Last updated: December 23rd, 2024 12:45 PM

Last updated: December 23rd, 2024 12:45 PM

What is the minimum turnover for GST?

The Goods and Services Tax (GST) is an indirect tax system introduced in India in 2017. It functions as a single tax on the supply of goods and services from the manufacturing sector to the consumer level. The GST Council, which is a body consisting of the finance ministers of all the states, determines the tax rate and other related issues, including GST turnover limit. According to recent amendments by the Central Government, the minimum GST turnover limit in India has been set at Rs. 40 Lakhs. This article talks about the minimum turnover limit for GST Registration in detail. Has your business exceeded the turnover GST registration turnover limit? Now is the time to secure your registration. IndiaFilings is here to assist you in obtaining your GST registration smoothly. [shortcode_4]Which activities are subject to taxation under GST?

Activities such as the supply of goods and services, sale of goods and services for the purpose of advancing commerce and import of commodities into India are subject to taxation under GST.Which activities are exempted from GST registration?

These activities are not required to be registered for GST:- supplying goods or services that are not taxable

- supply of goods or services by unregistered persons to registered individuals

- providing goods or services through an unregistered e-commerce operator.

What is the minimum GST turnover limit?

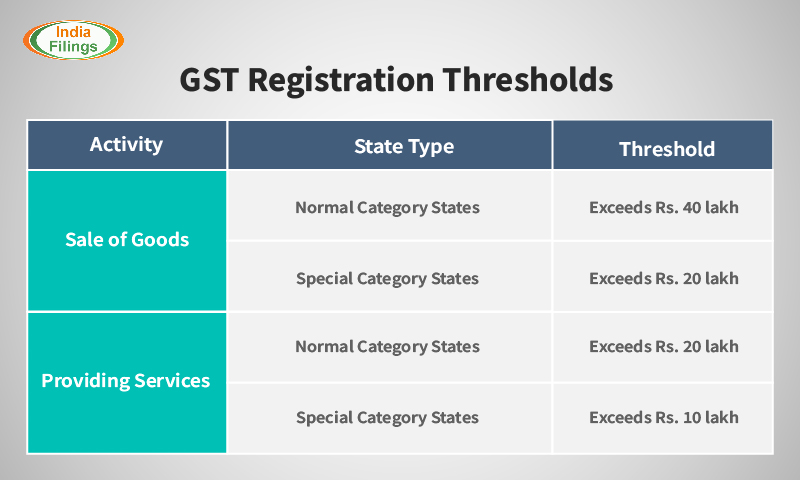

Companies with a yearly turnover of more than Rs. 40 Lakhs (for goods) and Rs.20 lakhs (for services) are required to register for GST and pay taxes on their taxable goods and services. Businesses with a yearly turnover of less than Rs. 40 Lakhs are not required to register for GST, but can choose to register for GST voluntarily. This is beneficial for businesses as it enables them to avail of input tax credit and other benefits. It should be noted that the minimum GST registration turnover limit in India is different for some special category states. The special category states have a minimum threshold limit for GST registration of Rs. 20 Lakhs (for the supply of goods) and Rs. 10 lakhs (for the supply of services). These special category states include Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Tripura, and Sikkim. The GST Council has also recommended that all businesses with a turnover of more than Rs. 40 Lakhs should register for GST, irrespective of their state of registration. This threshold is known as 'turnover for GST registration'. The minimum GST registration limit in India in 2023 is likely to remain the same, i.e. Rs. 40 Lakhs. This is expected to provide some relief to small businesses and enable them to avail of the benefits of GST. It is also likely to enable the government to collect taxes from all businesses, irrespective of their size. GST registration limit

GST registration limit

How to Calculate GST Turnover Threshold?

"To determine the GST registration threshold, you must assess the 'turnover for GST registration', which is the aggregate turnover of your business." It refers to the minimum turnover of the business you are required to register for GST: These are the factors you should consider when calculating the turnover limit for GST registration,- Taxable Sales Value: This refers to the total value of sales on which GST is applicable. You'll need to consider the value of all taxable goods and services you sell when calculating the GST registration turnover limit.

- Exempt Sales Value: Certain goods and services are exempt from GST. Even though these sales don't attract GST, you still need to consider their value when evaluating your turnover for registration purposes.

- Export of Goods and Services: This is the revenue your business generates from international sales. It is important as it is converted to local currencies for accounting, taxation, and compliance purposes.

- Interstate Supplies: It refers to the sale of goods or services to customers in other states of India and the IGST (Integrated Goods and Services Tax) rates for it.

What is the GST registration turnover threshold for businesses dealing with both goods and services?

The Goods and Services Tax (GST) registration threshold for businesses dealing with both goods and services is Rs. 20 lakhs and above. However, the threshold for businesses dealing only with goods is Rs. 40 lakhs. For those exclusively providing services, the threshold is Rs. 20 lakhs. The threshold limit is crucial as it determines whether a business needs to register for GST. Registering for GST is essential to complying with GST rules and regulations and avoiding penalties.Conclusion

In conclusion, the minimum GST registration limit for mandatory GST registration in India is Rs. 40 lakh for most businesses, with a lower threshold limit for GST registration of Rs. 10 lakh applicable in special category states. Businesses below this GST registration turnover limit can still register voluntarily to claim tax benefits. Remember to consider all aspects of your turnover, including taxable and exempt sales, exports, and interstate supplies, when evaluating the turnover limit for GST registration. Has your business reached the GST registration limit? Register for GST with IndiaFilings experts!! [shortcode_4]Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...