Last updated: March 5th, 2020 4:01 PM

Last updated: March 5th, 2020 4:01 PM

Zero Rated Supply under GST

Export supplies of a taxpayer registered under GST are classified as zero-rated supply under GST. Zero-rated supply under GST is eligible for a refund. Taxpayers shall furnish details of all zero-rated supply in GSTR 3B return and GSTR 1 return.What is Zero Rated Supply?

GST is not applicable in India for exports. Hence, all export supplies of a taxpayer registered under GST would be classified as a zero-rated supply. According to Section 16 of the IGST Act, zero-rated supply means any of the following supplies of goods or services:- Export of goods or services or both;

- Supply of goods or services or both to a Special Economic Zone developer

- Supply of goods or services or both to a Special Economic Zone unit.

GST Refund for Zero Rated Supply

As per GST rules, the supplier can claim the input tax credit in respect of goods or services used for the supplies as exports act as zero-rated supply, even though termed as non-taxable or even exempt supplies. To claim GST refund for exports, the taxpayer can export under bond or LUT and claim refund or export on payment of IGST and claim a refund. Click here to read on GST Interstate vs Intrastate Supply MeaningDetails to be Furnished in GST Returns

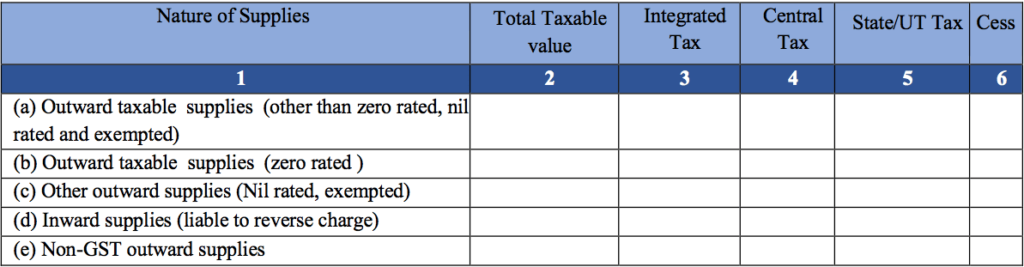

In GSTR 3B return and GSTR-1, all taxpayers must furnish details of all zero-rated supply. In the following table showing GSTR 3B return, the taxpayer must provide details of all export supply in row B. GSTR 3B Details of Outward Supplies

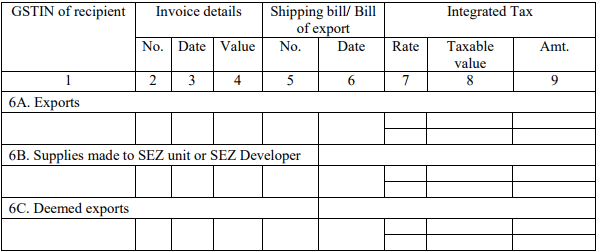

In GSTR-1 return, details of all export supply must be provided under the categories of exports, supplies made to SEZ unit or SEZ Developer and deemed exports.

GSTR 3B Details of Outward Supplies

In GSTR-1 return, details of all export supply must be provided under the categories of exports, supplies made to SEZ unit or SEZ Developer and deemed exports.

GSTR-1 Zero rated supplies

GSTR-1 Zero rated supplies

Zero Rated vs Exempt Supply

Export and supplies to SEZ units or developers are classified as zero-rated supply. On the other hand, nil or exempt supply are those supply with 0% GST rate. Exempted supply means the supply of any goods or services or both which attracts nil rate of tax or which may be wholly exempt from tax under section 11 of CGST Act or under section 6 of the IGST Act, and includes the non-taxable supply. The following points refers to the exempted supply:- GST does not apply on the outward exempted supplies;

- Input tax credit of inputs and / or input services used in providing exempted supply is not available i.e. no input tax credit on exempted supplies;

- A registered person supplying exempted goods or services or both shall issue ‘bill of supply’ instead of tax invoice.

Popular Post

In the digital age, the convenience of accessing important documents online has become a necessity...

The Atalji Janasnehi Kendra Project that has been launched by the Government of Karnataka...

The Indian Divorce Act governs divorce among the Christian couples in India. Divorce...

When an individual has more than a single PAN card, it may lead to that person being heavily penalised, or worse,...

Employees Provident Fund (PF) is social security and savings scheme for employee in India. Employers engaged...