Last updated: July 26th, 2021 4:40 PM

Last updated: July 26th, 2021 4:40 PM

West Bengal Property Registration

In India, as per the Indian Registration Act, 1908 it is mandatory to register the transfer of property with the appropriate Registrar. The immovable property transferred has to be registered to obtain the rights of the property transferred. The Department of Revenue is liable for property registration in the State of West Bengal. In this article, we look at the procedure for West Bengal property registration.Purpose of Property Registration

There are following benefits which are mentioned below for the registration of property.- To provide a conclusive guarantee of the genuineness of the document.

- To afford publicity to transactions.

- To ensure prevention of frauds, conservation of evidence, transfer of title to the owner.

- To maintain an up to day public record by registering a property.

- To afford the facility of determining whether a property has already been sold with and

- To afford security of title deeds and facility of proving titles in case the original deeds are lost or destroyed.

Documents Required

To register a property in the West Bengal state, the following documents are to be furnished along with the application form.- Identity proof like Aadhaar card/voter card/PAN card/passport/driving licence etc. of the parties.

- Assessment slip containing the market value and charge-ability of stamp duty and registration fees.

- PAN card or duly filled form 60 together with identity proof and address proof of the parties.

- Principal documents when the present document is supplementary to such principal documents.

- Particulars of stamp duty and registration fee payment.

- Permission from a competent authority in case of transfer of riot of any Scheduled Tribe person to a non-Schedule Tribe person.

Stamp Duty in West Bengal

The stamp duty is the percentage of the transaction value levied by the State Government, on every registered sale. To know about the stamp duty rates for various transactions in West Bengal click hereCalculate Market Value of Land

The applicant can calculate the market value of land for a property transaction on the West Bengal portal by following the steps below: Step 1: To view the applicable land market value, visit the market value page of revenue department of West Bengal. Step 2: Enter the details relevant to land on the page of the market value of land and click on "Display Market Value" button. Step 3: Then the amount of your land will be displayed on the next page. [caption id="attachment_57535" align="aligncenter" width="754"] West-Bengal-Property-Registration-Land-Value

West-Bengal-Property-Registration-Land-Value

Property Registration Process

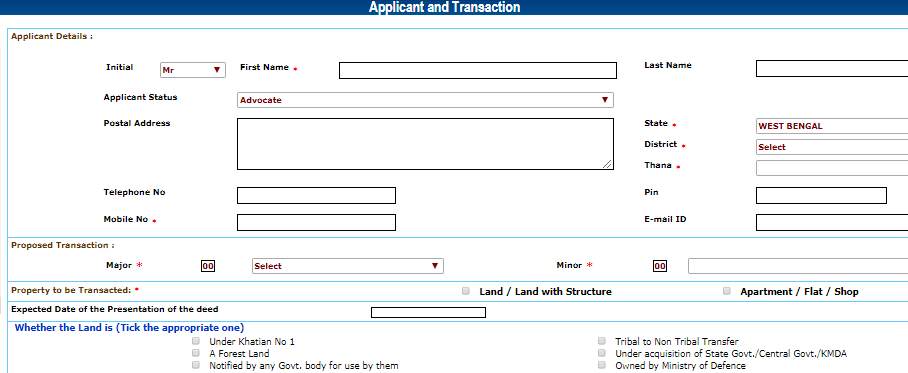

The following steps have been specified to register the property in West Bengal. Step 1: Visit the official website of West Bengal Government.e-Requisition Form Filing

Step 2: The applicant has to fill e-form for assessment of market value, Stamp duty and registration fees. [caption id="attachment_57536" align="aligncenter" width="762"] West-Bengal-Property-Registration-e-Requisition-Form-Filing

Step 3: Now, the e-assessment slip and the amount of mutation fee payable will also be generated.

West-Bengal-Property-Registration-e-Requisition-Form-Filing

Step 3: Now, the e-assessment slip and the amount of mutation fee payable will also be generated.

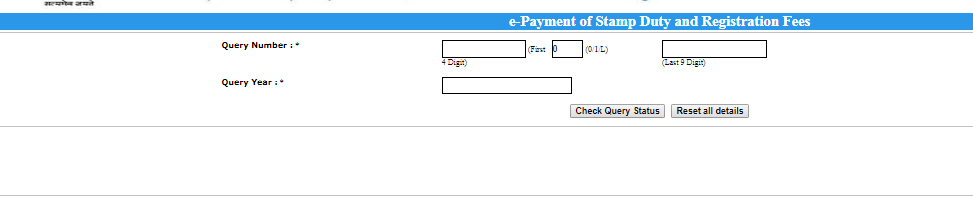

e-Payment of Stamp Duty and Registration Fee

Step 4: The applicant has to make payment for stamp duty and registration fee by entering a query number and query year. [caption id="attachment_57537" align="aligncenter" width="737"] West-Bengal-Property-Registration-make-payment

Step 5: Click on "Check query status" button.

West-Bengal-Property-Registration-make-payment

Step 5: Click on "Check query status" button.

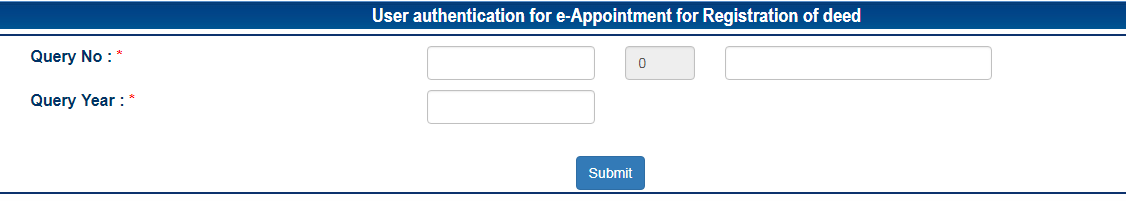

e-Appointment for the presentation of Deed

Step 6: Enter your query number and query year and click on the "submit" button. [caption id="attachment_57538" align="aligncenter" width="662"] West-Bengal-Property-Registration-e-Appointment

Step 7: The kiosk at the Registrar office will generate the token.

West-Bengal-Property-Registration-e-Appointment

Step 7: The kiosk at the Registrar office will generate the token.

Presentation of Deed

Step 8: The applicant has to present the Deed at proper registration offices along with e-Assessment slip, proof of payment, token for the queue, etc. before the appropriate registration officer. Step 9: Now, the system will register the Scribe's details and a number of total pages of the Deed along with a number of impressed stamp paper. Step 10: Further, the system will generate the serial number of Deed.Payment Verification

Step 11: Now, performs e-payment and captures applicant photo, fingerprint and signature.Deed Approval

Step 13: Scanning deed for verification and approved by the concerned authority (registration officer) with digitally signed signature. Step 14: Then, the applicant will receive the registered Deed, and that can be downloaded online from the website.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...