthly nonrefundable fee for temporary bar license | Initial Grant Fee | Security Deposit (1/3rd of Initial Grant Fee) | Fee for Grant of License for the Next period of settlement |

| Panchayat Area | Rs. 8,000 | Nil | Rs. 40,000 | Rs. 13,334 | Rs. 15,000 |

| Municipal / Notified Area | Rs. 12,000 | Nil | Rs. 60,000 | Rs. 20,000 | Rs. 30,000 |

| Municipal Corporation of Siliguri, Kolkata and Howrah Area | Rs. 25,000 | Nil | Rs. 1,50,000 | Rs. 50,000 | Rs. 60,000 |

| Other Municipal Corporation Area | Rs. 25,000 | Nil | Rs. 1,20,000 | Rs. 40,000 | Rs. 40,000 |

A retail foreign liquor license for consumption on the premises of any existing theatre, club, canteen (except canteen for Defence Personnel), Dak-bungalow, Railway refreshment room, dining car, steamer, customs airport or any place of public resort and entertainment and attached bar:

| Location of the Site | Non-refundable application fee | Monthly nonrefundable fee for a temporary bar license | Initial Grant Fee | Security Deposit (1/3rd of Initial Grant Fee) | Fee for Grant of License for the Next period of settlement |

| Panchayat Area | Rs. 8,000 | Nil | Rs. 3,00,000 | Rs. 1,00,000 | Rs. 20,000 |

| Municipal / Notified Area | Rs. 12,000 | Nil | Rs. 4,50,000 | Rs. 1,50,000 | Rs. 40,000 |

| Municipal Corporation Area | Rs. 25,000 | Nil | Rs. 6,00,000 | Rs. 2,00,000 | Rs. 50,000 |

Documents Required

The required document for applying West Bengal Liquor license is attached below.Online Application Procedure

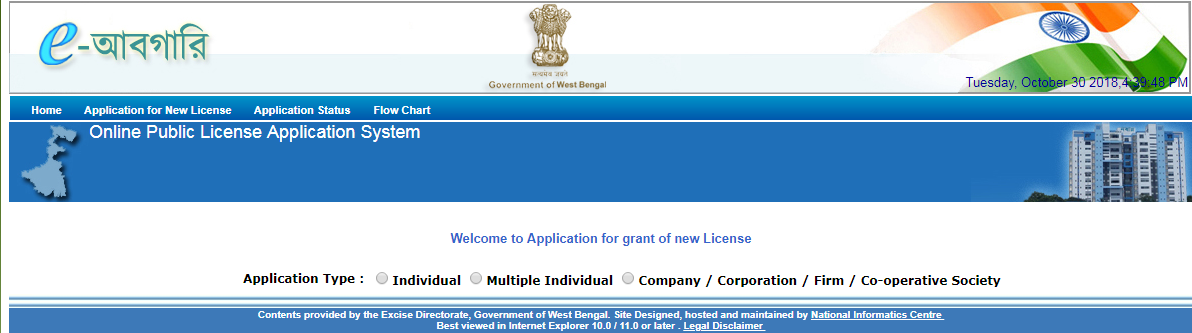

To apply for West Bengal Liquor License, follow the steps specified below. Visit Official Portal Step 1: Visit the official portal of West Bengal Excise Directorate. Step 2: Click on "Apply for new excise license" which is present on the home screen. Step 3: Select "Prepare application" option from the citizen corner. [caption id="attachment_63346" align="aligncenter" width="635"] West Bengal Liquor License - Step 3

Step 4: Now the select the type of application from the number of types.

[caption id="attachment_63347" align="aligncenter" width="664"]

West Bengal Liquor License - Step 3

Step 4: Now the select the type of application from the number of types.

[caption id="attachment_63347" align="aligncenter" width="664"] West Bengal Liquor License - Step 4

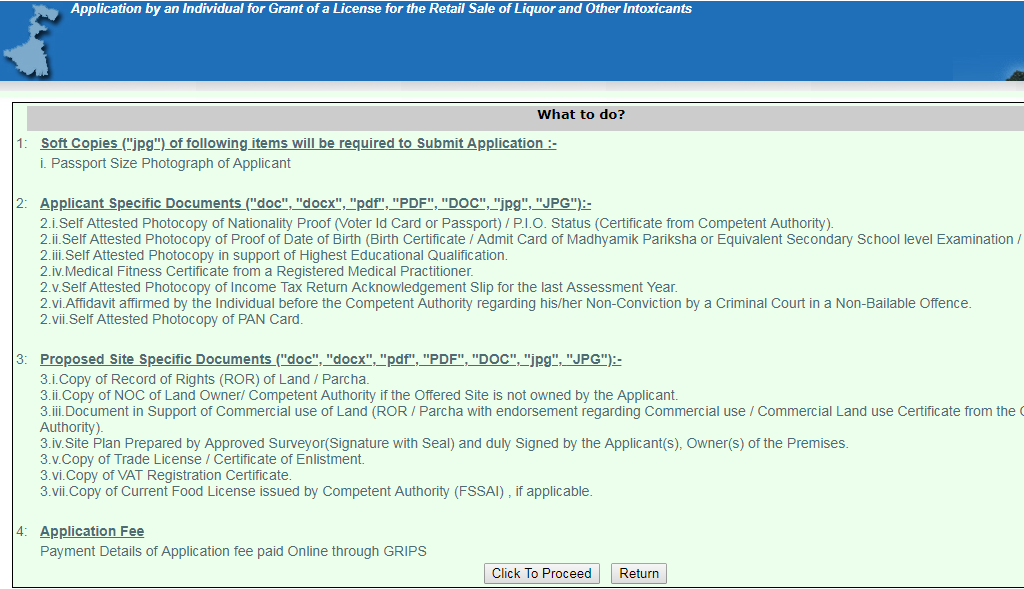

Step 5: Then the instruction page appears on the current screen click on "Click to proceed" button.

[caption id="attachment_63348" align="aligncenter" width="627"]

West Bengal Liquor License - Step 4

Step 5: Then the instruction page appears on the current screen click on "Click to proceed" button.

[caption id="attachment_63348" align="aligncenter" width="627"] West Bengal Liquor License - Step 5

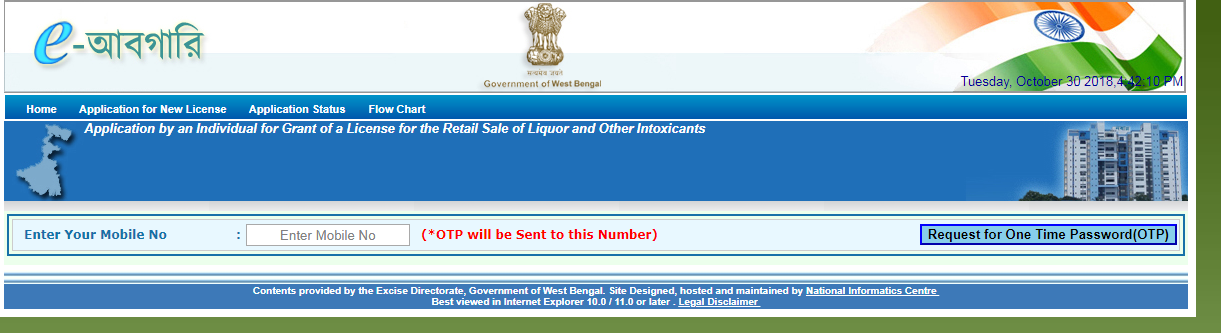

Step 6: Enter your mobile number and the OTP will be sent to the entered mobile number.

[caption id="attachment_63349" align="aligncenter" width="677"]

West Bengal Liquor License - Step 5

Step 6: Enter your mobile number and the OTP will be sent to the entered mobile number.

[caption id="attachment_63349" align="aligncenter" width="677"] West Bengal Liquor License - Step 6

Step 7: After entering the OTP, the page will be redirected to the online application form.

Application for Grant of New Licence

Step 8: Fill the application form with the necessary details and upload the scanned documents along with it.

Step 9: After filling the application, the applicant has to make an online payment.

Make e-Payment

Step 10: Upon payment, the applicant will receive acknowledgement as the confirmation.

Step 11: After verification by the concerned authority the license will be issued to the applicant.

West Bengal Liquor License - Step 6

Step 7: After entering the OTP, the page will be redirected to the online application form.

Application for Grant of New Licence

Step 8: Fill the application form with the necessary details and upload the scanned documents along with it.

Step 9: After filling the application, the applicant has to make an online payment.

Make e-Payment

Step 10: Upon payment, the applicant will receive acknowledgement as the confirmation.

Step 11: After verification by the concerned authority the license will be issued to the applicant.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...