Last updated: September 16th, 2024 2:53 PM

Last updated: September 16th, 2024 2:53 PM

What is a Partnership Deed?

A partnership deed, a partnership agreement, is a written document among business partners. It's a preferred choice among entrepreneurs due to its many benefits. However, running a partnership business involves planning and risk. Disagreements, financial issues, or internal conflicts can jeopardize your venture. Before investing your savings and efforts, it's wise to sign partnership deed a partnership deed, a legal document that safeguards each party's interests. Interested in learning more about what a partnership deed?.? In this article, we'll explain everything about partnership deeds and provisions of the Indian Partnership Act of 1932 and their importance. If you're planning to start a business and are considering registering a partnership firm, you're in the right place. Take the first step toward a successful partnership firm registration with IndiaFilings. [shortcode_53]What is a Partnership Deed?

A Partnership deed is a legal agreement that outlines the terms and conditions of a partnership between partners in a business venture. This legal document ensures a clear understanding of each partner's role and is crucial for the smooth operation of the firm. It details key aspects such as profit and loss sharing, responsibilities, procedures for admitting new partners, salary structures, and exit processes. Registered under the Indian Registration Act of 1908, the partnership deed is legally binding and helps resolve any potential legal disputes.Is a partnership agreement Mandatory?

Under the Indian Partnership Act of 1932, forming a partnership agreement in India is not mandatory. However, having a written partnership deed in place is highly advisable. This written agreement helps prevent disputes or misunderstandings among partners by clearly defining the terms of the partnership. Below are the key reasons highlighting the importance of a partnership deed;- Regulation of Rights and Responsibilities: It establishes clear regulations for the rights, duties, and liabilities of each partner within the firm.

- Prevention of Misunderstandings: The deed helps prevent misunderstandings among partners by specifying all the terms and conditions of the partnership arrangement.

- Dispute Resolution: In the event of a dispute among partners, the partnership deed provides a reference point for resolution, making the process smoother and legally binding.

- Profit and Loss Distribution: It clarifies how profits and losses will be shared among the partners, reducing potential conflicts.

- Role Specification: The roles and responsibilities of each individual partner are clearly defined in the partnership agreement.

- Remuneration Clauses: The deed may include clauses specifying the remuneration to be paid to partners for their services.

- Eligibility for Benefits: Registration of the partnership, as outlined in the deed, makes the firm eligible for various benefits, including obtaining a PAN, applying for bank loans, opening a bank account in the partnership firm's name, and securing registrations such as GST, IE Code, or FSSAI licenses.

Types of Partnership Deeds

There are three distinct types of partnership deeds:General Partnership Deed

- This is the most common type of partnership deed.

- It delineates the roles and responsibilities of each partner, their capital contributions, profit-sharing ratios, and the management of the partnership business.

Limited Partnership Deed

- This partnership deed encompasses both general and limited partners.

- General partners are responsible for managing the business and carry unlimited liability for the partnership's debts.

- Limited partners act as passive investors and have limited liability, restricting their liability to the extent of their capital contributions.

Limited Liability Partnerships (LLP) Deed

- A Limited Liability Partnership (LLP) is a partnership structure in which all partners benefit from limited liability.

- The LLP agreement outlines the roles and responsibilities of each partner, their capital contributions, profit-sharing ratios, and the management of the LLP business.

- It also defines the relationship between partners and the LLP.

Contents of the Partnership agreement

A partnership agreement serves as a safeguard for your interests in case of disputes or confusion regarding various matters within the partnership. Therefore, the Deed should encompass all the legal details related to the firm. Although there isn't a standardized format for drafting a Partnership Deed, we've compiled a list of essential information typically found in a partnership agreement to provide you with an overview:- Purpose of Partnership: Includes the names and addresses of all partners and essential details that describe the nature of the business undertaken by the partners.

- Principal Place of Business: Specifies the location(s) from which the firm will operate, as determined by the Partners.

- Partnership Duration: Indicates the date of the firm's establishment and the duration of the partnership.

- Capital Contribution: Details the contribution of the firm's capital, whether in cash, property, goods, or services, with agreed-upon values (allocated share-wise).

- Capital Withdrawals: Specifies the partner drawing policy and whether interest will be paid to the firm on such withdrawals.

- Salary & Commission: Outlines the ratio or percentage of partners' salaries.

- Profit & Loss Ratio: Defines the profit/loss distribution ratio among the Partners.

- Dissolution of Partnership: Describes how the firm's accounts will be handled in the event of dissolution.

- Admission of New Partners: Provides details regarding the admission, retirement, and exit of partners in the future.

- Bankruptcy Rules: Specifies procedures to follow if a partner declares bankruptcy.

- Accounting and Audit: Ensures that complete and accurate books of account for the firm's transactions are available for inspection by any partner at reasonable times.

- Voluntary Withdrawal of a Partner: Outlines rules for a partner's voluntary withdrawal from the partnership.

- Duties of Partners: Defines the roles and responsibilities of each partner.

- Banking and Partnership Funds: Addresses the placement of funds held in the firm's name into a designated bank account chosen by the Partners.

- Borrowings: Requires written consent from all partners for obtaining loans from banks, financial institutions, or third parties to fulfill the firm's financial needs.

- Partnership Financial Year: Specifies the financial year for the partnership.

Executing a Partnership Deed

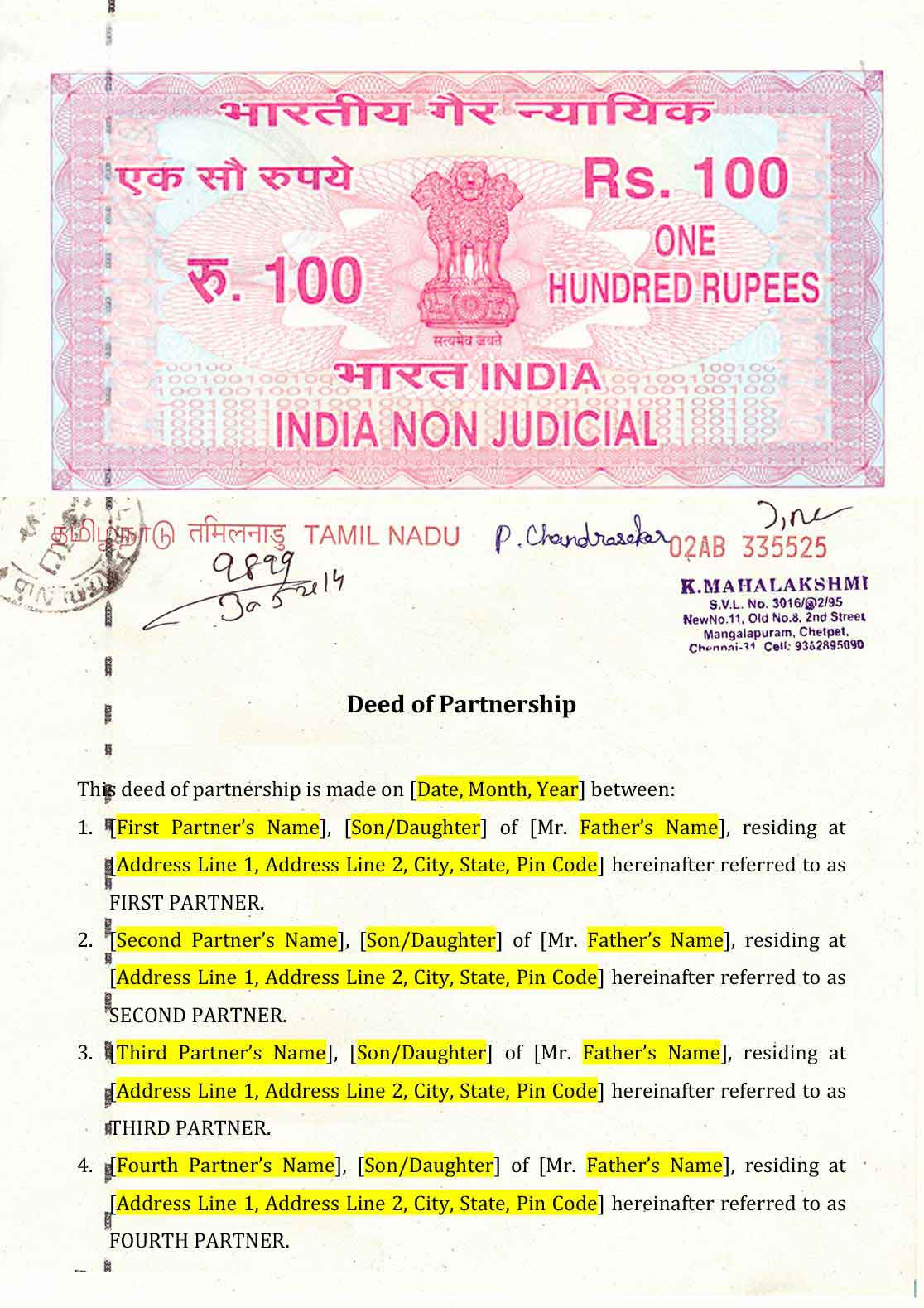

To formalize a partnership agreement, it is typically printed on a Non-Judicial Stamp Paper valued at Rs.100/- or more, depending on the value of assets held within the partnership firm. The signing of the partnership agreement usually takes place in the presence of all partners, and each partner retains a signed original copy for their records. After the partners sign the document, it is witnessed, and each partner retains a duplicate or triplicate signed copy of the partnership deed.Partnership Deed Format

Download Partnership Deed Format

Provisions of an Indian Partnership Act, 1932

The Indian Partnership Act of 1932 acts as a default agreement when no formal partnership deed is in place. Here are some key default provisions outlined in the Act:

- Profit and Loss Sharing: Without an agreement, profits and losses are shared equally among all partners (Section 18).

- Management: All partners have equal business management rights and must consent to any new partner (Sections 19 and 30). Decisions are made by majority vote (Section 25).

- Capital Contributions: The Act is silent on capital contributions. Partners might need to settle this through separate agreements, or courts may determine it based on the facts (e.g., a partner who invested more money might be entitled to a larger share of profits).

- Interest on Capital and Drawings: The Act is silent on interest for capital contributions or drawings.

- Salaries/Remuneration: Partners are not entitled to any salary or payment for their work in the business unless there's a specific agreement (Section 7(2)).

- Admission and Retirement of Partners: Admission of new partners requires the consent of all existing partners (Section 30). The Act is silent on the formal retirement process, but courts might determine a partner's rights based on the nature of the business.

- Dissolution: The partnership dissolves upon the happening of any of the following (Section 35):

- The death of a partner.

- The insolvency of a partner.

- The happening of any event which makes the business unlawful.

- The completion of the undertaking or the expiry of the term, if any, agreed upon.

- By the consent of all partners.

- Dispute Resolution: The Act doesn't specify a dispute resolution mechanism. Partners would likely need to resolve disagreements through negotiation or litigation.

Unregistered partnership deed

An unregistered partnership deed, according to the Indian Partnership Act of 1932, is an agreement that's written down but not officially recorded with the Registrar of Firms. It's still a valid agreement among the partners, but it comes with certain limitations:- It can't be used as proof to resolve disputes in court, whether among partners or involving third parties.

- Partners can't enforce the terms of the partnership deed against outsiders.

- Partners can't claim tax benefits or deductions unless the partnership deed is registered.

- In case of a dispute, partners can't sue each other or the firm.

Consequences of Not Forming a Partnership Agreement

Not creating a partnership deed in India can lead to several consequences:- Lack of Clarity: The absence of a partnership deed results in ambiguity regarding the terms of the partnership, including capital contributions, profit-sharing ratios, and the rights and responsibilities of each partner. This can give rise to misunderstandings, disputes, and even dissolution of the partnership.

- Lack of Legal Recognition: A partnership without a registered partnership deed lacks legal recognition. Consequently, the partnership cannot initiate legal actions or be subject to legal actions, enter into contracts, or hold property in its name.

- Unlimited Liability: In an unregistered partnership, each partner assumes unlimited liability for the partnership's debts and obligations. This means that personal assets of the partners can be utilized to settle the partnership's debts.

- Limited Access to Loans and Credit: Banks and financial institutions often require a registered partnership agreement as evidence of the partnership's existence before granting loans or credit.

- Challenges in Obtaining Licenses and Permits: To secure licenses and permits for the business, a registered partnership agreement may be a prerequisite.

Procedure to Register a Partnership Deed – Partnership Firm Registration

Registering a partnership deed in India involves the following steps:Selecting a Unique Name

Partners must choose a distinctive name for the partnership firm that is not already registered with the Registrar of Firms.Preparing the Partnership Deed

Partners need to draft a comprehensive partnership deed. This document should include essential details such as the partnership firm's name, partners' names and addresses, nature of the business, profit-sharing ratios, and other terms and conditions governing the partnership.Stamp Duty Payment

The partnership deed must be printed on non-judicial stamp paper of the appropriate value, which varies from one state to another. The stamp duty amount is determined based on the value of the partnership firm.Document Submission

Partners must submit the partnership deed and the prescribed form to the Registrar of Firms. The form should contain information such as the partnership firm's name, partners' names and addresses, and the date of the partnership deed.Verification and Registration

The Registrar of Firms examines the submitted documents. If all requirements are met and the Registrar is satisfied, the partnership firm is registered. The partnership deed is then officially stamped and returned to the partners.IndiaFilings offers Expert Guidance for Partnership Firm Registration.

IndiaFilings offers valuable assistance in preparing and registering your partnership agreement, guaranteeing a streamlined and compliant process. Our experienced professionals will guide you through every step, from drafting the partnership deed to ensuring all legal requirements are met. By leveraging our expertise, you can confidently navigate the complexities of partnership registration, allowing you to focus on your business's growth and success. [shortcode_53]Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...