Updated on: January 25th, 2020 4:36 PM

Updated on: January 25th, 2020 4:36 PM

Withdrawal from Composition Scheme

The registered taxpayer who intends to withdraw from the composition scheme is required to file an intimation for withdrawal in FORM GST CMP-04 within seven days of the occurrence of any event that makes the business ineligible for the GST composition levy. In this article, we look into the aspects of withdrawal from the composition scheme in detail.Opting Out of Composition Scheme

A taxpayer can withdraw from the Composition Levy at any time of the financial year for the below following reasons:- Voluntary withdrawal

- If exceeding the threshold limit as defined in Section 10 of the CGST Act

- Supplying restaurant services other than as mentioned under the clause of GST Act

- Supply of Goods not liable to Tax - goods and services you are supplying become exempt

- Supplying of goods through E-Commerce Operator

- Manufacturing Notified Goods

- Others

Effective Date of Withdrawal

There had always been an issue relating to the relevant effective date when there is any withdrawal from the composition scheme either by the taxpayer himself or withdrawal from the scheme has been initiated by the tax authorities. Recently, the CBIC, vide circular no. 77/51/2018-GST dated 31st December 2018, has clarified the issues relating to the said effective dates, which has been taken up in the present article.Withdrawal by Taxpayer

When the composition scheme taxpayer has himself opted for the withdrawal from the composition scheme, the effective date in such case would be:- The date indicated by the taxpayer in his intimation or application filed by him in FORM GST CMP-04.

Withdrawal by Tax Authorities

When the withdrawal from the composition scheme has been initiated by the tax authorities, the effective date in such case would be:- The date as determined by the tax authorities would be the effective date. The tax authorities can even determine any retrospective date, however, the date cannot be prior to the date of contravention of the provisions of the Central Goods and Service Tax Act or the Central Goods and Service Tax Rules.

Position Post Contravention of the CGST Act or the CGST Rules

When there is any contravention of the CGST Act or the CGST Rules, as per the provisions of section 10 (5), action would be initiated against the guilty composition scheme taxpayer, under the provisions of section 73 and section 74 of the CGST Act, for determination of tax, penalty and interest. The period covered would be the date of contravention of the provisions till the date of the issue of the order in FORM GST CMP-07. It has been clarified that the taxpayer would be liable to pay tax under section 9 from the date of issue of the order in FORM GST CMP-07. It has also been clarified that once the taxpayer is liable to pay the tax under section 9, he can apply for claiming of the eligible input tax credit on inputs, semi-finished goods or finished goods on inputs and capital goods held in stock as on the date immediately preceding the date of issue of the order in FORM GST CMP-07.Online Application Procedure

The taxpayers must follow the below steps to Withdrawal from Composition Levy online.Visit GST Portal

Step 1: Firstly, the taxpayers have to visit the Goods and Services Tax portal to apply for the Withdrawal from Composition Levy online. [caption id="attachment_65975" align="aligncenter" width="790"] step 1 - Withdrawal from Composition Levy

step 1 - Withdrawal from Composition Levy

Login into Portal

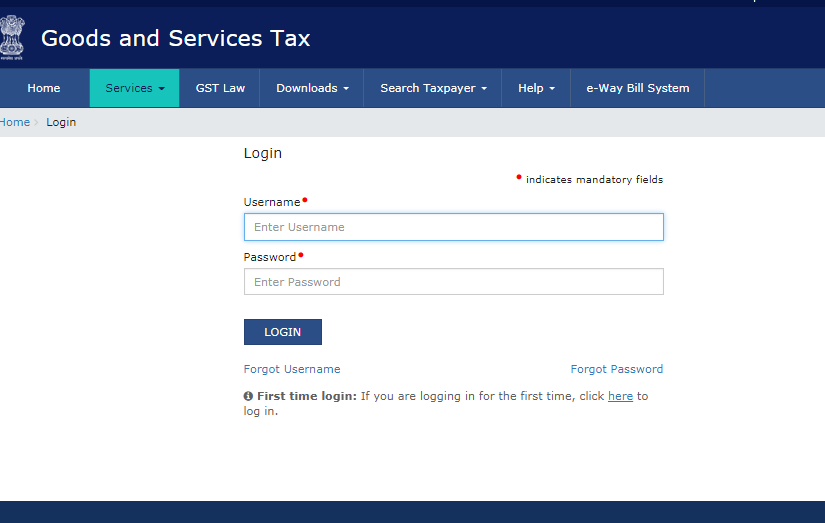

Step 2: Click on the ‘Login’ button to access the username and password page. Step 3: Enter the correct ‘Username’ and ‘Password’ credentials along with the captcha in the required field and click ‘login’. [caption id="attachment_65976" align="aligncenter" width="825"] Step 3 - Withdrawal from Composition Levy

Step 3 - Withdrawal from Composition Levy

Application for Withdrawal from Composition Levy

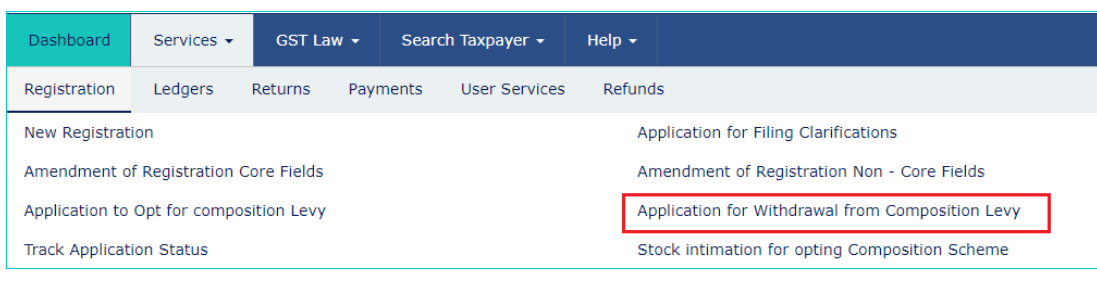

Step 4: After logging in, select ‘Application to Opt for Composition Levy’ from the Registration Menu under the service tab that is visible on the home page. [caption id="attachment_65980" align="aligncenter" width="1097"] Step 4 - Withdrawal from Composition Levy

Step 5: Upon clicking on the Intimation/Application for Withdrawal from Composition Levy link, the page will be displayed.

Step 6: Select the date from which the withdrawal from Composition Levy is sought using the calendar.

[caption id="attachment_65990" align="aligncenter" width="1108"]

Step 4 - Withdrawal from Composition Levy

Step 5: Upon clicking on the Intimation/Application for Withdrawal from Composition Levy link, the page will be displayed.

Step 6: Select the date from which the withdrawal from Composition Levy is sought using the calendar.

[caption id="attachment_65990" align="aligncenter" width="1108"] Step 6 - Withdrawal from Composition Levy

Note: The date for withdrawal from Composition Levy cannot be before the date on which Composition Levy has opted.

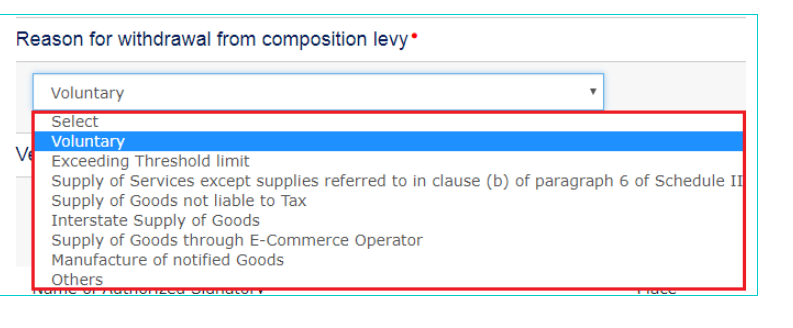

Step 7: Then select the Reason for withdrawal from Composition Levy from the drop-down list.

[caption id="attachment_65985" align="aligncenter" width="793"]

Step 6 - Withdrawal from Composition Levy

Note: The date for withdrawal from Composition Levy cannot be before the date on which Composition Levy has opted.

Step 7: Then select the Reason for withdrawal from Composition Levy from the drop-down list.

[caption id="attachment_65985" align="aligncenter" width="793"] Step 7 - Withdrawal from Composition Levy

Step 7 - Withdrawal from Composition Levy

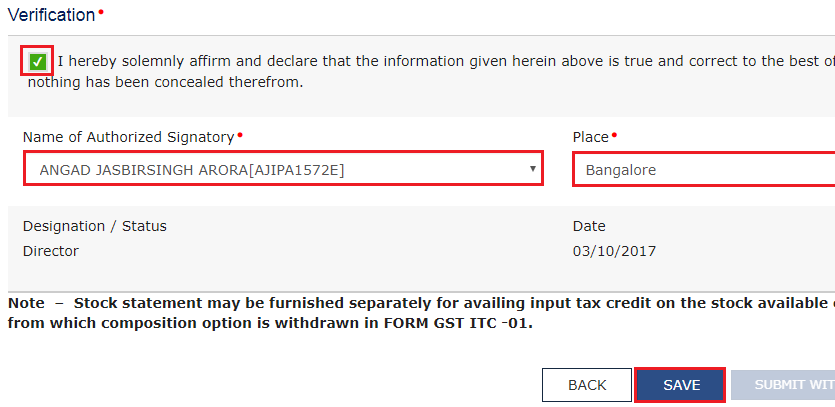

Verification Process

Step 8: Before submitting the application, also check the box for the Verification process (below the Composition Declaration) that states that all the information given is true and that nothing has been concealed from the authority. [caption id="attachment_65992" align="aligncenter" width="835"] Step 8 - Withdrawal from Composition Levy

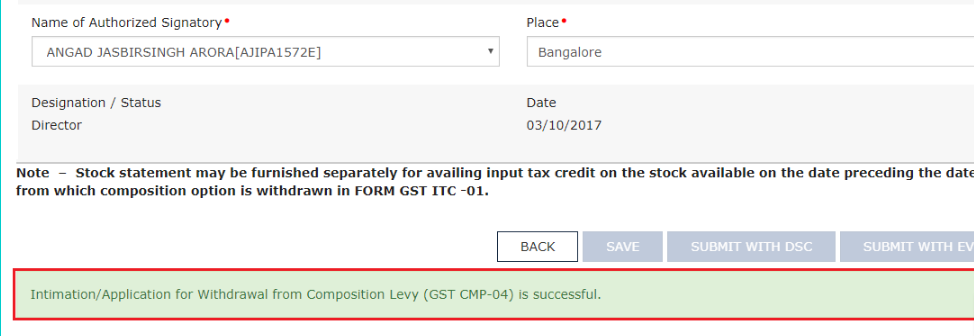

Step 9: Finally, select the Authorized Signatory from the drop-down menu.

Step 10: Enter the place where the application is filed, in the Place field.

Step 11: Also click the ‘save’ button to save the application form and retrieve it later.

Step 8 - Withdrawal from Composition Levy

Step 9: Finally, select the Authorized Signatory from the drop-down menu.

Step 10: Enter the place where the application is filed, in the Place field.

Step 11: Also click the ‘save’ button to save the application form and retrieve it later.

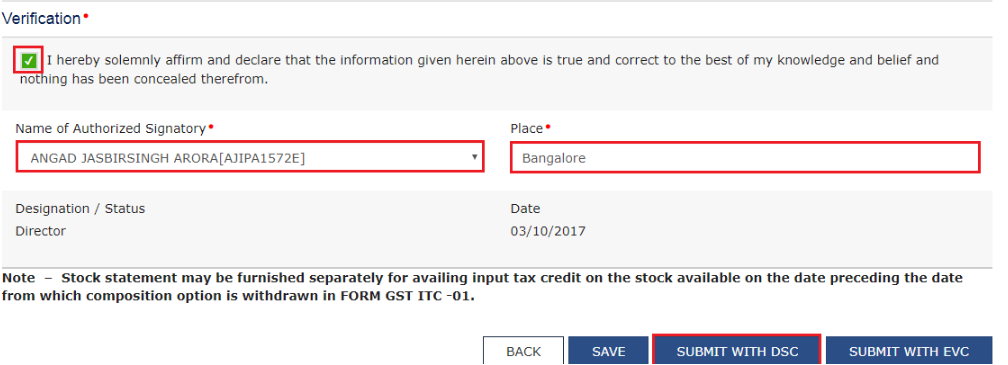

Submit the Application

Step 12: Upon selecting the Authorized Signatory and the Place, only then the options to submit the form will get activated. Step 13: Sign the form by using either the Digital Signature Certificate (DSC) or the EVC option. On selecting any of these below options, OTP will be received. [caption id="attachment_65994" align="aligncenter" width="1008"] Step 13 - Withdrawal from Composition Levy

Step 13 - Withdrawal from Composition Levy

Using DSC Option

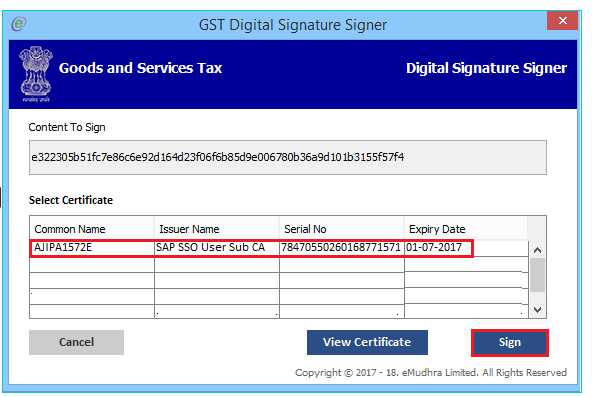

Step 14: If using a DSC, select the registered DSC from the emSigner pop-up screen and then proceed from there accordingly. [caption id="attachment_65996" align="aligncenter" width="681"] DSC - Withdrawal from Composition Levy

DSC - Withdrawal from Composition Levy

Using EVC Option

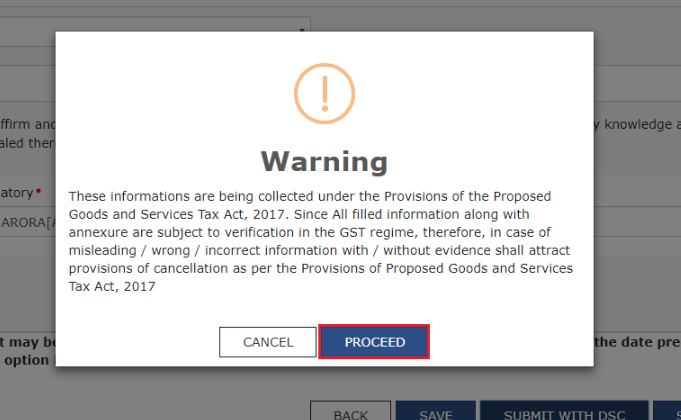

Step 15: Enter the OTP that has been received and then click on the Validate OTP button. Step 16: The user will get a prompt to confirm the action, click on Proceed to move forward.Digital Signature Signer

Step 17: The system will retrieve the installed digital signatures available using the emSigner, and a pop-up message to select the desired DSC. Select the desired signature to receive the confirmation message. [caption id="attachment_66001" align="aligncenter" width="609"] Step 17 - Withdrawal from Composition Levy

Step 17 - Withdrawal from Composition Levy

Acknowledgement Message

Step 20: On successfully filing the application for cancellation of registration, the system will generate the ARN and display a confirmation message. Step 20 - Withdrawal from Composition Levy

Step 21: GST Portal will also send a confirmation message on the registered mobile phone number and e-mail-ID.

Step 22: On successfully filing the application to Opt-out from the Composition Levy, the system will generate the ARN for the work item will be generated and sent via e-mail and SMS within the next 15 minutes.

Step 23: Once the application to withdraw from the Composition Levy is filed, the application is auto-approved and is taken out of the Composition Levy.

Note: Once opt-out from Composition scheme, go to My Profile on the GST portal and check that the Taxpayer Type is changed to Regular from Composition and the access to all the returns are applicable to a Regular taxpayer.

Step 20 - Withdrawal from Composition Levy

Step 21: GST Portal will also send a confirmation message on the registered mobile phone number and e-mail-ID.

Step 22: On successfully filing the application to Opt-out from the Composition Levy, the system will generate the ARN for the work item will be generated and sent via e-mail and SMS within the next 15 minutes.

Step 23: Once the application to withdraw from the Composition Levy is filed, the application is auto-approved and is taken out of the Composition Levy.

Note: Once opt-out from Composition scheme, go to My Profile on the GST portal and check that the Taxpayer Type is changed to Regular from Composition and the access to all the returns are applicable to a Regular taxpayer.

Authentication of Withdrawal

After filing the application to withdrawal from the Composition levy, the taxpayers are required to file a statement in the FORM GST ITC-01 containing details of the stock of inputs and the inputs contained in finished goods or semi-finished held in stock on the date on which the option is withdrawn, within a period of 30 from the date from which the option is to withdraw.Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...